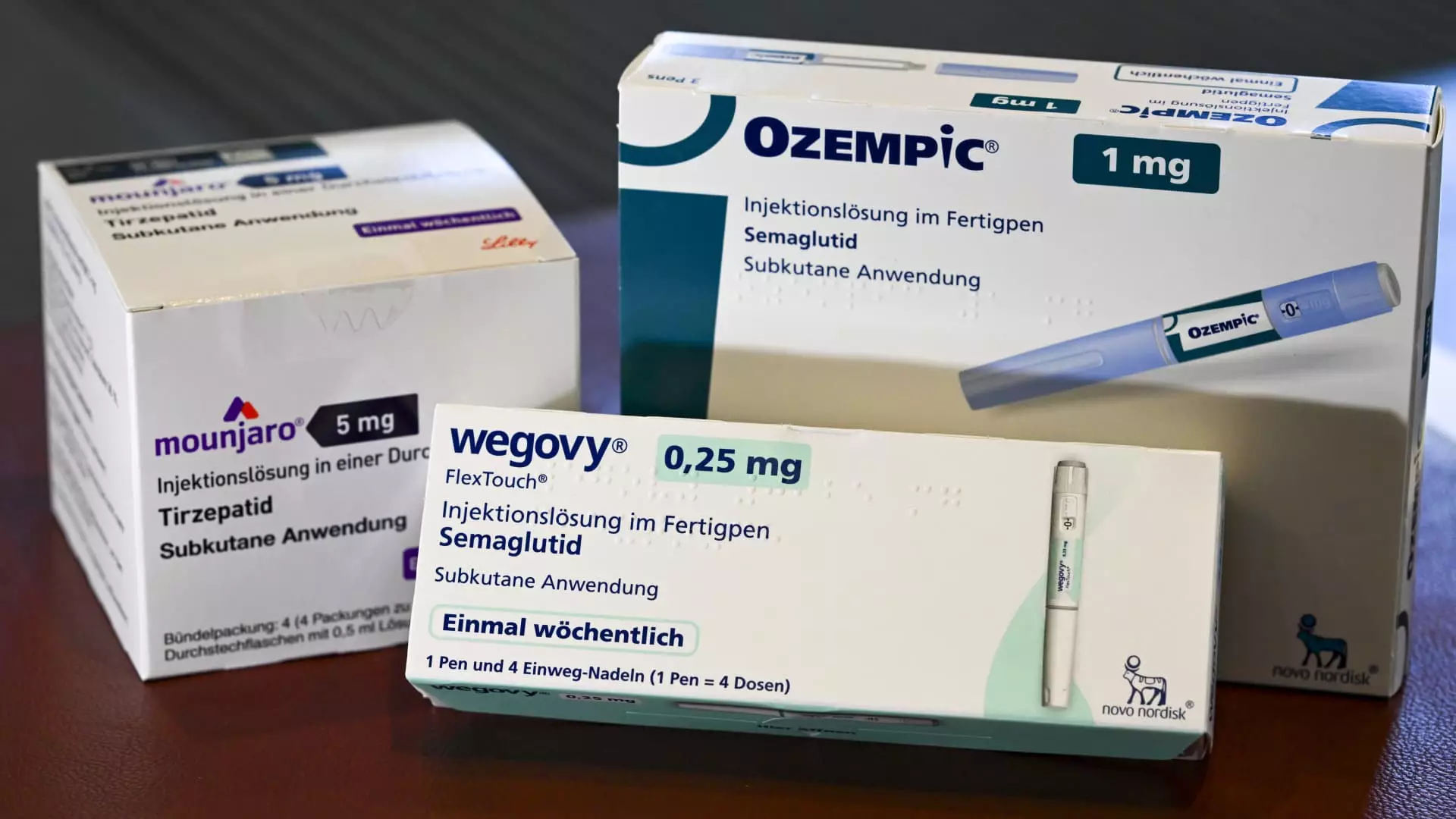

In recent years, the turbulence in the healthcare landscape has shed light on exorbitant medication prices, particularly for diabetes and weight loss drugs like Mounjaro, Ozempic, and Wegovy. These GLP-1 receptor agonists have skyrocketed in demand, prompting critical questions from employers regarding the sustainability of their healthcare costs. As corporate America grapples with rising health expenditures, one cannot ignore the paradoxical relationship between high drug costs and potential long-term savings.

A report from Aon reveals that the landscape is changing dramatically, with claims of a 44% decline in major cardiovascular incidents among users of these drugs. It’s a compelling statistic that raises skepticism yet also sparks hope. If these medications can reduce hospital visits and long-term health complications, the initial financial burden could be justified. However, the price tag of over $1,000 per dose brings forth a harsh reality: the upfront costs are staggering, and employers are caught between a rock and a hard place.

Cost Versus Health Outcomes

It seems contradictory that a drug heralded for its benefits can also drive up short-term costs. A study of 139,000 workers revealed some unsettling truths. While GLP-1 users initially incurred higher medical expenses due to increased doctor visits and monitoring for complications typically linked to obesity—like sleep apnea and acid reflux—there is a silver lining. The long-term projection shows a return on investment, with a reported average decline in overall healthcare spending of 7% after two years for those who adhered closely to their treatment plan.

What’s striking here is the sharp contrast between immediate and future costs. This is not merely a discussion of dollars and cents but a broader conversation about public health and economic efficiency. When one considers the burden obesity and related illnesses place on the healthcare system, a proactive approach may, in fact, be the more economically sound choice. However, the interim phase where employers absorb ballooning health costs remains a sticking point.

The Broader Implications for Employers

Employers play a pivotal role in the healthcare saga. Aon’s management strategies suggest that employers can mitigate their risks by supporting the use of GLP-1s. The company has even launched its subsidized program to facilitate compliance among employees, which may serve as a blueprint for other organizations. This initiative underscores a critical shift in how workplaces view health benefits—not just as a line item on a balance sheet but as an investment in productivity and workforce health.

The idea that human capital can provide a return through preventive measures is not new, yet the application of this thought is essential in today’s economic climate. It is high time that businesses realize health is wealth, particularly when chronic diseases are at stake. The reduction in major cardiac events is not merely a statistic; it’s a wake-up call to reassess corporate health strategies.

Shifting Perceptions

However, the road ahead is rife with challenges and skepticism. Critics may argue that companies should not bear the financial weight of such expensive medications. The call for broader insurance coverage is vital, yet it raises ethical questions about profit margins, pharmaceutical pricing, and access to medications. Why should a drug that has the potential to save lives also come with a financial death sentence for many?

As a center wing liberal, the answer entails a balanced approach—addressing affordability while promoting healthier lifestyles. If these drugs lead to significant health improvements, as data suggests, shouldn’t society collectively shoulder the costs? The success of GLP-1 medications presents an opportunity to advocate for policies emphasizing preventive healthcare rather than reactionary treatments.

By fostering healthier expectations and outcomes, we can jumpstart discussions around drug pricing reform and expanded health coverage. The efficacy of GLP-1 drugs may ultimately lead us to rethink the conventional wisdom surrounding healthcare costs, steering us toward a future where investment in health is seen not as an expense but as a strategic necessity.