The recent upheaval on Wall Street is causing investors to feel like they are on a rollercoaster, navigating dizzying heights followed by alarming drops. The narrative surrounding the U.S.-China trade war has dominated headlines, leaving many to question the wisdom of their investment choices. However, amidst the chaos, there exists a compelling reason to view this volatility not as a threat, but as an invitation to seize bold opportunities. As a center-left liberal, I find it invaluable to scrutinize this situation critically and recognize the latent potential wrapped within the chaos.

This tumultuous environment serves as a reminder that investing is inherently linked with uncertainty. For instance, during a week characterized by erratic swings, the S&P 500 managed to close more than 5% higher, showcasing a resilience that shouldn’t go overlooked. Investors often concentrate on the immediate fallout of economic decisions, but it’s essential to elevate our perspectives and appreciate market behavior over a longer time horizon. While one can be overwhelmed by fluctuating sentiment, a grounded, clear-headed approach reveals avenues for growth that lurk beneath the surface.

Why Chipmakers Are the Unsung Heroes

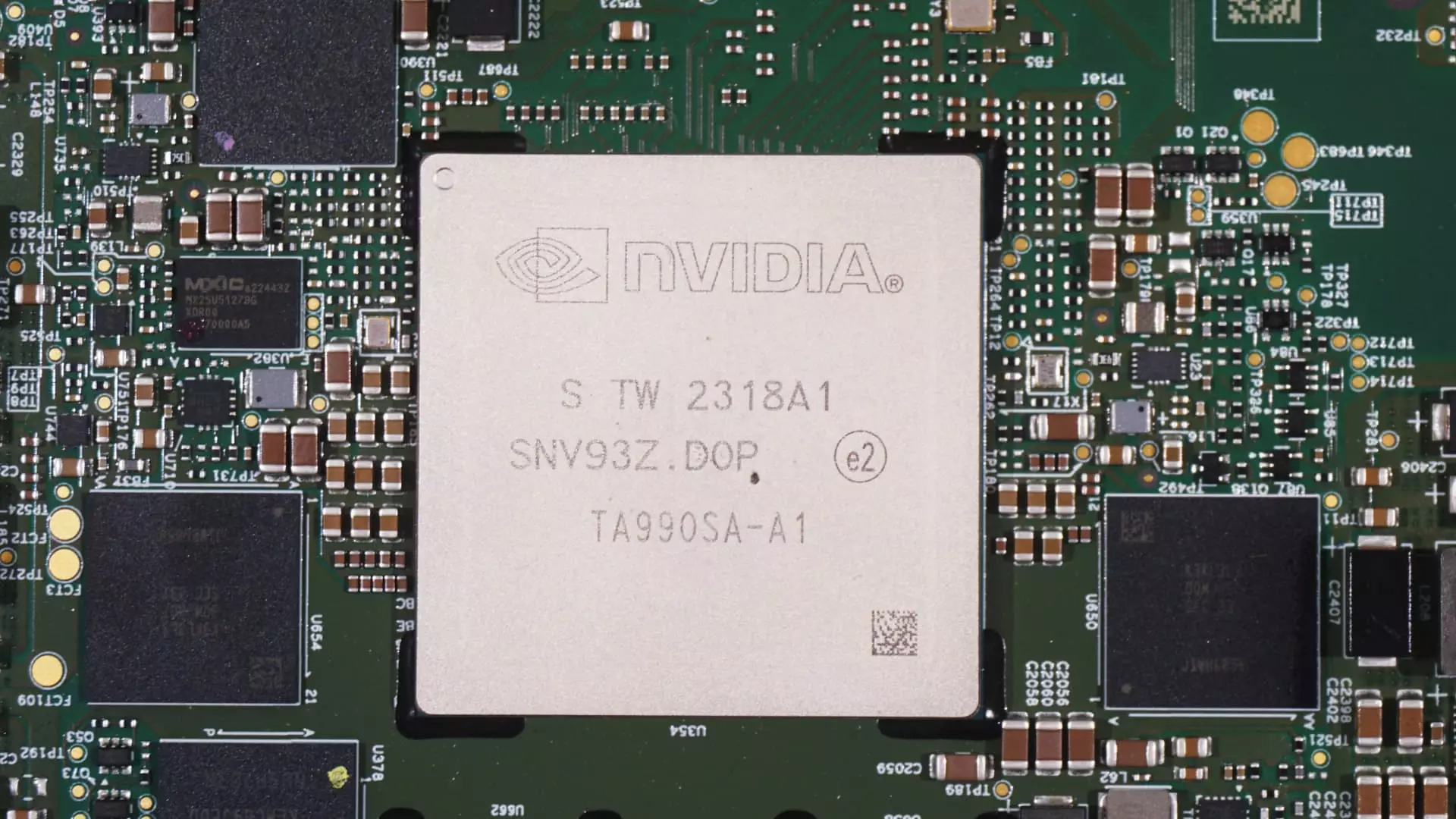

One undeniable trend emerging from this chaos is the success of chipmakers like Broadcom and Nvidia. Their impressive week-over-week gains, of 22% and 17% respectively, indicate a resurgence that stands counter to the broader market’s uncertainty. Investing in technology, especially in these transformative sectors, can lead to substantial long-term benefits. The remarkable bounce-back after a significant sell-off illustrates how companies capable of adaptation will thrive amid adversity.

The recent developments regarding tariffs and their implications for the semiconductor industry have catalyzed stock performance. While typical investors may falter in fear of geopolitical upheaval, those wielding knowledge about market nuances understand that the semiconductor sector is crucial for innovation. Thus, it makes perfect sense that investors should rally behind firms with global relevance and robust consumer interest, even when appearances may suggest otherwise.

Furthermore, the news that China’s tariffs on chips would be influenced by their manufacturing location and the announcement of Broadcom’s $10 billion stock buyback program bolster the notion that these companies have solid fundamentals that warrant confidence. This understanding may empower investors to secure positions now, potentially leading to fruitful returns in the coming months.

The Broader Market’s Psychological Landscape

It is easy to become ensnared by the whirlwind of market volatility, sifting through headlines that invoke fear and uncertainty. Still, one must remember the psychological factors that play a crucial role in market behavior. Fear drives many decisions, leading to hasty sell-offs. It’s vital for investors to recognize that volatility often creates mispricing in the market, and understanding that prices may not always reflect a company’s intrinsic value is key.

This week’s stock moves remind us of the proverbial saying, “buy low, sell high.” Many frightened investors relinquish their holdings during downturns, thereby missing potential gains tied to future recoveries. To take the reins of one’s own financial future, an investor must carefully analyze and reassess their positions rather than abide by frantic sentiment alone. Embracing calculated risks could lead to remarkable opportunities to amass wealth, even in difficult climates.

Economic Data: The Beacon in the Storm

As we approach the upcoming earnings reports and economic data releases, understanding the trends surrounding retail sales and import/export prices will be essential. The Bureau of Labor Statistics and the Census Bureau’s reports offer much-needed insights into consumer behavior and spending patterns that could effectively inform investment strategies.

The typically myopic view of focusing on stock price fluctuation should shift toward an analytical appreciation of economic indicators. The importance of context—such as lingering inflation and shifting consumer habits—must be recognized. By turning this lens, savvy investors may position themselves advantageously and reflect on how broader economic conditions shape their portfolios.

Amid discussions about upcoming earnings reports, like those from Goldman Sachs and Abbott Labs, the potential for shifts in market sentiment cannot be ignored. Investors must remind themselves that every new piece of information holds transformative potential. Risks can only be mitigated if one continuously absorbs information and adjusts their approach accordingly.

Confronting the Future: The Endurance of Investing

The somewhat disorienting nature of current market conditions could deter a less resilient investor, but for those of us willing to critically scrutinize the tides of capitalism, the actuating force of this volatility holds promising possibilities. A well-informed, balanced approach will be much more beneficial than reactive strategies driven by fear.

Indeed, amidst what many see as chaos lies the potential for opportunity and growth. Whether it’s investing in technology or analyzing sound capital expenditures, embracing nuanced views that challenge the narrative can yield unprecedented returns. Now, more than ever, it’s vital for investors to reject alarmist conclusions and innovate their own paths forward—therein lies the marrow of true investing.