Recently, financial commentator Jim Cramer expressed interest in investing in BlackRock, a titan in the asset management industry and the world’s largest asset manager. The consideration of BlackRock for Cramer’s “Bullpen”—a watchlist of potential stocks—marks a significant moment given the company’s recent financial performance. Following a robust third-quarter earnings report that exceeded analysts’ expectations, BlackRock’s stock surged to new heights. This performance illustrates not just the strength of BlackRock’s business model, but also hints at broader market trends that savvy investors like Cramer are keen to exploit.

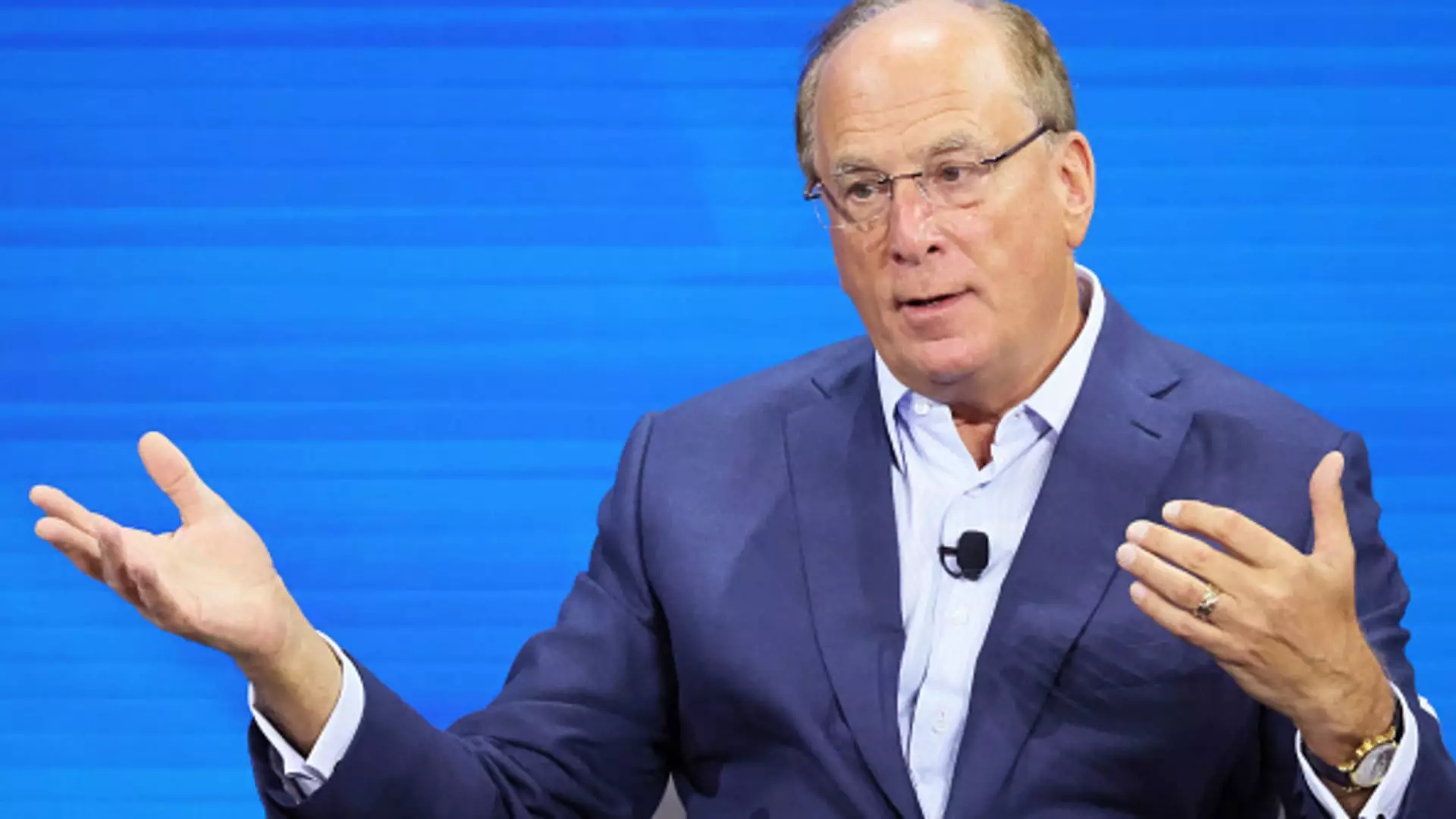

A key takeaway from BlackRock’s recent earnings release is the astonishing growth in assets under management (AUM), which soared to an incredible $11.5 trillion. This monumental figure indicates a staggering addition of $2 trillion over the past five years. As CEO Larry Fink articulated during a CNBC interview, this growth positions BlackRock firmly within the upper echelon of asset managers. Fink’s insights reveal a company that is not merely resting on its laurels; rather, it displays an aggressive growth trajectory bolstered by significant inflows, particularly following stock market rallies.

The recent acquisition of Global Infrastructure Partners for $12.5 billion, which contributed over $100 billion in assets to BlackRock, exemplifies the firm’s strategy to diversify and strengthen its portfolio. Such decisions not only enhance BlackRock’s market position but also reflect a broader trend among investment firms seeking to capture new avenues for growth amidst a dynamic financial landscape.

The investment climate has recently been rendered more complex due to shifting monetary policy. With the Federal Reserve’s decision to cut interest rates after a sustained period of higher rates, the financial industry faces both opportunities and challenges. Wall Street giants like BlackRock must navigate through this evolving landscape, which is laden with uncertainty regarding future rate adjustments. Analysts are currently speculating about the potential for further rate cuts, which could affect investment strategies moving forward.

Interestingly, despite these macroeconomic challenges, BlackRock’s performance remained stellar, which raises questions about how effectively the firm maneuvers through such turbulence. Cramer’s mention of other financial entities, including Wells Fargo and Morgan Stanley—both of which performed admirably—signals that BlackRock is not an isolated success story but part of a larger picture where financial firms are responding adeptly to changing conditions.

Cramer’s hesitation in fully committing to BlackRock, despite its alluring prospects, speaks to the careful and methodical approach he employs. He has been balancing his focus between Wells Fargo and Morgan Stanley, indicating that no investment decision is made lightly. For investors, this underscores the importance of thorough analysis and patience in stock selection. Even with compelling data backing BlackRock, Cramer maintains his stance of caution and deliberation, which is a prudent strategy in the investment realm.

Cramer has acknowledged BlackRock’s impressive performance, noting that while the stock has already experienced a significant run-up—over 12% in a month compared to the S&P 500’s 4%—its potential for further growth remains plausible. This sentiment may resonate with other potential investors who are weighing their options in a competitive market.

Jim Cramer’s consideration of BlackRock for his investment watch list underscores the potential that exists within the financial markets and particularly within asset management. The firm’s robust AUM growth, strategic acquisitions, and ability to navigate changing economic conditions set it apart as a competitor to watch. As uncertainties regarding federal interest rates linger, savvy investors must remain vigilant. BlackRock’s current trajectory suggests not only a strong present but also a compelling future, making it a captivating candidate for those looking to make strategic investment decisions in the financial sector. Cramer’s cautious optimism reflects a balanced investment strategy, advocating for smart, informed investing practices in a rapidly evolving marketplace.