Warren Buffett, the legendary investor, has finally disclosed his secret stock pick in a recent regulatory filing, and it’s none other than Chubb. Berkshire Hathaway, Buffett’s conglomerate, has acquired almost 26 million shares of Chubb, totaling a stake valued at $6.7 billion. This move has propelled Chubb to become Berkshire’s ninth largest holding as of the end of March. The announcement of Berkshire’s stake in Chubb led to a nearly 7% surge in Chubb’s shares during extended trading. Year-to-date, Chubb’s stock has seen a 12% increase.

Berkshire Hathaway, headquartered in Omaha, has a significant presence in the insurance sector. From the well-known auto insurer Geico to the reinsurance giant General Re, Berkshire Hathaway has a diverse portfolio that includes a variety of home and life insurance services. In addition to Chubb, Berkshire Hathaway has made strategic acquisitions in the insurance market, such as the $11.6 billion purchase of Alleghany in 2022. However, Berkshire recently divested its positions in Markel and Globe Life within the same industry.

The intriguing aspect of Warren Buffett’s investment in Chubb is the veil of secrecy surrounding it. Berkshire Hathaway kept this purchase hidden from the public for two consecutive quarters, seeking confidential treatment to withhold the details of its stock holdings. Despite the speculation surrounding Berkshire’s mystery holding, particularly in the realm of bank stocks, the revelation of Chubb as the chosen investment came as a surprise to many.

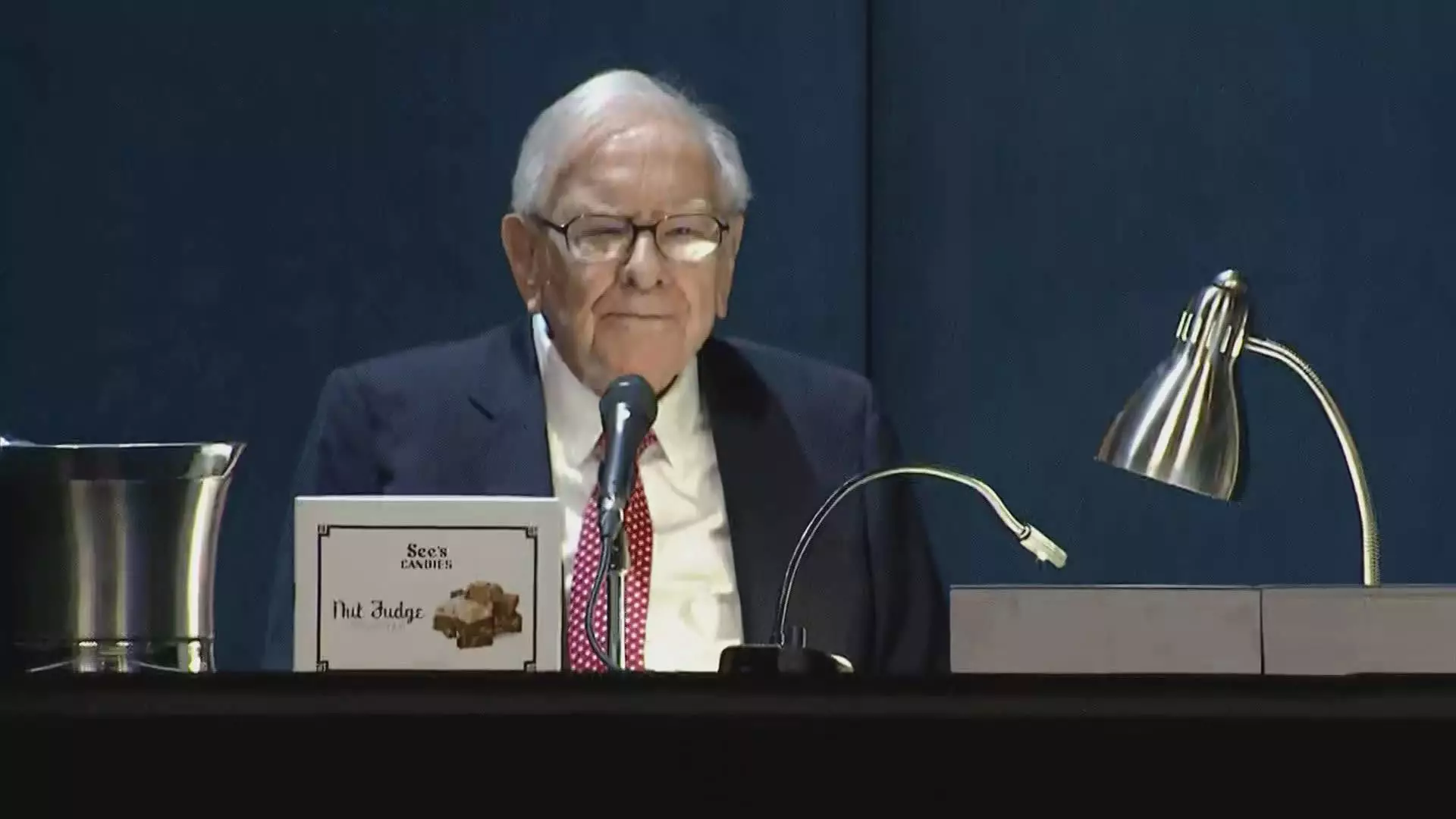

During Berkshire Hathaway’s annual meeting in Omaha, the topic of this undisclosed purchase did not surface, further adding to the element of surprise. Buffett’s conglomerate’s cost basis for “banks, insurance, and finance” equity holdings witnessed a substantial surge in the first quarter, followed by a significant increase in the second half of the previous year, sparking speculation regarding the nature of the undisclosed investment. It is noteworthy that Berkshire Hathaway rarely opts for confidentiality for its stock purchases, with the last instance being the acquisition of Chevron and Verizon in 2020.