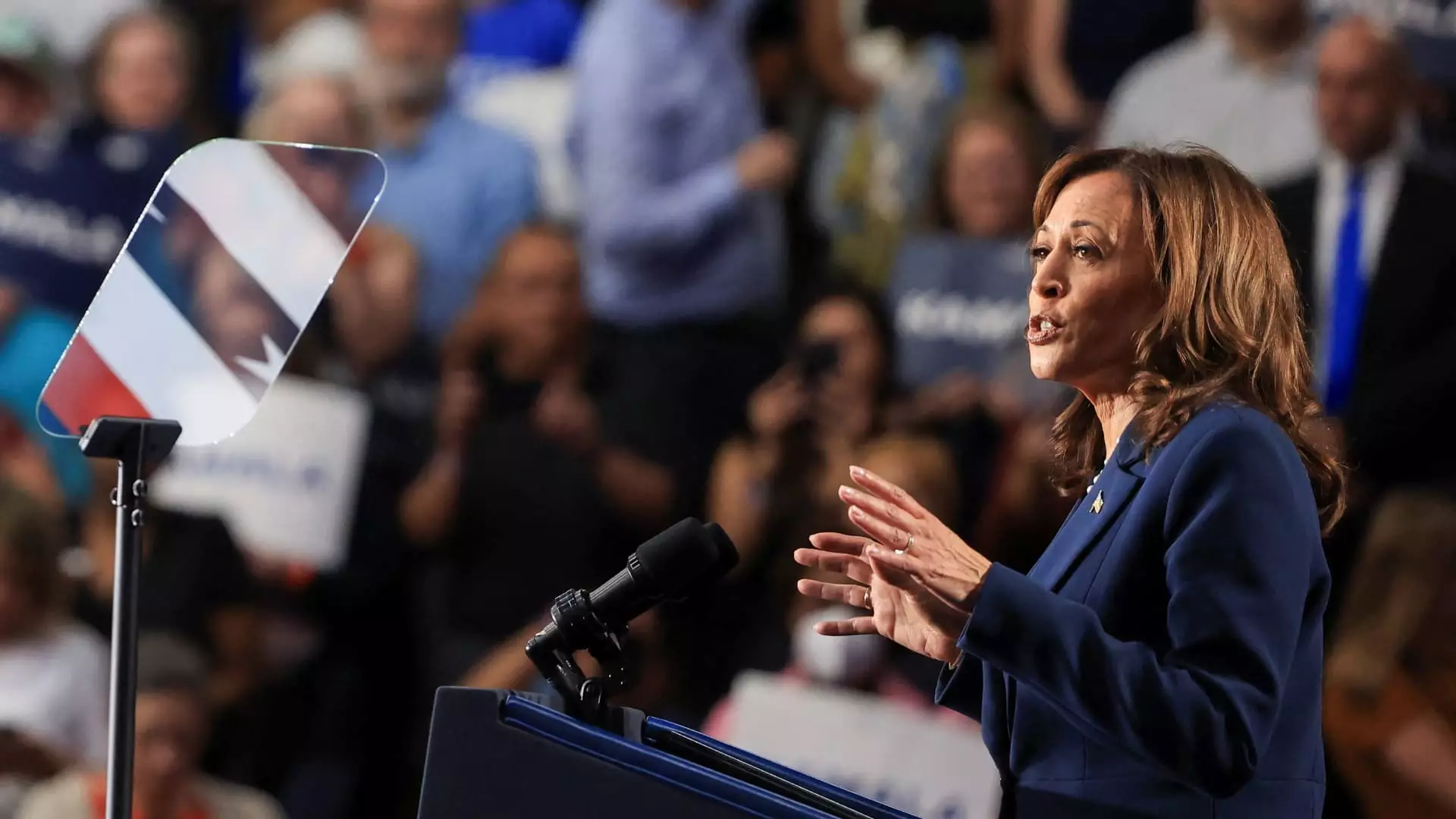

In a pivotal moment in her political career, Vice President Kamala Harris recently articulated a powerful vision aimed at revitalizing the middle class during a speech in West Allis, Wisconsin, marking one of her initial public addresses as the leading candidate to succeed President Joe Biden in the Democratic primaries. Harris declared, “Building up the middle class will be a defining goal of my presidency,” emphasizing that a robust middle class is synonymous with a strong America. The focus on socioeconomic equity is not merely rhetoric; it reflects the urgent need to address the wealth gap that has become a defining issue in contemporary American politics.

One of the cornerstone proposals of Harris’s campaign is the LIFT the Middle Class Act, which aims to provide ongoing financial relief to lower- and middle-income families. This program suggests offering an annual tax credit of up to $3,000 per individual or $6,000 per couple, potentially supplementing the income of millions of Americans who struggle to make ends meet. According to experts, this tax initiative is essential given the rising cost of living, with inflation persistently eroding real incomes. For many working-class families, financial security has become an increasingly elusive goal, exacerbated by the effects of the COVID-19 pandemic and ongoing economic fluctuations.

The thrust of the LIFT Act extends beyond mere tax relief; it reflects a broader societal recognition of the need for a safety net that addresses the unique challenges faced by renters and everyday workers. As many families grapple with exorbitant housing costs, the LIFT Act could serve as a crucial financial lifeline. This perspective adds a significant dimension to the ongoing debate regarding fiscal policy and socio-economic equity, particularly in the context of rising rental prices and financial instability among renters who often receive limited support compared to homeowners.

In light of President Biden’s recent proposal to impose a cap on rent increases, experts have raised concerns regarding its effectiveness. The proposed 5% cap for landlords owning 50 or more units might create a false sense of security for renters while introducing potential unintended consequences, such as a reduction in available rental properties as landlords opt out of the market to avoid the constraints. Differing insights point towards the LIFT Act as a more flexible solution that directly aids renters granting them necessary relief without introducing distortions into the market.

Georgetown University experts emphasize that tax credits might not only benefit renters but also stimulate economic activity by putting money directly into the hands of consumers, thereby enhancing overall demand. This contrasts sharply with the implications of rent control policies, which, while well-meaning, often create market inefficiencies that could diminish housing availability over time. Harris’s strategy to utilize direct financial assistance acknowledges the current realities of inflation and economic stagnation, presenting a more sustainable approach to alleviating the burdens on working-class families.

The rapid advancement of artificial intelligence technologies is ushering in new uncertainties surrounding job security, sparking ongoing discussions about the future landscape of work in America. Economists warn that as automation continues to evolve, many traditional jobs may become obsolete, creating a pressing need for policies that provide social insurance for affected workers. The context in which Harris is operating — characterized by both economic instability and a transformative technological landscape — accentuates the need for robust measures like the LIFT Act.

Skepticism surrounding job security, primarily fueled by AI advancements, has left many workers anxious about their prospects. Scholars argue that creating safety nets through financial mechanisms not only offers immediate support but also serves as a preemptive measure against potential employment disruptions. In such an unpredictable climate, introducing extensive tax credit systems like the LIFT Act could be key to enhancing financial resilience for American families.

Despite the promise offered by the LIFT Act, funding mechanisms remain a significant issue. Previous analyses indicate that substantial federal expenditure is required to implement the LIFT initiative, potentially necessitating repealing past tax cuts for higher-income earners. However, the prospect of addressing the national budget deficit poses a formidable challenge. Harris will need to navigate ongoing political complexities, including the expiration of tax cuts initiated by the previous administration, alongside competing priorities, such as the restoration of enhanced child tax credits that have proven vital during economic upheavals.

The augur of addressing child poverty through comprehensive tax reform emphasizes the complex interplay of policy decisions that could shape Harris’s economic platform. It remains to be seen whether her administration will prioritize the LIFT Act, but the momentum behind child tax expansion suggests a potential pivot towards maximizing immediate relief for families.

Harris’s vision for uplifting the middle class transcends individual policies; it represents a call to action for re-examining America’s commitment to socio-economic equity. As policymakers grapple with the intricacies of tax finance, housing, and job security, the overarching narrative becomes clear: without a well-defined strategy to empower the middle class, economic growth may remain an unattainable ideal. The challenge lies not only in crafting ambitious policies but also in fostering a political environment conducive to progressive reform. The path towards a fair economic future hinges on unity and bipartisan collaboration, reinforcing the notion that a thriving middle class is fundamental to a robust democracy.