Investors in the K-pop sector have faced a tumultuous start to the year, with lower fourth-quarter sales, decreased profits, and scandals impacting stock prices. The “big four” companies – JYP Entertainment, YG Entertainment, Hybe, and SM Entertainment – have all experienced declines in their stock prices since the beginning of the year. These market fluctuations were exacerbated by a dating scandal involving one of SM Entertainment’s artists, resulting in a significant drop in the company’s market value. Despite these challenges, Goldman Sachs expressed optimism for the industry in a recent report, highlighting a “high potential for valuation re-rating” based on continued multi-year earnings growth.

Goldman Sachs challenged the mainstream mindset that focuses on album sales as a key indicator of success in the K-pop industry. The analysts argued that offline concert attendance is a more accurate metric for measuring the industry’s reach and growth. They pointed out that album sales can be inflated by wallet share, where fans purchase multiple albums, skewing the data. Moreover, the analysts noted that the pandemic artificially inflated album sales due to the lack of in-person interactions, leading to a distorted perception of fan engagement. By shifting the evaluation criteria to in-person concert attendance, Goldman Sachs highlighted the industry’s ongoing growth trajectory, particularly in Japan, which is poised to become a key market for K-pop companies.

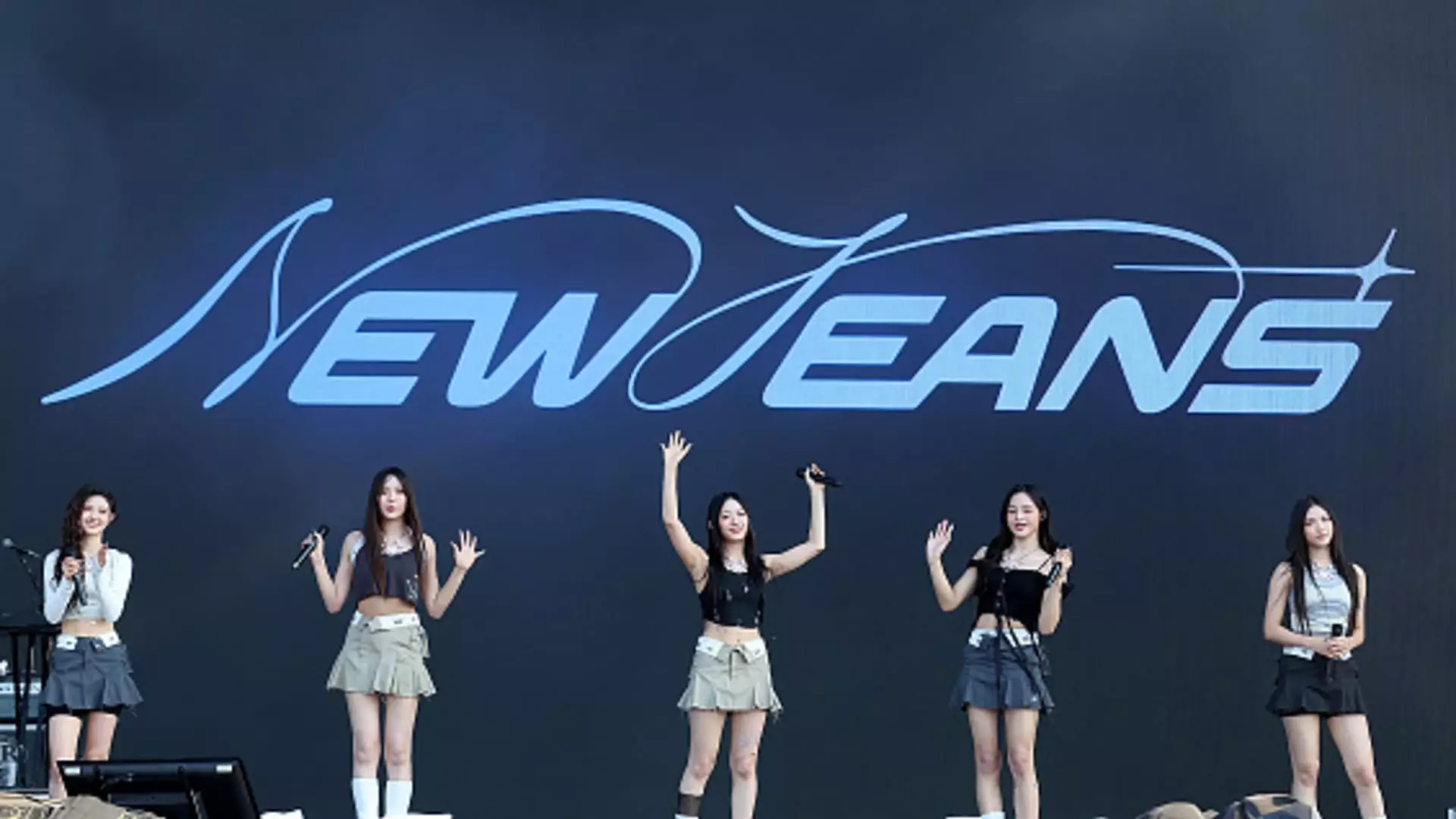

Japan presents a significant growth opportunity for K-pop companies, as highlighted by Goldman Sachs. The country has historically been a strong market for K-pop, with several Korean agencies making inroads into the live music scene. The recent scandal involving Japan’s top talent agency has further opened the door for K-pop artists, paving the way for increased audience engagement. Hybe, SM, and JYP are expected to see their market share in Japan double over the next few years, driven by new group debuts and strategic partnerships. Additionally, K-pop’s global fanbase is expanding rapidly, with a notable presence in the U.S. market. Recent successes, such as a Hybe-managed girl group’s chart-topping album and debut at Lollapalooza, underscore the industry’s growing influence on the international stage.

Hybe’s recent announcement of an expanded partnership with Universal Music Group signals K-pop’s increasing mainstream appeal and global reach. The exclusive distribution rights for Hybe’s artists and labels, coupled with UMG’s star-studded roster, position K-pop as a dominant force in the music industry. This strategic alliance not only enhances Hybe’s bargaining power but also solidifies K-pop’s position as a key player in the global music landscape. As the industry continues to evolve and innovate, these collaborations and cross-market successes pave the way for further growth and influence on a worldwide scale.

While the K-pop sector has faced its fair share of challenges in recent months, the underlying potential for growth and revaluation remains strong. By redefining success metrics, tapping into new markets, and forging strategic partnerships, K-pop companies are poised to elevate their status on the global stage. As the industry continues to evolve and expand, the untold story of K-pop’s journey towards mainstream recognition and commercial success unfolds with each chart-topping album and sold-out concert. With a passionate fanbase and a dynamic approach to creativity and collaboration, K-pop stands at the forefront of a new era in the music industry, where boundaries are blurred, and possibilities are endless.