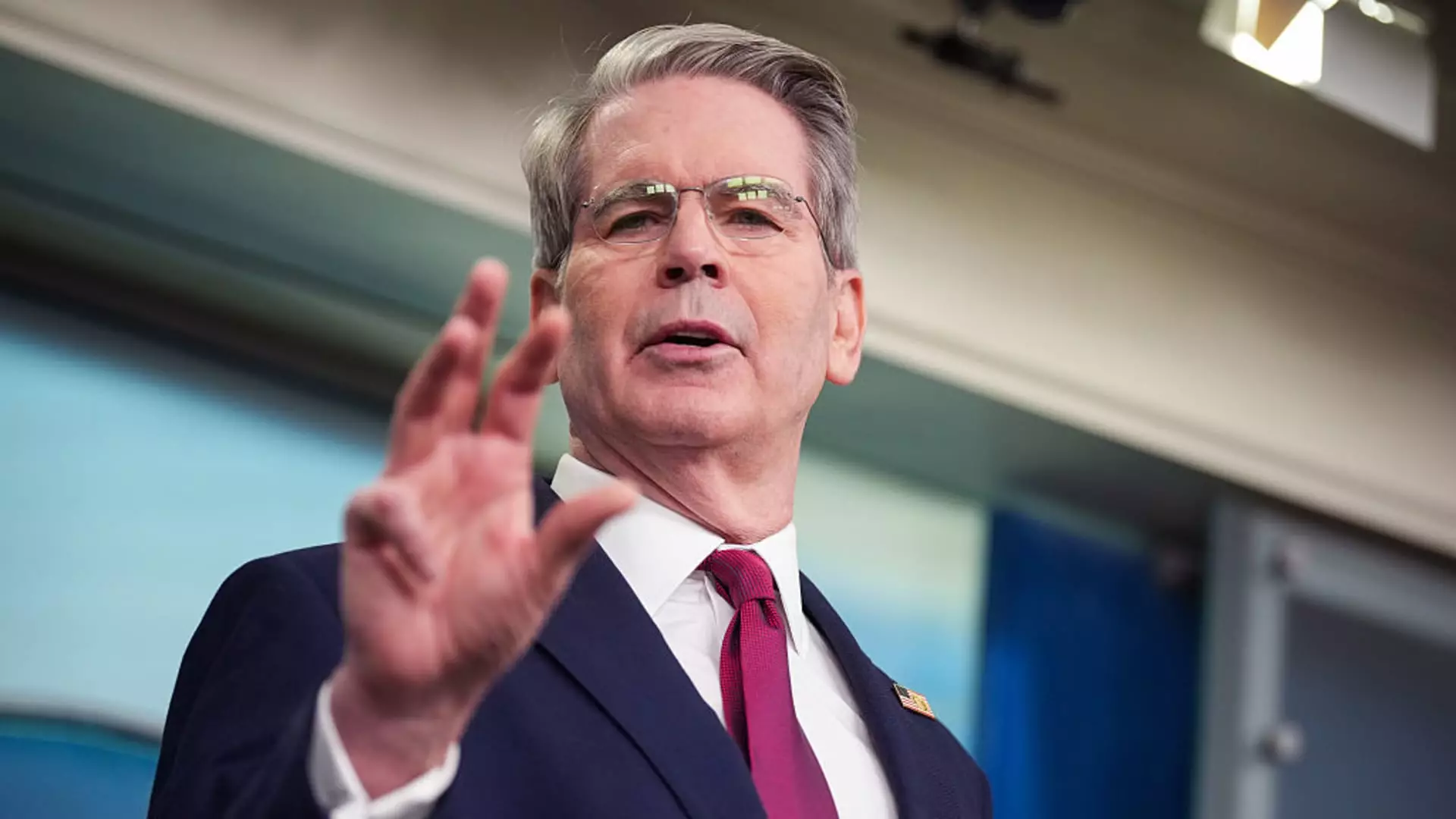

In a recent press conference, Treasury Secretary Scott Bessent raised eyebrows by stating that individual investors have largely maintained their positions through the current turbulence in the stock market. He claimed that while institutional investors have panicked, retail investors exhibit unwavering faith in President Donald Trump’s tariff policy. This assertion posits a stark divide in investor mentality, revealing an intriguing dynamic where individual investors remain staunchly loyal to the president’s economic strategies despite the significant market turmoil surrounding them.

Bessent’s mention of Vanguard statistics, which showed that a staggering 97% of retail investors have chosen not to make any trades over the last 100 days, suggests a remarkable level of restraint. Yet, one cannot help but question whether this perceived faith is a sign of strength or naivety. Is it truly confidence in a policy, or rather, a lack of options in a challenging financial landscape that has compelled these individuals to remain inactive?

Market Reactions and Tariff Impact

The broader implications of Trump’s tariffs have sparked widespread fear among institutional investors, with many now adopting bearish positions to hedge against what they perceive as a looming economic downturn. The stock market recently experienced its worst sell-off since the pandemic, and these tariffs have been a significant catalyst for the panic. Institutions such as hedge funds view tariff-based policies as a possible precursor to recession, as concerns about increased consumer prices and dwindling supplies rear their heads. If this climate proves to be prescient, then the unwavering belief of individual investors could quickly transform into desperate regret at having held their positions too long.

The Chief Economist at Apollo, Torsten Slok, has warned that these tariffs could lead to issues on the ground for consumers, predicting shortages and rising prices. Such predictions contrast sharply with the complacency exhibited by many retail investors and add weight to the argument that ignoring the realities of a turbulent market could have dire consequences.

Brand America at Risk

Ken Griffin, founder of Citadel, has articulated a key concern regarding the long-term implications of Trump’s trade policies, suggesting that the United States’ global reputation may suffer irreparable damage. This notion adds another layer to the already complex discussion surrounding tariffs and investment strategies. If Brand America begins to tarnish, it could lead to significant shifts in international finance, potentially undermining the very foundation of U.S. Treasury debt, which has long been viewed as a stable haven for investors.

In a world where economic data and stock performance increasingly intertwine with politics, the allegiance of individual investors to Trump’s tariff strategy raises provocative questions. The market’s resilience may be deceptive, as maintaining faith in a policy fraught with risks poses the very real danger of exacerbating future economic challenges.

The confidence that individual investors exhibit could soon be put to the test. The juxtaposition of retail endurance against institutional fear highlights a critical divergence in perceptions that may ultimately shape the economic landscape. As the scenario unfolds, one must remain vigilant—whether this confidence holds might soon reveal itself to be a perilous gamble.