Warren Buffett’s Berkshire Hathaway has been making headlines recently due to its continued trimming of its stake in China’s biggest electric vehicle maker, BYD. Despite being an early investor in BYD, thanks to the late Charlie Munger, Berkshire Hathaway has sold an additional 1.3 million Hong Kong-listed shares of BYD for $39.8 million. This move has reduced Berkshire’s holding to 6.9% from the previous 7%.

Back in 2008, Berkshire Hathaway made a substantial investment in BYD by purchasing around 225 million shares for approximately $230 million. This investment has proven to be extremely profitable as the electric vehicle market has experienced explosive growth in China and beyond. After BYD’s stock soared nearly 600% to a record high in April 2022, Berkshire started offloading half of its holding through sales in 2022 and 2023.

Founded by Wang Chuanfu, BYD initially started by manufacturing batteries for mobile phones in the 1990s. However, by 2003, the company shifted its focus towards automobiles and has since established itself as the leading car brand in China, along with being a major producer of EV batteries. In the fourth quarter of 2023, BYD surpassed Tesla as the world’s top EV maker by selling more battery-powered vehicles than its U.S. rival.

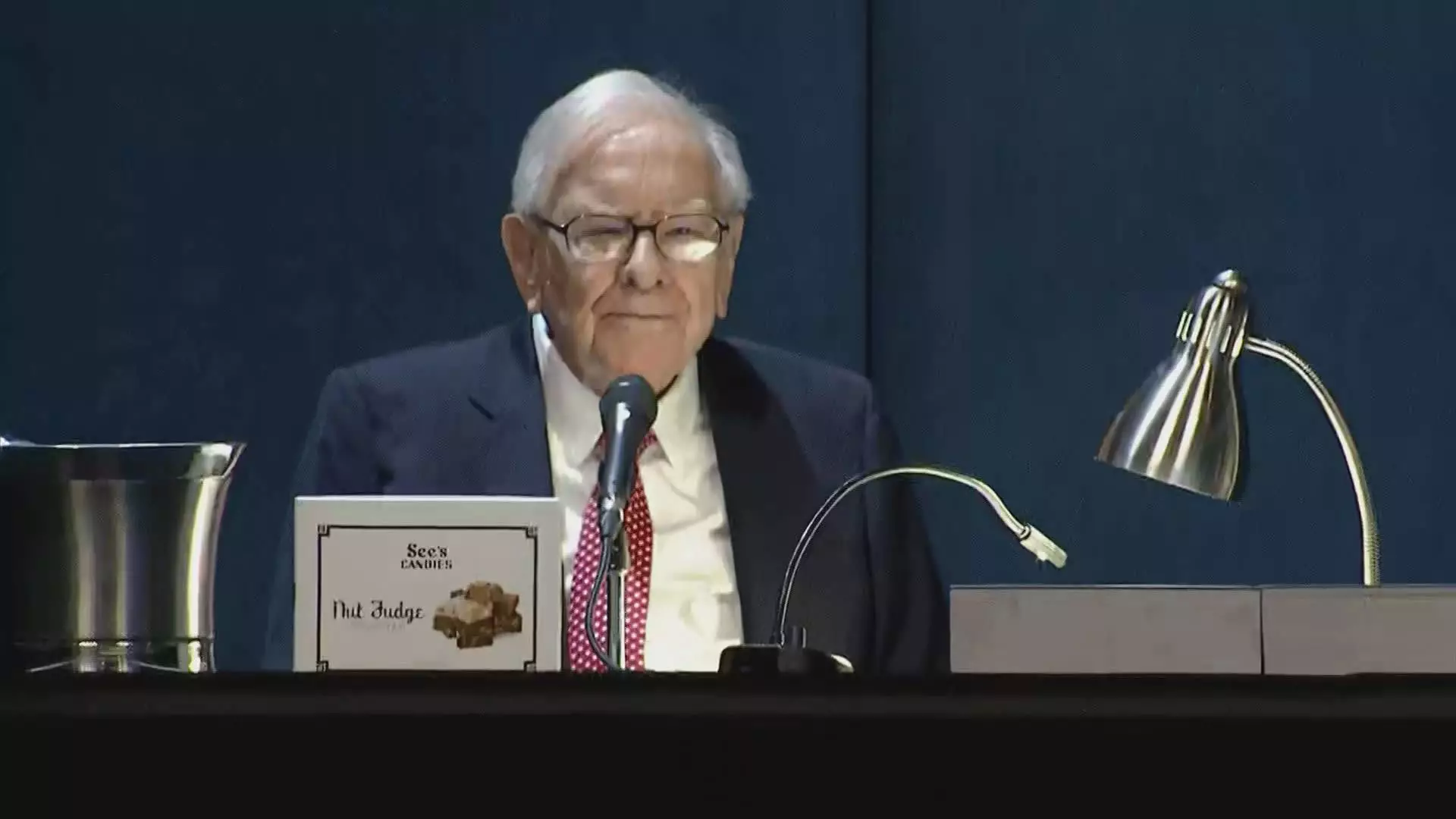

Warren Buffett credited the late Charlie Munger, Berkshire Hathaway’s vice chairman, for the success of the investment in BYD. Munger was introduced to BYD by his friend Li Lu, the founder of Seattle-based asset manager Himalaya Capital. Buffett acknowledged that Munger deserves “100 percent of the credit for BYD,” highlighting the crucial role Munger played in identifying and investing in BYD at the right time.

As Berkshire Hathaway continues to trim its stake in BYD, it raises questions about the conglomerate’s future outlook in the electric vehicle market. With the growing competition and advancements in EV technology, Berkshire Hathaway may need to reassess its investment strategies to remain competitive in this rapidly evolving industry.

Berkshire Hathaway’s decision to sell its stake in BYD reflects the changing dynamics of the EV market and the need for investors to adapt to emerging trends. It will be interesting to see how Berkshire Hathaway navigates the evolving landscape of the electric vehicle industry and positions itself for future success.