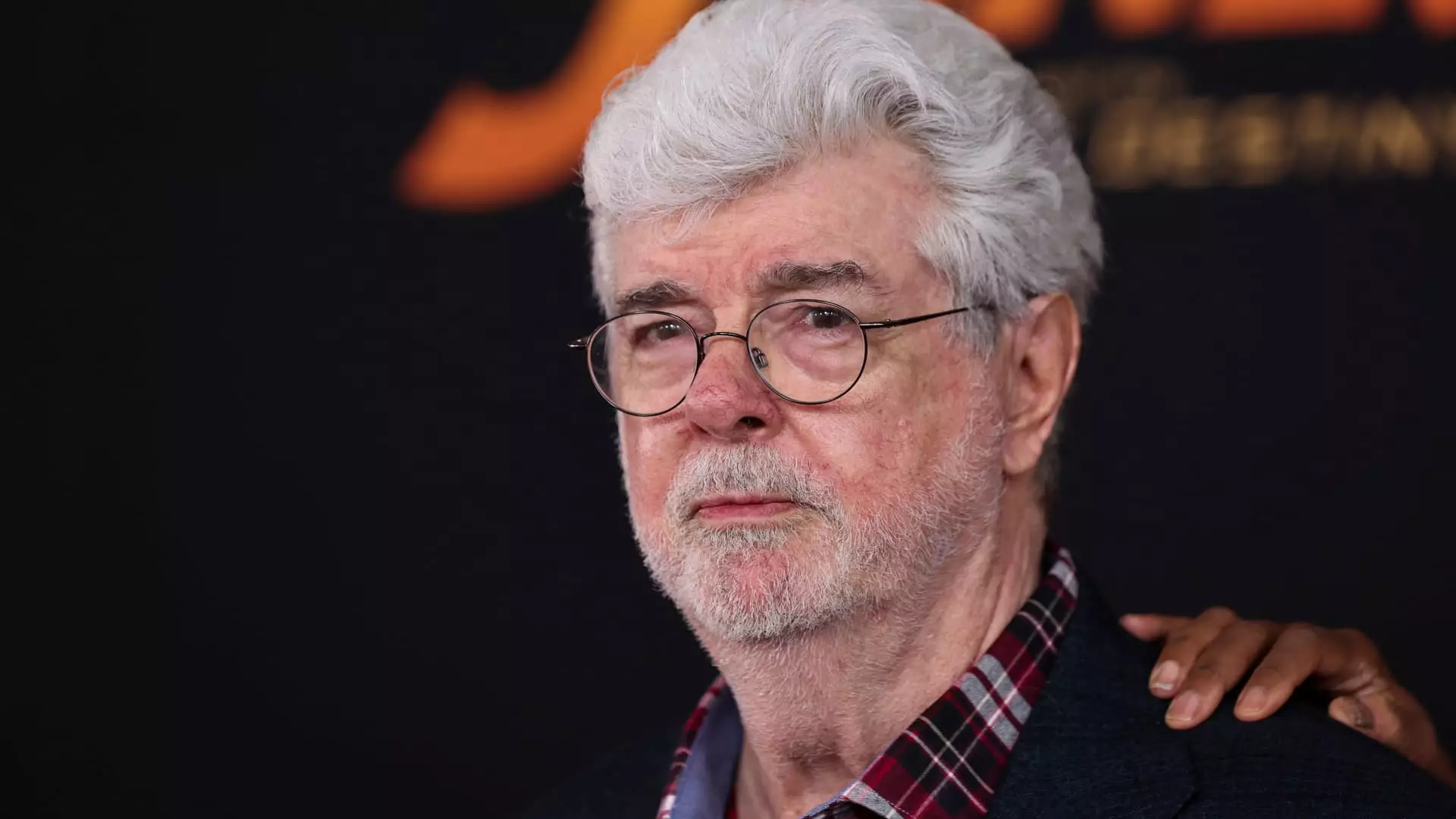

Renowned filmmaker and Hollywood icon George Lucas has thrown his weight behind Walt Disney CEO Bob Iger in the ongoing proxy battle with activist investor Nelson Peltz. With 37.1 million Disney shares acquired during Disney’s acquisition of Lucasfilm in 2012, Lucas now holds the position of the largest individual investor in the company.

The endorsement from George Lucas carries significant weight not only due to his substantial stake in Disney but also because of his stature in the entertainment industry. As the creative genius behind the iconic “Star Wars” and “Indiana Jones” franchises, Lucas has left an indelible mark on the world of cinema. Moreover, his contributions to digital film editing and computer-generated imagery have revolutionized the film industry.

Activist investor Nelson Peltz, along with his firm Trian Fund Management, has been pushing for changes within Disney, including the nomination of Peltz and former Disney CFO Jay Rasulo to the board. Peltz’s proposed overhaul of Disney’s traditional TV channels reflects his belief that they are no longer a profitable venture. On the other hand, Bob Iger has been focused on restructuring the company to make the Disney+ streaming platform a success, which includes significant cost-cutting measures such as thousands of layoffs.

In addition to George Lucas, Disney has garnered support from a range of influential figures in its battle against Peltz. The endorsements from the heirs of Walt and Roy Disney, as well as JPMorgan Chase CEO Jamie Dimon, highlight the widespread backing that Iger has managed to secure. With such heavyweight supporters in his corner, Iger is bolstered in his efforts to navigate the challenges posed by the proxy battle and effect meaningful change within Disney.

As the battle between Disney and activist investor Nelson Peltz heats up, the endorsement from George Lucas serves as a significant vote of confidence in Bob Iger’s leadership. With the backing of industry giants and a solid track record of innovation and success, Iger appears well-positioned to steer Disney through these turbulent times and emerge stronger on the other side.