Cody Gude, a 35-year-old Tampa, Florida resident, was eagerly anticipating a decrease in his monthly student loan payment from $200 to $100 under the new Saving on a Valuable Education (SAVE) plan. The plan, introduced by President Joe Biden, promised to provide substantial relief to student loan borrowers by reducing their monthly payments based on their discretionary income. This reduction in payment would have allowed Gude to focus solely on his work as a social media consultant, without having to deliver groceries on Instacart part-time. However, Gude’s hopes were dashed when he learned that two federal judges had temporarily halted major parts of the SAVE plan, leaving millions of borrowers confused and disappointed.

The temporary injunctions issued by federal judges in Kansas and Missouri put a pause on the implementation of the new repayment plan, leaving borrowers in limbo. While some aspects of the SAVE plan, such as lowering monthly payments to 5% of discretionary income, were already in effect, the full benefits of the plan were set to kick in on July 1. The confusion among borrowers was palpable, with many wondering whether they would still see the relief they had been promised or if their payments would revert to the previous amounts.

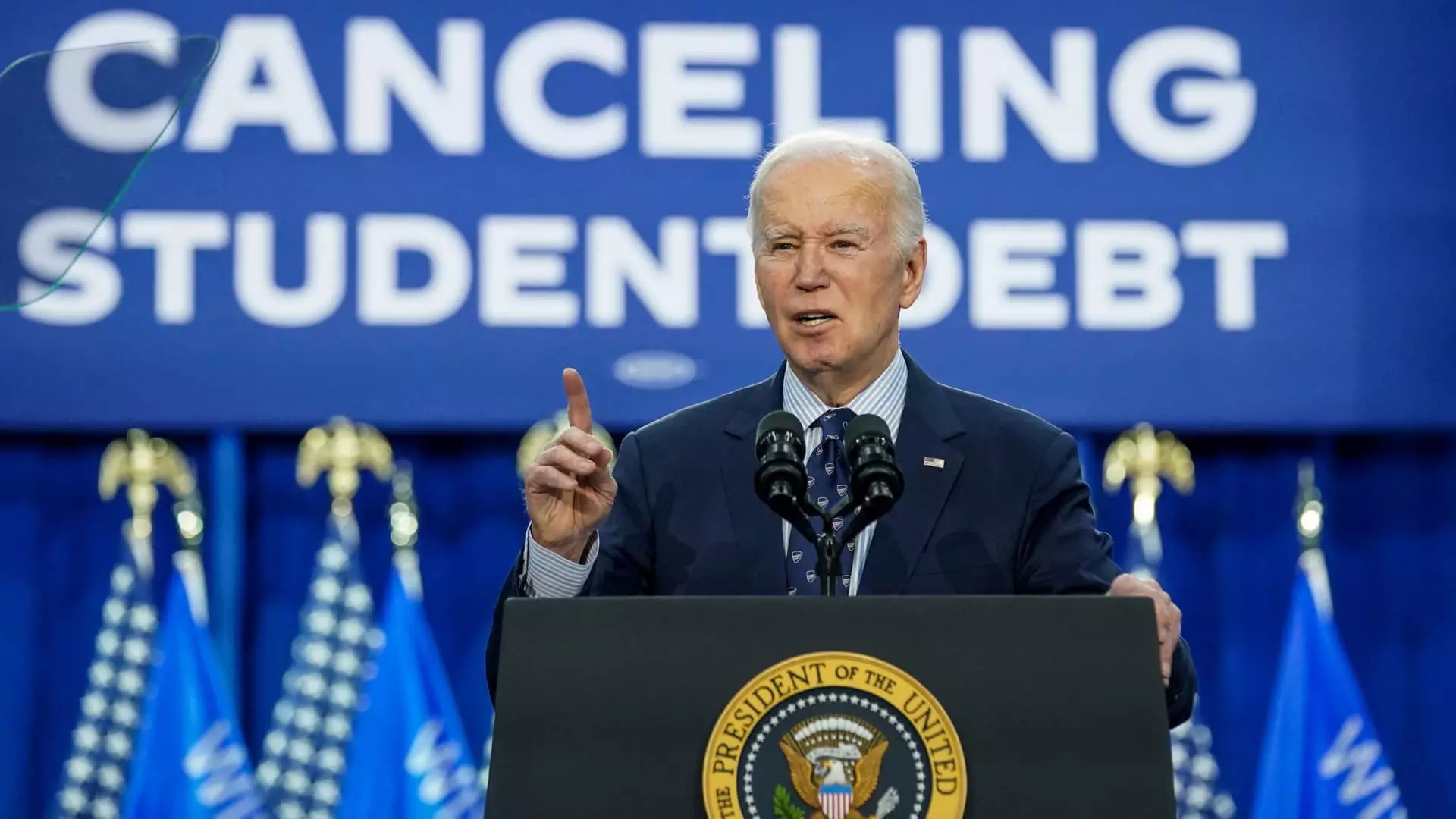

The SAVE plan, touted as the most affordable student loan plan ever, aimed to provide relief to millions of borrowers by reducing their monthly payments and offering loan forgiveness after a certain period. The plan replaced the Revised Pay As You Earn (REPAYE) option and had more generous terms, such as reducing the monthly payment requirement from 10% to 5% of discretionary income. However, the plan faced legal challenges from Republican-led states, including Florida, Arkansas, and Missouri, who argued that the Biden administration had overstepped its authority.

The federal judges’ rulings on the SAVE plan highlighted the contentious nature of the program. While some aspects of the plan were allowed to remain in effect, such as shielding a higher share of borrowers’ income from payment calculations, the judges put a halt to the provisions that significantly lowered borrowers’ monthly payments. They cited concerns over the cost of the program, with estimates suggesting that the SAVE plan could cost $475 billion over the next decade, a stark difference from the $15.4 billion cost of the REPAYE plan it replaced.

As the legal battle over the SAVE plan unfolds, borrowers are left to navigate the uncertainty surrounding their student loan payments. While some may continue to benefit from the reduced bills under the plan, others may see their payments revert to previous levels. The timeline for the legal cases remains unclear, with experts predicting that the cases may drag on for months, potentially reaching the Supreme Court for a final ruling.

The legal battle surrounding the SAVE plan highlights the challenges faced by student loan borrowers seeking relief from their debt. The conflicting narratives from government officials, legal experts, and borrowers themselves reflect the complexities of the student loan repayment system. As the cases move through the legal system, borrowers are left in a state of uncertainty, unsure of what the future holds for their student loan payments.