The past week saw all three major averages closing higher, as Wall Street reacted positively to softer retail sales and consumer price data for April. The weaker-than-expected reports served as a signal for further disinflation, which is crucial for any potential interest rate cuts by the Federal Reserve. Despite some mixed signals, such as the producer price index showing an increase in wholesale prices, the overall sentiment was optimistic.

The S&P 500 reached a historic high, closing above 5,300 for the first time ever, while the Dow also recorded a milestone by surpassing 40,000. These gains were reflected in the weekly performance, with the Dow up by 1.2%, the S&P 500 rising by 1.5%, and the Nasdaq climbing by 2.1%. Technology, real estate, and healthcare sectors led the way, while industrials and consumer discretionary sectors faced losses.

The earnings season for the second quarter has been largely positive, with 93% of S&P 500 companies reporting. The majority of these companies have reported positive earnings surprises and sales surprises. As the earnings season winds down, attention will shift to the outlook provided by these companies for the upcoming quarters.

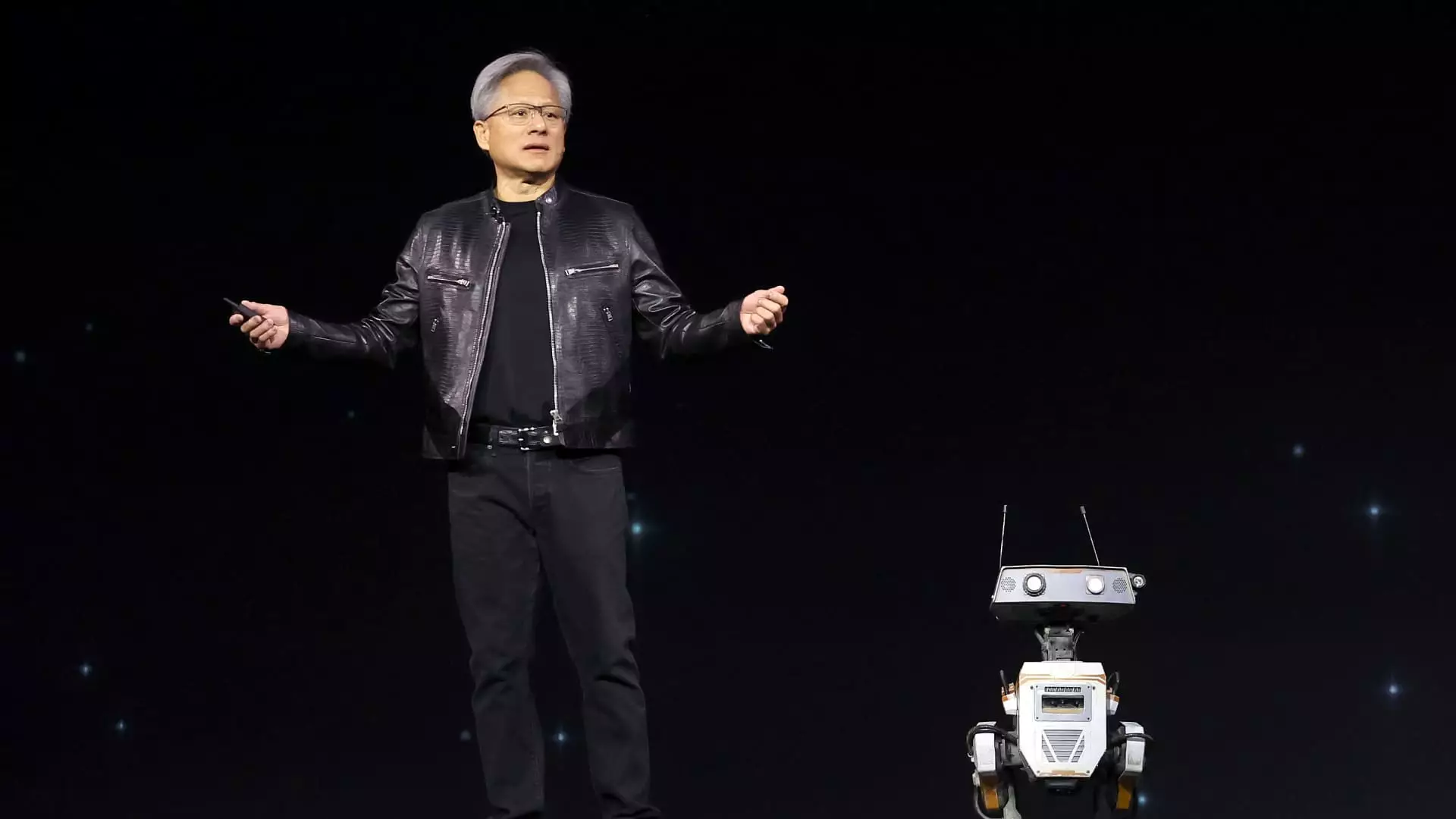

The week ahead is expected to be slower in terms of economic data releases, with the focus primarily on two housing reports. However, investors will keep a close watch on earnings reports from three portfolio companies, including Palo Alto Networks, TJX Companies, and Nvidia. These reports will provide insights into various sectors such as cybersecurity, retail, and semiconductor industries.

The housing market remains a key factor in discussions around inflation, as shelter costs have been a significant driver of rising prices. Despite recent disinflation trends in the housing sector, it continues to exert pressure on consumers and poses challenges for the Federal Reserve in terms of interest rate decisions. The upcoming housing reports will shed light on the current state of the market and its implications for inflation.

Palo Alto Networks is expected to rebound following a strategic shift in its business approach, while TJX Companies is likely to benefit from consumer preferences for discounted products in the current inflationary environment. Nvidia, a leader in AI and chip manufacturing, is anticipated to deliver strong results driven by sustained demand for its products. These earnings reports will provide valuable insights into the performance and outlook of these companies.

The market dynamics are influenced by a combination of economic data, earnings reports, and sector-specific trends. Investors should remain vigilant in monitoring the evolving landscape and be prepared to adapt their strategies accordingly. The upcoming week presents a mix of opportunities and challenges, with a focus on key economic indicators and corporate earnings shaping the market trajectory.