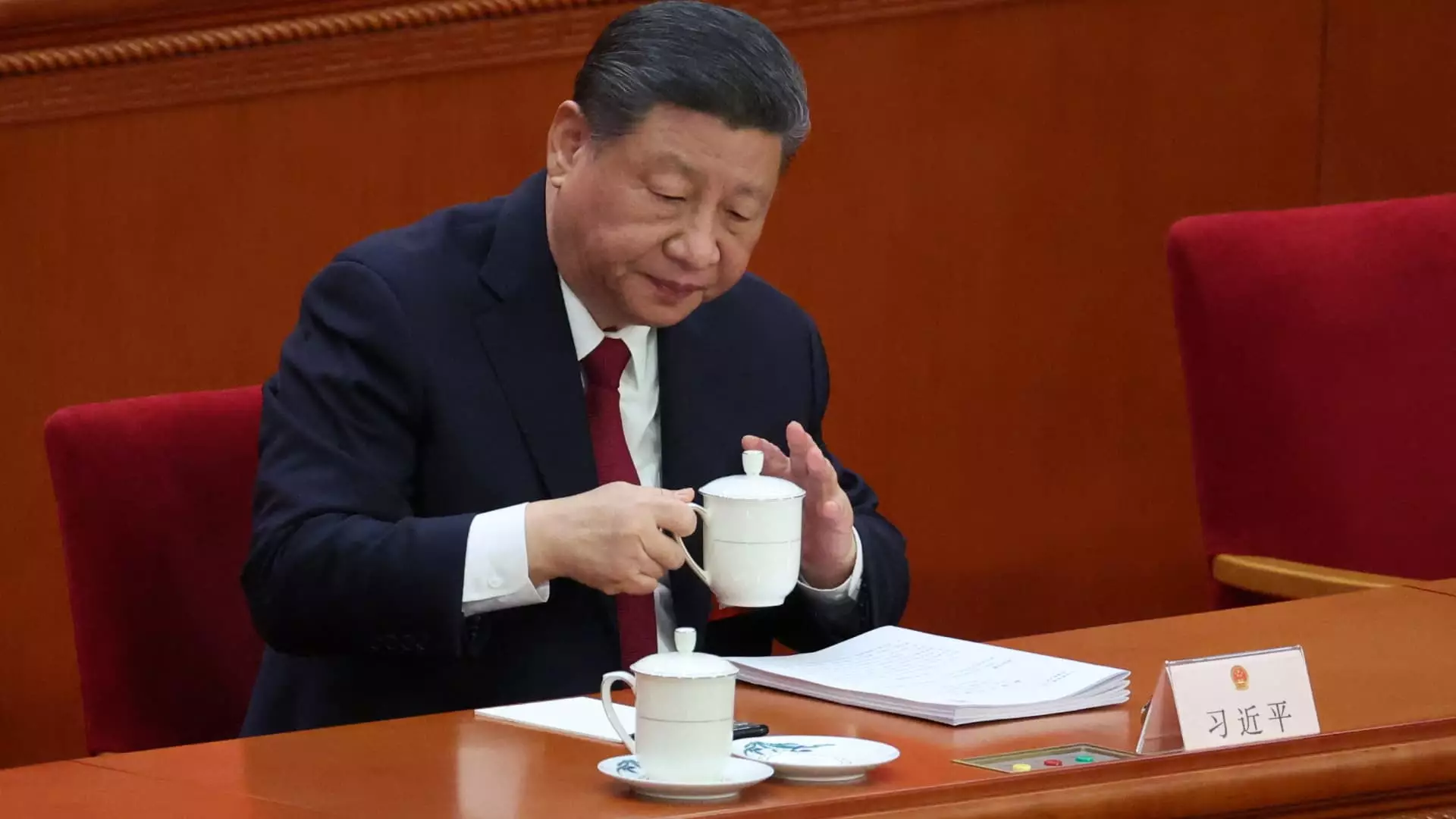

In an era marked by economic uncertainty, the recent decisions made by China’s Politburo under Xi Jinping’s direction appear to reflect a precarious bet. With external pressures mounting, particularly from escalating trade tensions with the United States, the Politburo convened to discuss strategies for supporting struggling businesses. While the intentions behind these measures are commendable, the efficacy of such a plan under the looming shadow of “increased external shocks” warrants scrutiny—and even skepticism. This once-omnipotent economic powerhouse is exhibiting signs of vulnerability, and the remedies being proposed could be insufficient to stave off the inevitable repercussions of global economic realignments.

Excessive Dependence on Fiscal Flimflam

China’s reliance on targeted fiscal measures to stimulate businesses raises a critical concern: is this approach merely a stopgap solution to a deeper structural problem? While lowering interest rates and easing reserve requirements might provide temporary relief, these strategies can often lead to unintended consequences, such as asset bubbles and increased debt levels. The Chinese economy is caught in a precarious balancing act; any reckless financial maneuvering may exacerbate existing issues, leading to greater instability. It appears that policymakers are more in love with the idea of managing perceptions rather than implementing long-lasting, transformative changes that genuinely boost economic resilience.

Middle-Income Mirage: A Band-Aid on a Gaping Wound

The focus on raising incomes for middle and lower-income groups is a noble aspiration; however, it may be overly optimistic given the current milieu of economic distress. While the Politburo has recognized the necessity of empowering these groups through improved consumption, the question remains: how will this change be materialized amid declining exports and rising costs? Policies aimed at bolstering income must be backed by real wage growth and opportunities for upward mobility. These grand declarations may ultimately devolve into mere lip service without actionable frameworks that foster meaningful economic participation across social strata.

Technological Aspirations in an Uncertain Landscape

Another concerning aspect of the recent Politburo meeting was the emphasis on technological advancement, particularly in artificial intelligence. There is no doubt that technology is a crucial component of modern economies; however, China’s ambitious goals seem overly reliant on quick fixes to counterbalance the trade fallout. Investing in tech development without addressing foundational economic issues could lead to a misallocation of resources. It is imperative that technological integration is coupled with a robust strategy for workforce retraining and education to ensure that the population can adapt to these advancements rather than being left behind as the economy shifts. Without such considerations, the investment could yield innovative unicorns without the necessary groundwork to sustain them in a volatile global environment.

The Stubbornness of Human Nature: A Recipe for Complacency

The current strategy being employed demonstrates a worrisome stubbornness on the part of Chinese leadership. By reaffirming previous policies instead of proposing innovative solutions, China’s top officials risk falling into a quagmire of complacency. Zhiwei Zhang’s comment that the government is “not in a rush to launch a large stimulus” may signify an insight into bureaucratic inertia rather than strategic patience. Policymakers need to adapt swiftly and decisively to emerging challenges; anything less might allow critical opportunities for recovery and resilience to slip away into the annals of missed chances. A stagnation rooted in the past, plagued by an inability to confront emerging realities, could be the tipping point that seals China’s fate in the tangled web of global trade dynamics.

As China’s political apparatus endeavors to navigate this tumultuous economic landscape, the proposed measures appear to oscillate between hopeful optimism and stark vulnerability. If the country is to maintain its status as a global economic leader, it must be willing to innovate and adapt—facing the future with the agility and foresight that its proud heritage has often promised, yet too seldom delivered.