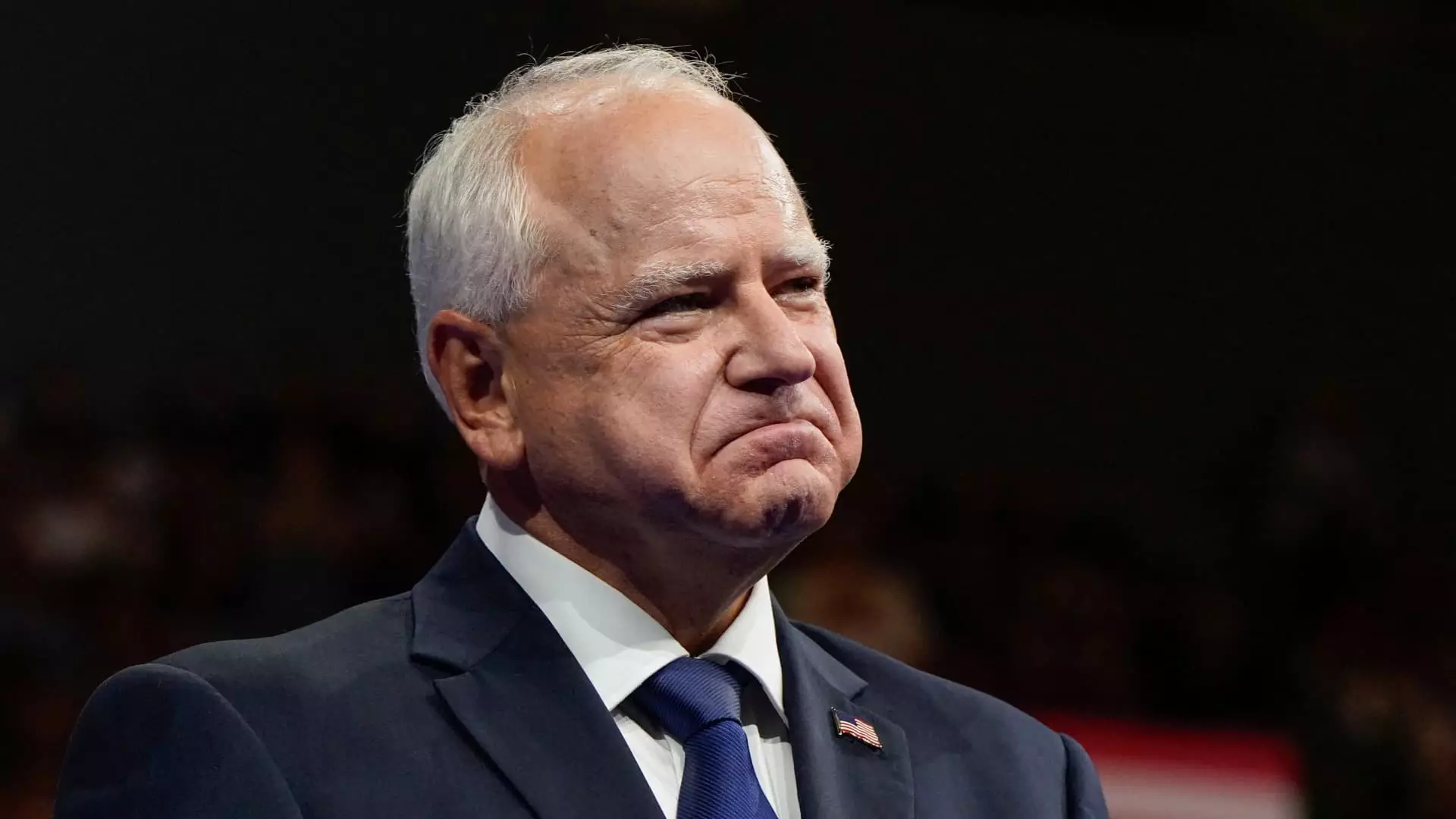

In the midst of financial struggles faced by many retirees, there has been a growing call to exempt Social Security from income taxes. This issue has gained bipartisan support and has now become a focal point in the 2024 election. Former President Donald Trump and Minnesota Gov. Tim Walz, the running mate of Vice President Kamala Harris, have both put forward proposals to address this pressing concern. Trump, during an interview on “Fox & Friends,” expressed his commitment to alleviating the tax burden on seniors relying on Social Security benefits.

While both federal and state proposals aim to exempt Social Security from income taxes, they differ in certain aspects. Federal income taxes on Social Security are calculated based on “combined income,” which includes adjusted gross income, non-taxable interest, and a portion of Social Security benefits. The thresholds for taxation vary, with up to 85% of Social Security benefits subject to tax for individuals with higher combined income. On the other hand, Minnesota’s state legislation focuses on expanding tax exemptions for Social Security recipients with lower adjusted gross income.

Richard Auxier, a principal policy associate for the Urban-Brookings Tax Policy Center, has highlighted the transformative nature of Trump’s proposal. If enacted, the exemption of Social Security from federal income tax could have significant implications for the budget deficit, increasing it by $1.6 trillion over a decade. Moreover, it could accelerate the insolvency of the Social Security and Medicare trust funds, moving the projected dates earlier. While the exact impact remains to be seen, experts are concerned about the long-term sustainability of such a policy.

Minnesota’s decision to expand tax exemptions for Social Security recipients demonstrates a targeted approach to addressing the issue. By eliminating income taxes for most seniors with lower adjusted gross income, the state aims to align its tax policies with the needs of its aging population. This move, according to Jared Walczak from the Tax Foundation, allows Minnesota to stand out among the few states that tax Social Security benefits. The lower revenue cost of this approach compared to the federal proposal indicates the flexibility states have in implementing tax exemptions.

As the debate around tax exemptions for Social Security continues, policymakers must carefully weigh the costs and benefits of such proposals. While providing relief for retirees is crucial, the financial implications of these measures cannot be overlooked. Balancing the need for adequate funding for Social Security and Medicare with the desire to alleviate tax burdens on seniors remains a complex challenge. The decisions made at both the federal and state levels will have far-reaching consequences for the future sustainability of these crucial social programs.

The push to exempt Social Security from income taxes reflects a shared concern for the well-being of retirees across the political spectrum. However, the specifics of these proposals and their potential impacts vary significantly. As policymakers navigate this complex terrain, it is essential to consider the broader implications of tax exemptions on the financial stability of key social programs. Only through careful analysis and thoughtful decision-making can we ensure a sustainable future for retirees reliant on Social Security benefits.