In recent years, the U.S. stock market has seen a significant increase in concentration, with just a handful of companies dominating the market. This growing trend has raised concerns among experts about the potential risks it poses to investors. For instance, the top 10 stocks in the S&P 500 accounted for 27% of the index at the end of 2023, a substantial increase from the 14% share a decade earlier. This rapid rise in concentration is the most significant since 1950, demonstrating the extent to which the market has become dominated by a few key players.

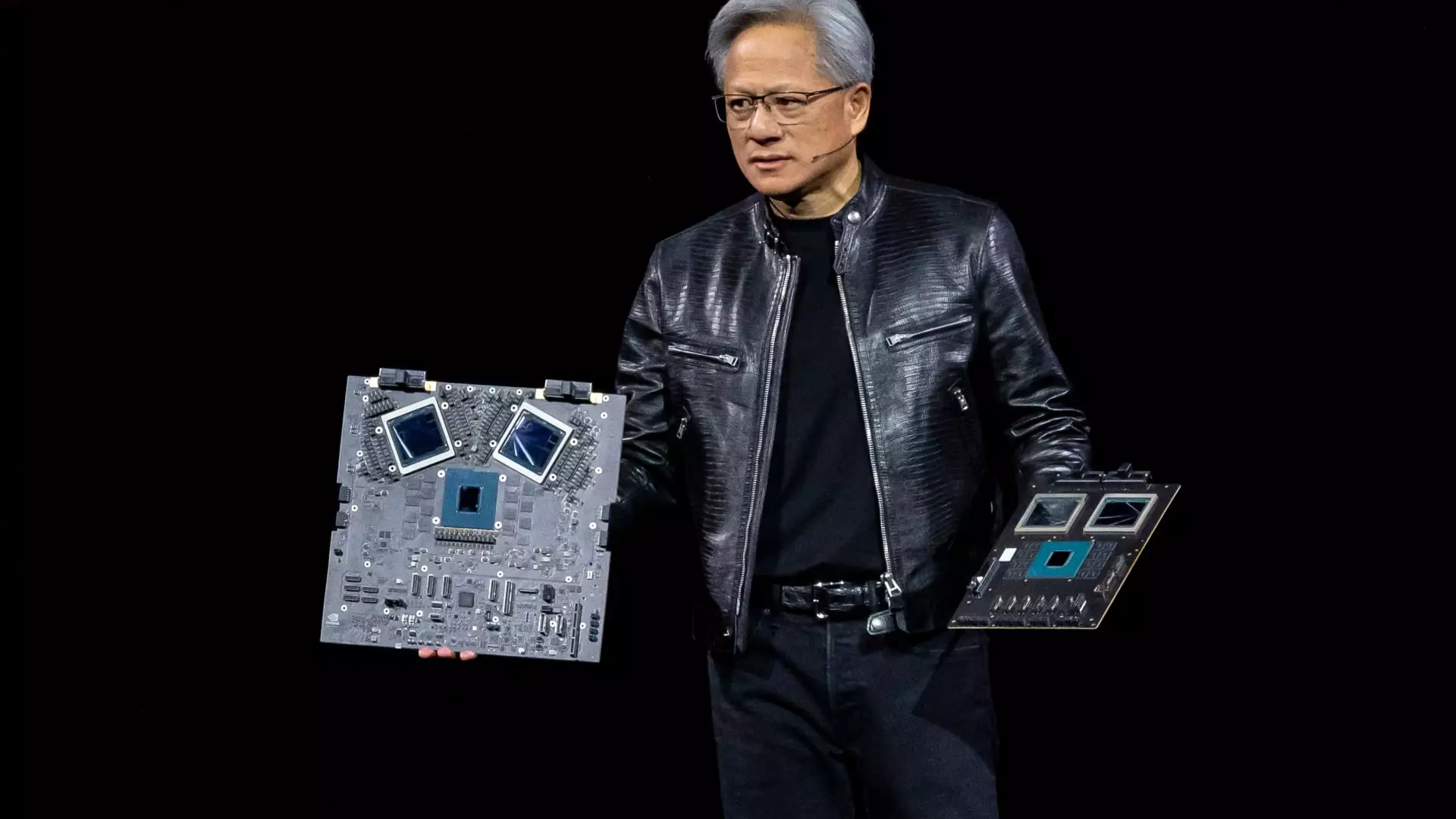

The emergence of the so-called “Magnificent Seven” companies, including Apple, Amazon, Alphabet, Meta, Microsoft, Nvidia, and Tesla, has further intensified the concentration in the market. These top companies alone make up about 31% of the index, highlighting the outsized influence they have on investors’ portfolios. In 2023, the Magnificent Seven stocks were responsible for more than half of the S&P 500’s gain, underscoring the potential risks associated with such high levels of concentration. This concentration poses a significant threat to investors, as a downturn in one or more of these key players could jeopardize a substantial amount of investor money.

While some experts warn of the risks associated with the growing concentration in the market, others believe that the concern may be overstated. Many investors are diversified beyond the U.S. stock market, with investments spread across different asset classes and regions. Additionally, the current level of concentration is not unprecedented by historical or global standards. Research indicates that stock concentration levels have been higher in the past without necessarily leading to negative outcomes for investors. This suggests that while concentration poses risks, it may not be as dire as some fear.

For investors looking to mitigate the risks associated with stock market concentration, diversification is key. A well-diversified equity portfolio should include a mix of large, medium, and small-sized companies, as well as exposure to foreign markets and other asset classes like real estate. Target-date funds, which automatically adjust asset allocation based on an investor’s age, offer a simple and effective way to achieve diversification. By spreading investments across a range of assets, investors can reduce their exposure to the potential pitfalls of concentrated market sectors.

The growing concentration in the U.S. stock market has raised valid concerns about the risks it poses to investors. While the dominance of a few key companies may offer significant returns in the short term, it also exposes investors to heightened levels of risk. By adopting a diversified investment approach and spreading investments across different asset classes, investors can better protect themselves against the potential downsides of concentrated market sectors. As the market continues to evolve, it is essential for investors to remain vigilant and adapt their strategies to navigate the challenges posed by stock market concentration.