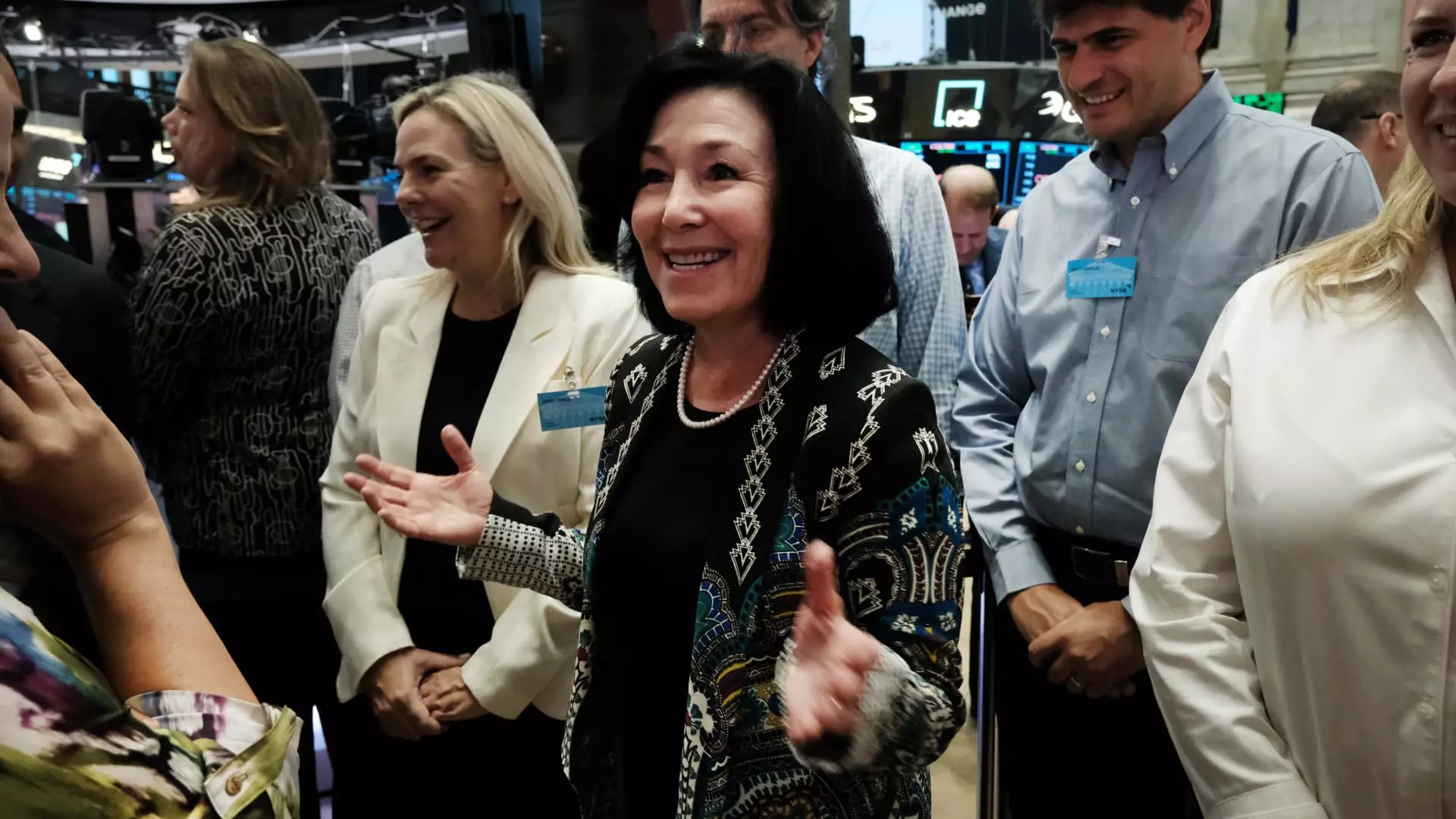

Oracle Corporation has recently captivated market attention, with its shares climbing approximately 6% in after-hours trading following a significant revision to its revenue forecasts. In an analyst meeting held during the Oracle CloudWorld conference in Las Vegas, CEO Safra Catz outlined ambitious targets, signaling a robust outlook for the company’s financial trajectory. The new guidance for fiscal 2026 is set at a minimum of $66 billion—outpacing analyst expectations that hovered around $64.5 billion. This positive momentum is indicative of a broader trend as Oracle’s shares have soared nearly 15% over the past three trading sessions, reaching record highs after a quarterly earnings report that outperformed estimates. This surge culminates in an impressive 55% gain year-to-date, positioning Oracle as a formidable player in the tech sector, second only to Nvidia among large-cap tech giants.

What makes Oracle’s outlook particularly noteworthy is its foresight into the fiscal 2029 landscape, projecting revenues will exceed $104 billion. This strategic long-term planning is becoming increasingly integral for investors as companies navigate the rapidly evolving tech industry. Catz reinforced her confidence in these projections by highlighting the importance of strategic partnerships with major cloud providers like Amazon, Google, and Microsoft, which facilitate the deployment of Oracle’s database solutions across diverse platforms. The collaborative tie-ups enhance Oracle’s ability to adapt in the competitive cloud computing landscape, making its offerings more accessible to a wider range of customers.

Contributing to Oracle’s upward trajectory is the remarkable growth of its cloud infrastructure segment, which recorded an impressive 45% increase in the last quarter. This growth rate outpaces that of established competitors, including Amazon, Google, and Microsoft. As enterprises increasingly migrate their workloads to the cloud, Oracle stands poised to capitalize on this shift. Furthermore, Oracle’s emphasis on artificial intelligence (AI) positions it advantageously for future expansion. The announcement regarding the commencement of orders for over 131,000 Nvidia “Blackwell” graphics processing units reflects a commitment to not just participate in but actively lead in AI development. By leveraging these next-gen GPUs, Oracle is preparing to meet the impending demands for computing power in AI applications.

In alignment with its revenue generation strategies, Catz also revealed expectations for capital expenditures to double during the current 2025 fiscal year. This proactive investment approach highlights Oracle’s commitment to reinforcing its infrastructure and enhancing technological capabilities. Such financial strategies are critical as the company aims to build on its cloud services while expanding its AI technology presence in a fiercely competitive market. Overall, Oracle’s recent advancements and projections depict a company at the cusp of transformative growth, supported by a clear vision, strategic alliances, and significant capital investments geared towards shaping the future of cloud computing and artificial intelligence.