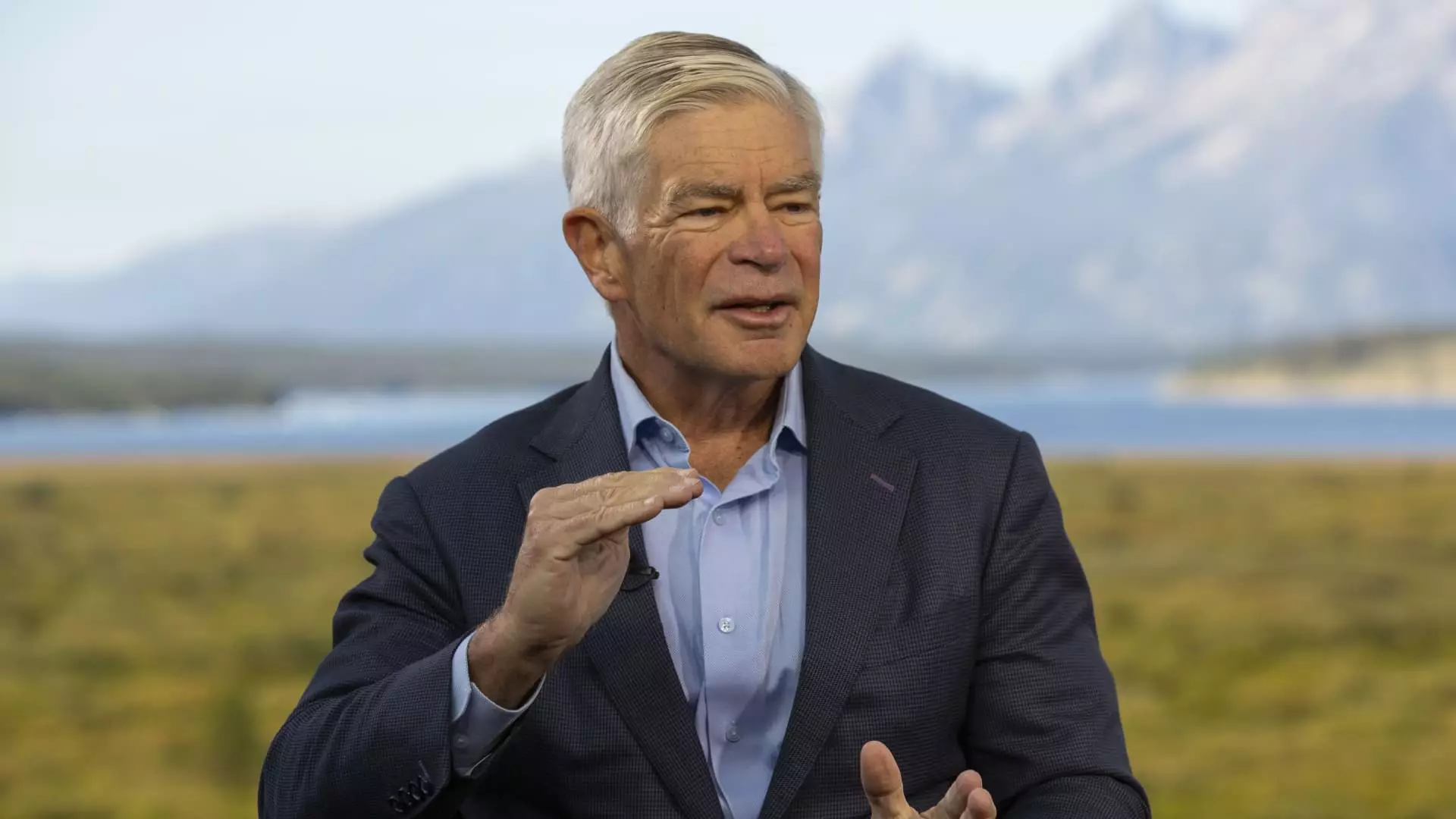

Philadelphia Federal Reserve President Patrick Harker has made it clear that he is in favor of an interest rate cut in September. Speaking at the Fed’s annual retreat, Harker emphasized the need to start the process of moving rates down in an effort to stimulate economic growth. This endorsement comes after minutes from the last Fed policy meeting hinted at a possible cut, pointing to growing confidence in the future of inflation and concerns about the labor market.

Market expectations are high for a rate cut in September, with a 100% certainty of a quarter percentage point reduction and a 1-in-4 chance of a more aggressive 50 basis point cut. Harker, however, remains undecided on the magnitude of the cut, stating that he needs to see more data before making a final decision. The Fed has kept rates steady for some time now in an effort to combat inflation, but recent indicators suggest that a shift in policy is imminent.

Harker made it clear that the Fed’s decisions are independent of political influence, emphasizing the importance of data-driven policy making. As the presidential election looms in the background, Harker stressed the Fed’s role as proud technocrats whose job is to respond appropriately to economic data. With a focus on maintaining the stability of the economy, Harker believes that now is the time to start bringing rates down.

Kansas City Fed President Jeffrey Schmid also weighed in on the future of policy, citing rising unemployment as a key factor in the decision-making process. While acknowledging the impact of a tightening labor market on inflation, Schmid pointed to recent cooling indicators as a sign that more action is needed. Despite noting that banks have weathered the high-rate environment well, Schmid believes that there is still work to be done to address the current economic challenges.

Harker and Schmid, both nonvoters on the rate-setting Federal Open Market Committee this year, will have the opportunity to vote on future rate decisions. While Harker won’t have a vote until 2026, Schmid is set to participate in next year’s policy discussions. Their perspectives offer valuable insights into the considerations that will shape the Fed’s future monetary policy decisions.

The case for an interest rate cut in September appears to be gaining momentum. With key Fed officials like Harker and Schmid endorsing the need for a policy shift, the stage is set for a potentially significant adjustment in the coming weeks. As the Fed continues to monitor economic data and evaluate the impact of its decisions, the path forward will likely involve a careful balance of stimulating growth while maintaining financial stability.