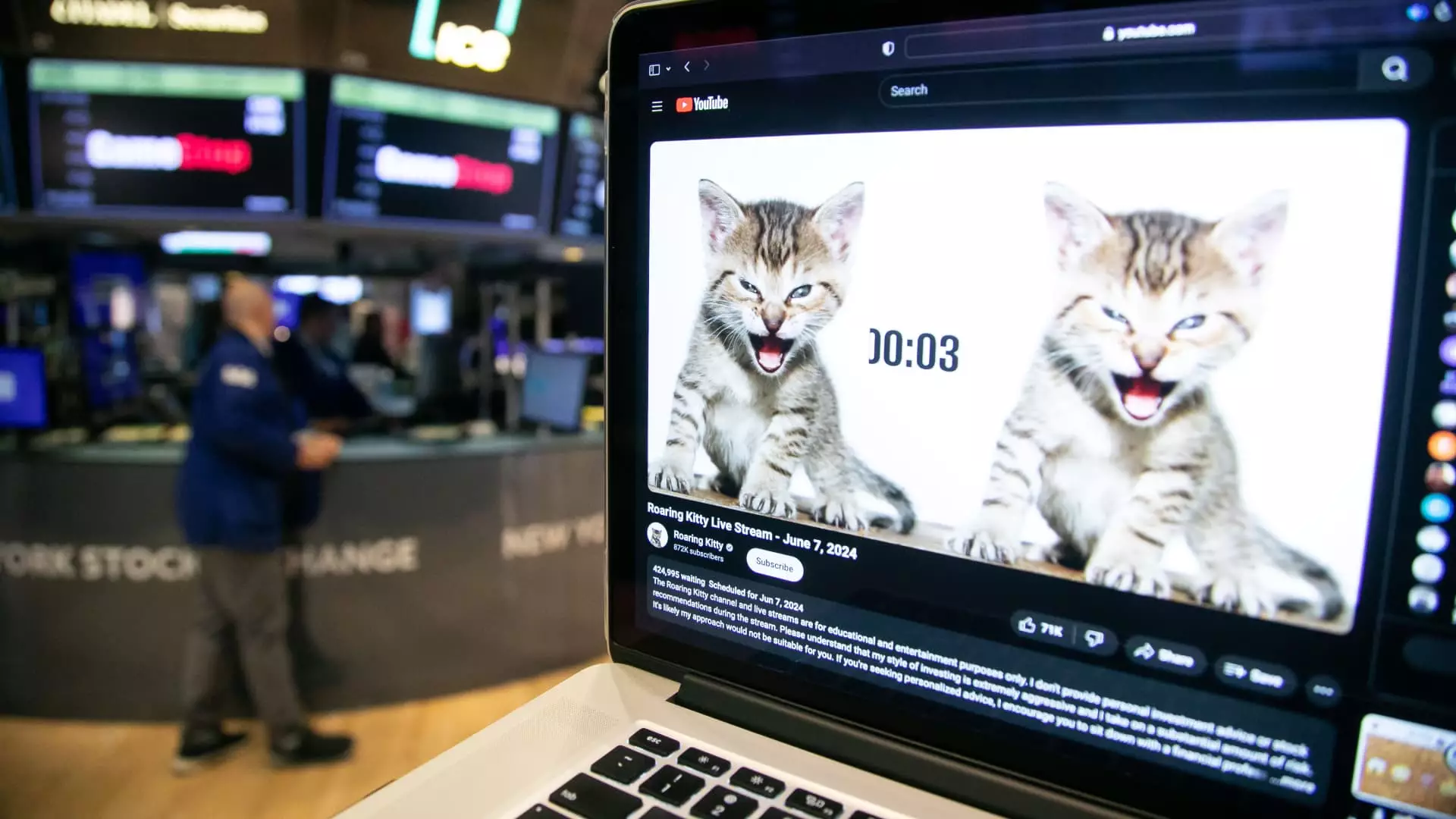

The sell-off in GameStop shares on Wednesday was accompanied by a spike in trading volume in the call options that meme stock leader “Roaring Kitty” owns. This intensified sell-off saw GameStop calls with a strike price of $20 and an expiration date of June 21 trading a whopping 93,266 contracts, more than nine times its 30-day average volume. The price of these contracts dropped more than 40% during the session, while the stock plunged 16.5%. It remains unclear whether Roaring Kitty was behind this large volume, but options traders suspect his involvement due to his significant holdings in those contracts.

Speculations and Concerns

Options traders have speculated that Keith Gill, also known as Roaring Kitty, may need to sell his calls prior to expiration or roll the position into another call option to avoid having to raise a substantial amount of cash to exercise them on June 21. This speculation has been fueled by the concern that if Gill were to exercise the calls, he would need $240 million to take custody of the stock, which is more than what he has publicly shown in his E-Trade account. Wall Street has been closely monitoring any signs of him unloading the position, as it could potentially impact the stock’s price.

Implications and Risks

The significance of Roaring Kitty’s role in the GameStop call options frenzy raises questions about the risks involved in such high-volume trading activities. The volatility and uncertainty surrounding meme stocks like GameStop can lead to drastic price fluctuations and steep losses for investors. The need for substantial capital to exercise call options further adds to the complexity of such speculative investments. The potential impact of a large player like Gill exiting his position underscores the fragility of the market and the influence of individual traders on stock prices.

The sell-off in GameStop shares and the surge in trading volume in call options owned by Keith Gill highlight the speculative nature of meme stocks and the risks associated with high-volume trading. As the market continues to be influenced by individual traders and social media-driven movements, it is essential for investors to carefully assess the implications of such trading activities and the potential consequences of significant players like Roaring Kitty adjusting their positions. The GameStop call options frenzy serves as a reminder of the volatility and unpredictability of the stock market, emphasizing the importance of thorough research and risk management in investment decisions.