The complexities surrounding student loan forgiveness in the United States have intensified following the withdrawal of significant debt relief proposals by the Biden administration. Originally aimed at easing the financial burdens of millions of borrowers, these plans have now been shelved, raising urgent questions about the future of student debt and the implications for higher education finance.

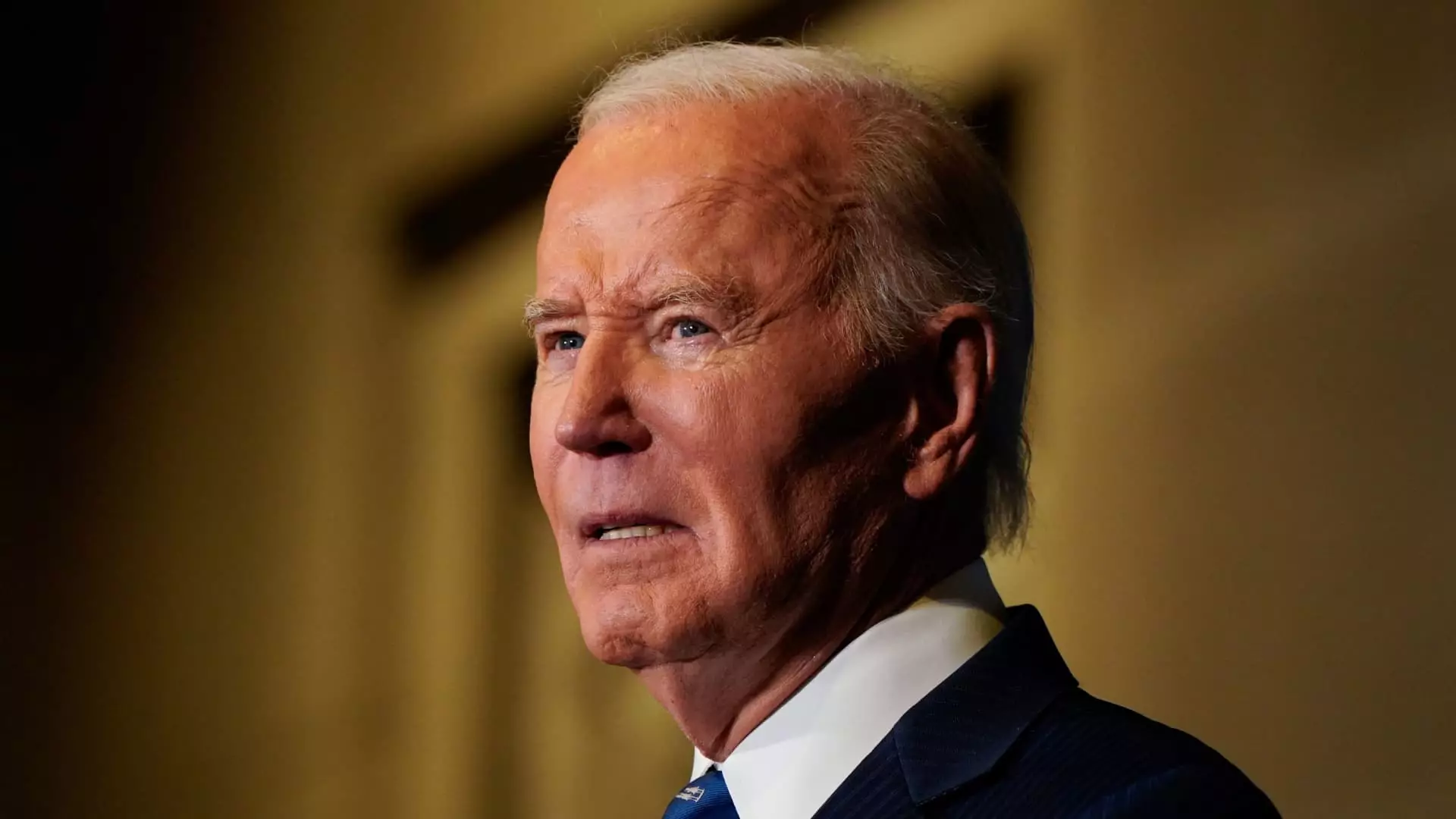

In a surprising turn of events, the Department of Education officially retracted two ambitious plans intended to forgive student loans for particular demographics of borrowers. These plans had the potential to alleviate significant debt for individuals who had been in repayment for many years, as well as those grappling with precarious financial situations. The Department cited “operational challenges” as the primary reason for this withdrawal, emphasizing that limited resources would now be focused on helping borrowers transition back into repayment. This maneuver unveils the administration’s struggle to balance effective debt relief with practical implementation capabilities, particularly in the dwindling weeks of Biden’s term.

This retraction comes at a pivotal moment as the political landscape is poised to shift with the impending inauguration of President-elect Donald Trump, a known critic of student loan forgiveness policies. Trump’s vehement opposition, characterized by his campaign rhetoric labeling such efforts as “vile” and possibly illegal, only adds to the uncertainties surrounding future initiatives aimed at alleviating the educational debt crisis.

The Biden administration had positioned itself as a counterforce to the growing student debt crisis, particularly after the U.S. Supreme Court’s decision in June 2023 to block an earlier plan for widespread student loan forgiveness. As a result, what emerged was a second-tier initiative, informally dubbed “Plan B,” which sought to offer relief through more targeted means. The failure to advance these proposals diminishes the administration’s broader strategy to address educational debt’s punitive impact on American families.

Experts highlight a stark contrast between the current administration’s approach to student debt and the anticipated policies of the incoming administration. Mark Kantrowitz, a higher education expert, articulated the futility of the proposals in the face of inevitable political backlash, underscoring a deeper systemic challenge within the federal education financing structure.

The withdrawal has not gone unnoticed, drawing sharp criticism from consumer advocates and educators alike. Many see this as a significant setback in the fight against the burdens of student loans. Persis Yu, a prominent voice from the Student Borrower Protection Center, lamented the lost opportunity to provide relief that would have fundamentally transformed the economic landscape for many working-class families. Such sentiments reflect a broader apprehension about the direction of financial aid and support for students.

Others emphasize the precarious nature of current loan programs, such as the Public Service Loan Forgiveness (PSLF) and Teacher Loan Forgiveness (TLF). The PSLF program, which offers loan cancellation after ten years of qualifying payments for public sector employees, along with TLF for educators serving in low-income communities, remains a beacon of hope amid the uncertainty. However, many borrowers express an underlying fear that these programs could also face jeopardy under a future administration, potentially creating a ripple effect of anxiety for those contemplating long-term commitments to public service.

Despite the retreat on broader forgiveness strategies, the Education Department maintains that several avenues for relief remain accessible. Borrowers are encouraged to explore the existing programs and guidance available through resources such as Studentaid.gov and databases maintained by organizations like the Institute of Student Loan Advisors. These platforms provide valuable information regarding state-level forgiveness options, which could offer some relief to borrowers navigating the complexities of repayment.

In the shadows of the withdrawn proposals, the ongoing dialogue about student loan forgiveness continues to evolve. The stakes are increasingly high as millions of Americans grapple with their educational debts during a time of economic strain. Moving forward, the challenge will be not only to revive the conversation about effective debt relief but also to advocate for systemic changes to ensure that education does not come with the burden of insurmountable debt.

In a climate marked by political volatility and economic uncertainty, the fate of federal student loan forgiveness hangs in a delicate balance, beckoning a critical reassessment of priorities within the U.S. education system.