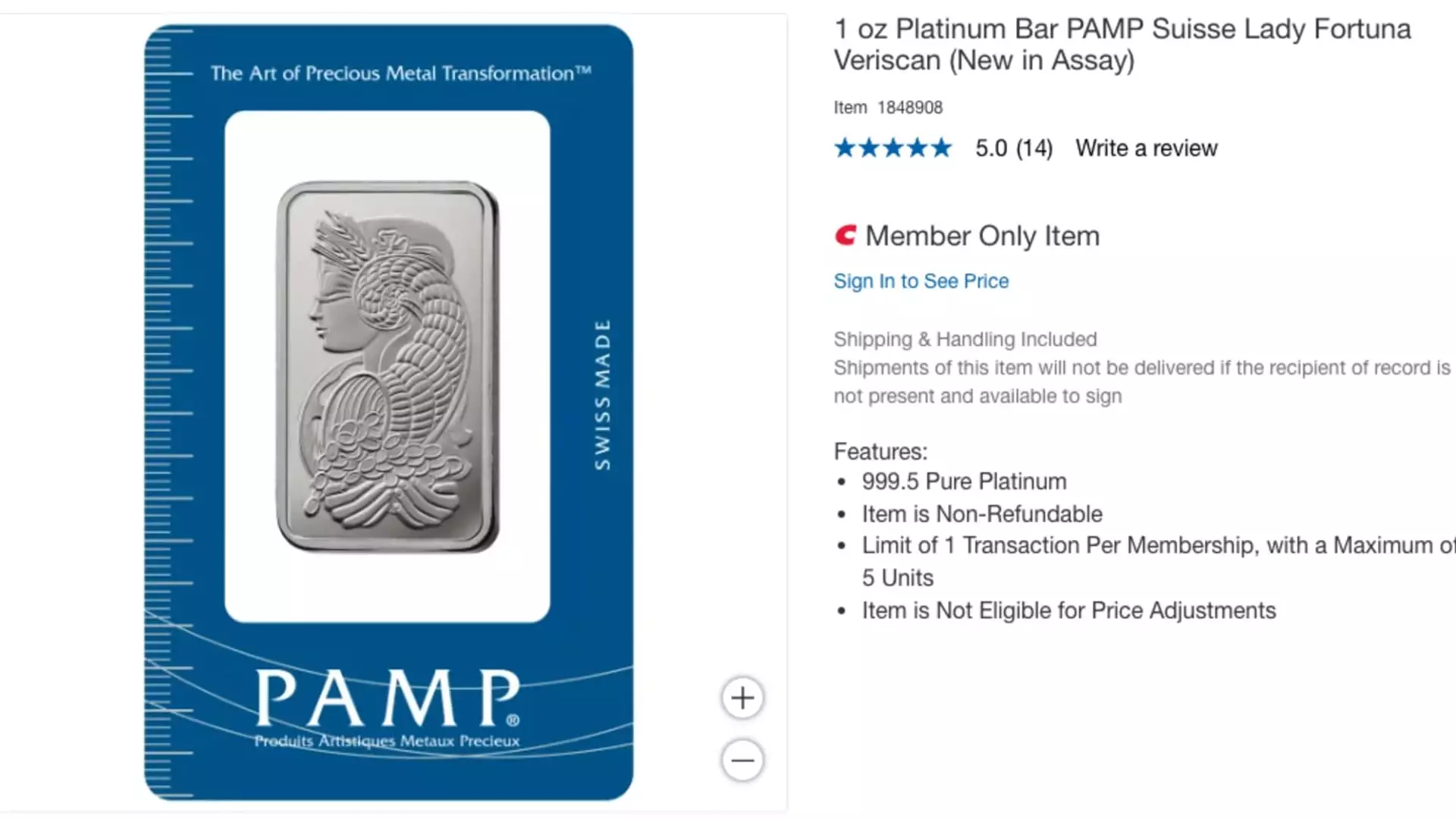

Costco, a retail giant known for its bulk items and warehouse shopping model, is making significant strides in the precious metals market. Its latest addition to the online catalog features Swiss-made platinum bars, each weighing one ounce and priced at $1,089.99. This move aligns with the company’s successful foray into gold bar sales, which have become increasingly popular among its members. By catering to a niche market that values both investment security and quality, Costco appears to be strategically positioning itself within the precious metals sector.

The platinum bars are exclusively available for online purchase, a decision that has generated curiosity and intrigue among potential buyers. However, this offering does come with certain restrictions: deliveries are not permitted to Louisiana, Nevada, or Puerto Rico, which raises questions about regulations or logistical challenges faced in these regions. Additionally, to gain access to these products, consumers must hold a Costco membership, which incurs an annual fee ranging from $65 to $130. This requirement underscores Costco’s commitment to fostering a loyal membership base, while simultaneously creating a barrier to entry that may deter non-members from participating in these precious metal investments.

Costco’s recent plunge into precious metals follows a notable success story. The company launched its gold bars in August 2023, quickly seeing demand skyrocket to the extent that they were selling out within hours of restocking. Reports indicate that Costco was moving approximately $200 million worth of gold bars monthly following this initial launch, showcasing an impressive consumer appetite for tangible assets. Richard Galanti, the then-chief financial officer of Costco, noted that members eagerly awaited availability, often buying the maximum allowed of two bars per order. This trend highlights a burgeoning interest in precious metals as a safeguard against economic uncertainty and inflation.

Understanding the allure of precious metals requires a look at market trends. The value of gold has appreciated dramatically over the past few years, soaring by more than 40% in just one year and by over 70% in the last half-decade. Investors are drawn to its stability and proven worth as a hedge against inflation. Conversely, platinum’s path has not been as smooth; although it has experienced a gain of over 15% in the last year, it has struggled with volatility, recently dropping by more than 8% after hitting an earlier high above $1,100 in 2024. This contrasts starkly with gold’s consistent upward trajectory, and key figures in investment sectors will be watching closely how Costco navigates the sale of such fluctuating assets.

Costco’s entry into the precious metals market represents a calculated strategy to attract a specific demographic of investors who are seeking safe havens for their wealth. As gold and platinum markets witness fluctuations, the retailer’s unique online offerings could potentially lure in both casual buyers and serious investors. Costco’s ability to swiftly respond to market demands positions it advantageously in this competitive landscape, continuing to bolster its reputation as a one-stop shop for both everyday products and high-value investments. The unfolding dynamics of Costco’s precious metals offerings will undoubtedly be an interesting story to follow as they evolve in response to market trends.