The Tax Cuts and Jobs Act of 2017 brought significant changes to the American tax system. One of the key provisions of this act was the reduction of federal income tax rates across the board. This resulted in lower tax rates for most individual taxpayers, with the top rate dropping to 37% from 39.6%. However, these tax breaks are temporary and are set to expire in 2025. If Congress does not take action to extend these provisions, the individual tax rates will revert to pre-TCJA levels, ranging from 10% to 39.6%.

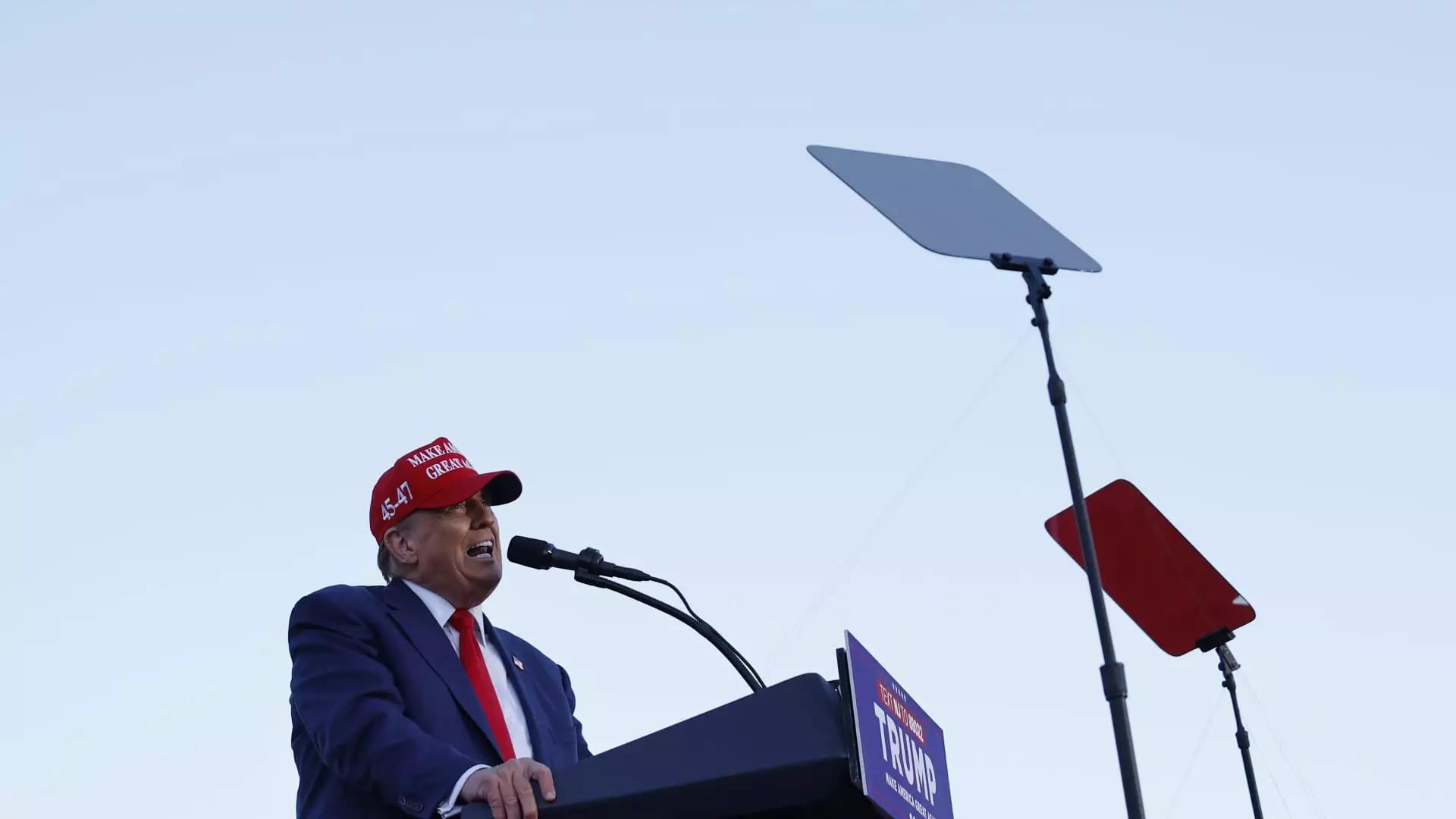

The looming expiration of the TCJA highlights the uncertainty surrounding the future of the American tax system. Both President Joe Biden and former President Donald Trump have expressed support for extending middle-class tax provisions introduced by the TCJA. However, with control of the White House and Congress up in the air, the fate of these tax breaks remains unclear.

One of the most significant changes introduced by the TCJA was the nearly doubling of the standard deduction, which made it less likely for taxpayers to itemize deductions. This change simplified the tax filing process for many Americans. However, experts warn that if the standard deduction reverts to 2017 levels after 2025, more taxpayers may need to itemize deductions to maximize their tax savings.

Another key element of the TCJA was the $10,000 cap on state and local tax (SALT) deductions. This provision has been a point of contention for lawmakers in high-tax states such as California, New Jersey, and New York. The scheduled expiration of the SALT cap in 2025 raises questions about the future tax burden for residents of these states.

In light of the impending changes to the tax code, some taxpayers have been taking advantage of the lower tax rates introduced by the TCJA. For example, higher earners have been leveraging lower income tax rates by converting pretax or nondeductible IRA money to Roth IRAs. Additionally, some individuals have been making early withdrawals from inherited IRAs to minimize future tax liabilities.

The increase in federal gift and estate tax exemptions through 2025 has prompted many ultra-wealthy Americans to transfer assets to the next generation tax-free. However, these exemptions are set to decrease significantly in 2026 if Congress does not pass new legislation. The potential impact of these changes on estate planning has become a key consideration for many high-net-worth individuals.

The expiration of the tax breaks introduced by the TCJA in 2025 poses significant challenges for American taxpayers. With the fate of these provisions hanging in the balance, tax planning has become increasingly complex. It is essential for individuals to stay informed about the potential changes to the tax code and to develop strategies to mitigate their impact on their financial well-being. Ultimately, proactive tax planning can help taxpayers navigate the uncertain future of the American tax system.