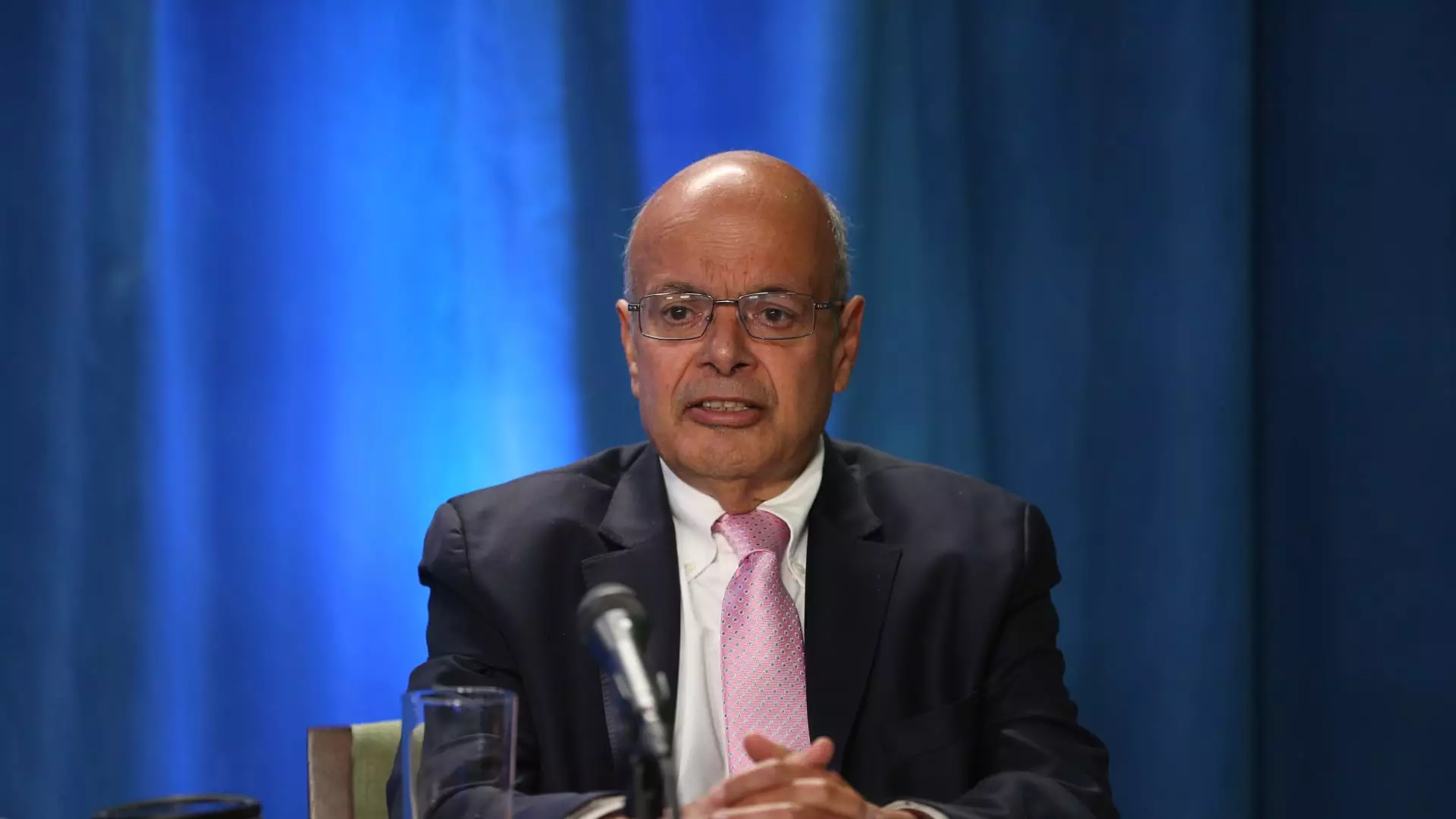

The recent disclosure that Ajit Jain, the insurance chief and vice chairman at Berkshire Hathaway, has sold more than half of his stake in the company has raised eyebrows within financial circles. This significant maneuver, worth approximately $139 million, involves Jain divesting 200 shares of Berkshire Class A at an average price of $695,418. Such a large-scale selling of stock by a key executive inevitably prompts speculation about both personal motivations and broader market implications.

Jain’s decision to offload a considerable part of his holdings—now reduced to just 61 shares—comes at a time when Berkshire’s stock has reached notable highs. The conglomerate achieved a market capitalization of $1 trillion by trading above $700,000 per share, which may suggest that Jain capitalized on an opportune moment to realize profits. Interestingly, this sale constitutes 55% of Jain’s total stake, marking the most drastic reduction since he became part of the Berkshire team in 1986. While the actual motivations behind Jain’s decision remain unclear, it has led to various interpretations among analysts and investors alike.

David Kass, a finance professor at the University of Maryland, interprets Jain’s actions as indicative of his belief that Berkshire’s shares are currently fully valued. This aligns with an observable slowdown in Berkshire’s share buyback activities, which fell dramatically from $2 billion in previous quarters to a mere $345 million in the second quarter of this year. Bill Stone, CIO at Glenview Trust Co., echoed a similar sentiment, suggesting that at a price exceeding 1.6 times book value, Berkshire’s shares appear to be close to Warren Buffett’s conservative estimate of intrinsic value. Stone’s analysis indicates that further buybacks from Berkshire may not be likely unless share prices fall significantly.

Ajit Jain’s influence within Berkshire Hathaway cannot be overstated. Originally from India, he has been a crucial player since joining the company, especially in pushing the firm into the reinsurance domain and revitalizing operations at Geico, which is regarded as one of Berkshire’s key assets. Buffett himself has praised Jain, stating in his annual letter that Jain has created vast value for the shareholders. Such accolades indicate the level of trust and respect Jain commands within the corporate structure.

The question of succession has loomed over Berkshire Hathaway, and while Greg Abel has been named as Warren Buffett’s eventual successor, there were earlier speculations regarding Jain’s potential leadership. In a recent clarification, Buffett remarked that Jain is not interested in taking the helm of the conglomerate, indicating that the dynamics between Jain and Abel may be more collaborative than competitive. This insight contributes to understanding the internal governance and future direction of the company.

Ajit Jain’s recent sell-off of a substantial portion of his Berkshire Hathaway shares reflects a complex interplay of personal strategy, market perception, and future leadership considerations at one of the world’s most renowned companies. As investors and analysts dissect these developments, one thing is clear: Jain’s decision could signal a broader message regarding Berkshire’s valuation and the current state of its financial operations. The implications of this strategic move will be closely monitored not only for its impact on Berkshire’s stock but also for its indications of Jain’s future role within the company and the overall direction of Warren Buffett’s legacy.