The recent rally in the U.S. stock market, with the S&P 500 and Nasdaq Composite hitting unprecedented highs, might seem like a validation of economic resilience and investor optimism. Yet, beneath this façade lies a complex patchwork of uncertainty, risk, and structural fragility that calls into question the sustainability of this surge. While headlines trumpet

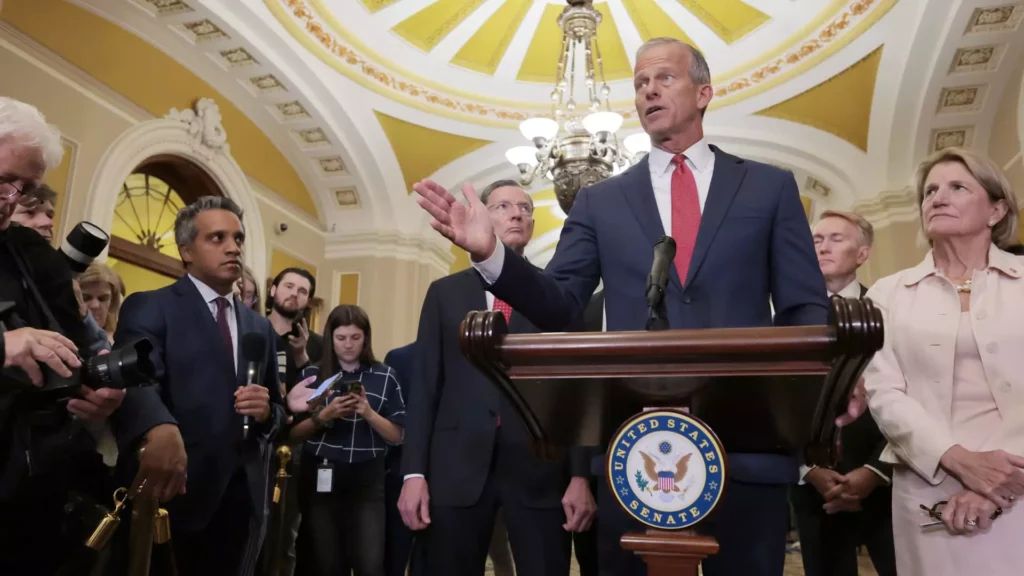

The Senate Republicans’ latest legislative proposal, ambitiously branded as the “One Big Beautiful Bill Act,” emerges not as a boon for Americans but as a stark symbol of misplaced priorities that blatantly favor the affluent while punishing the most vulnerable. What’s most striking—and unforgivable—is that this sprawling package is poised to worsen economic inequality during

The WNBA is undeniably taking a daring leap forward, unveiling plans to expand its footprint from 13 teams to an impressive 18 over the next five years. Awarding new franchises to Cleveland, Detroit, and Philadelphia is being hailed by league officials as a historic milestone. Yet, beyond the celebratory headlines, one must critically examine whether

BitMine Immersion Technologies’ recent move to center its treasury strategy around Ethereum is a notable, albeit risky, gamble that may redefine how crypto companies manage their reserves. The appointment of Fundstrat’s Tom Lee as chairman signals serious intent to transcend BitMine’s modest market presence and reposition itself as a major player in the ether mining

In today’s financial landscape, where markets oscillate wildly and geopolitical tensions persist, chasing high-flying growth stocks is an increasingly risky proposition. While the S&P 500 recently danced to new heights, the underlying macroeconomic turmoil reminds us that market euphoria can quickly give way to volatility. This environment elevates the importance of dividend-paying stocks—not merely as

Debt in America often lurks behind the scenes as an invisible force that profoundly shapes career trajectories and choices. Far from being a mere financial statistic or an abstract economic burden, debt actively constrains ambitions, stifles innovation, and turns the workforce into a reluctant captive. Countless workers are shackled by monetary obligations, compelling them to

June has undoubtedly been a remarkable month for Coinbase, vaulting it to the top of the S&P 500 performers thanks to a potent mix of regulatory breakthroughs, strategic product expansions, and its recent inclusion in the prestigious index. Here lies a company that, after turbulent months marked by uncertainty and skepticism, is now basking in

Venice, a city synonymous with beauty, history, and cultural heritage, has long grappled with the paradox of welcoming tourists while preserving the fragile ecosystem and authentic spirit of its waterways and narrow alleys. This delicate balance has now been shattered by the ostentatious spectacle that is Jeff Bezos and Lauren Sanchez’s $50 million wedding. The

American consumer behavior has undergone a striking transformation over the past year. Once characterized by the exuberant splurges of “revenge spending”—a post-pandemic attempt to reclaim lost experiences and comforts—households are now pulling back decisively. This pendulum swing towards elevated saving rates reflects more than just prudence; it signals pervasive anxiety about the economic future. The

The luxury real estate market in 2025 is exhibiting a fascinating and frustrating polarization. On one side, ultra-wealthy buyers with fortunes exceeding $30 million remain undeterred by economic uncertainty, trade tensions, or volatile markets. Their behavior contrasts sharply with that of the merely affluent—those who enjoy wealth but lack billionaire status—who are demonstrating caution and