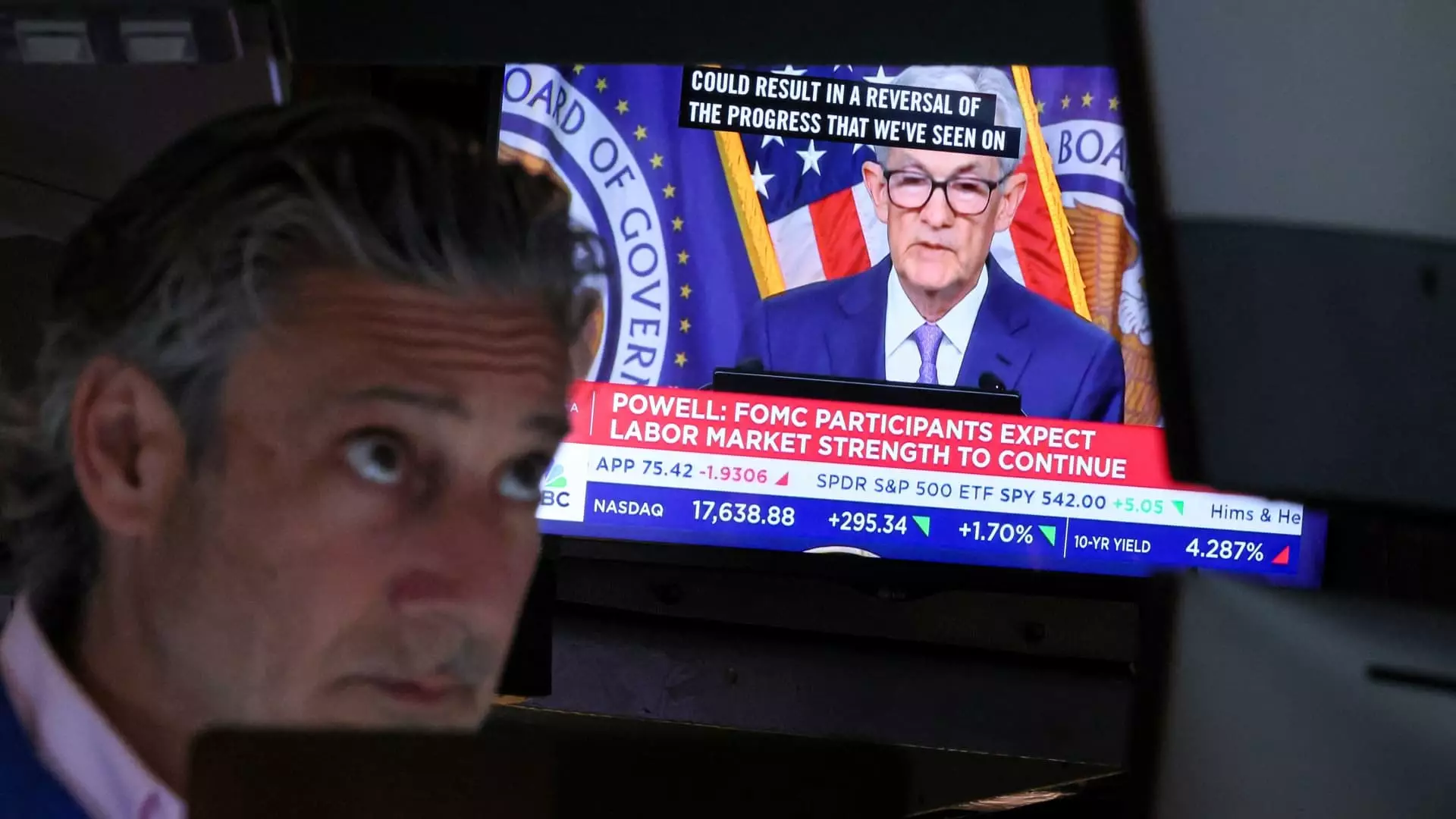

The stock market has seen a significant uptrend since the last monthly meeting in June. With the current expectation of the Federal Reserve lowering interest rates, traders have been driving stocks to new highs. The Dow Jones Industrial Average, S&P 500, and Nasdaq Composite have all reached all-time highs. This optimism in the market has led to various trading opportunities for investors.

Amidst the overbought market conditions, the Club has strategically executed a series of trades. By offloading shares of companies like TJX Companies and making profitable sales of Meta Platforms and Palo Alto Networks, the Club has managed to lock in significant gains. Additionally, the Club has capitalized on the tech pullback by initiating positions in companies like Advanced Micro Devices.

A key theme that has emerged in the stock market is the shift towards sectors outside of Big Tech. Investors are increasingly looking for opportunities in areas like small-cap stocks, as seen in the substantial jump in the Russell 2000 index. While mega-cap tech stocks have shown mixed performance, there is a noticeable rotation towards other sectors with potential growth opportunities.

Among the top-performing stocks in the Club’s portfolio, companies like Ford Motor, Morgan Stanley, Stanley Black & Decker, Apple, and Dover have seen significant gains. Factors like improving sales outlook, monetary policy easing, and advancements in artificial intelligence have contributed to the success of these companies. By identifying key drivers behind each stock’s performance, the Club has been able to make informed investment decisions.

As a subscriber to the CNBC Investing Club with Jim Cramer, investors receive trade alerts before any trades are made. Jim Cramer follows a specific protocol before executing trades in the charitable trust’s portfolio, ensuring transparency and accountability. By leveraging expert insights and market analysis, investors can stay informed and make strategic investment choices.

The recent trends in the stock market present both challenges and opportunities for investors. By carefully analyzing market movements, identifying emerging sectors, and leveraging expert guidance, investors can navigate the dynamic landscape of the stock market effectively. With a focus on strategic decision-making and staying informed about market trends, investors can optimize their portfolio performance and achieve their investment goals.