The U.S. Department of Education has extended the deadline for borrowers to request a loan consolidation in order to qualify for key student loan forgiveness. Borrowers now have until June 30 to take advantage of this opportunity, which will combine their federal student loans into one new federal loan. By applying for loan consolidation by this deadline, borrowers could potentially have their debt canceled sooner than they would have otherwise.

Upon consolidating their loans before the June 30 deadline, borrowers enrolled in an income-driven repayment plan will receive a one-time adjustment on their payment count. This means that borrowers will earn credit toward all their loans based on the one they have been making payments on the longest. Additionally, certain periods that previously did not count towards forgiveness, such as months spent in deferments or forbearances, will now be factored in.

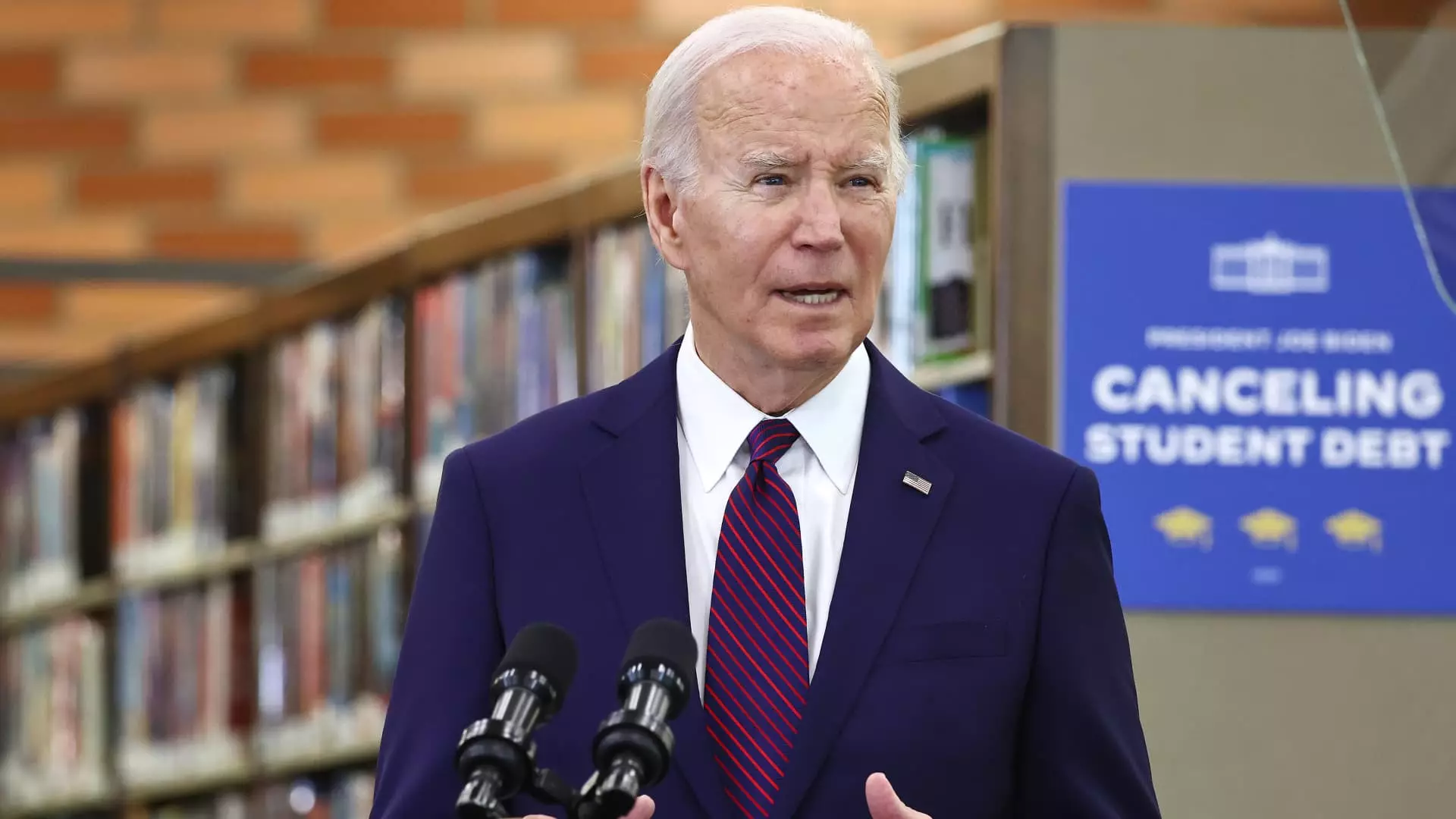

The payment count adjustment initiative is part of the Biden administration’s efforts to address longstanding issues faced by student loan borrowers. In 2022, the administration announced a review of accounts of those in income-driven repayment plans, following evidence that borrowers were not always receiving proper accounting of their payments. The aim is to ensure that borrowers are given credit for every month they have rightfully earned toward forgiveness.

Borrowers pursuing the Public Service Loan Forgiveness program can also benefit from the payment count adjustment. By certifying their qualifying employment for certain months, these borrowers can receive additional credit towards forgiveness. This adjustment allows borrowers to potentially accelerate the forgiveness process and avoid unnecessary delays in reaching full relief.

While student loan consolidation usually restarts a borrower’s forgiveness timeline, the temporary payment count adjustment opportunity presents a strategic move for borrowers looking to expedite the forgiveness process. Consolidating loans can be especially advantageous for those who have been making payments for many years and for borrowers with multiple loans from different periods. By consolidating before the deadline, these borrowers may be eligible for immediate forgiveness on all their loans.

Borrowers interested in taking advantage of the extended forgiveness deadline can apply for a Direct Consolidation Loan at StudentAid.gov or through their loan servicer. The application process is quick and straightforward, taking under 15 minutes to complete. All federal student loans, including Federal Family Education Loans, Parent Plus loans, and Perkins Loans, are eligible for consolidation. In some cases where borrowers end up with more payments than required for forgiveness, they may be eligible for refunds.

The extension of the student loan forgiveness deadline and the accompanying payment count adjustment offer significant benefits to borrowers seeking relief from their student loan debt. By taking advantage of this opportunity before the June 30 deadline, borrowers can potentially expedite the forgiveness process and achieve full cancellation of their student debt sooner than expected.