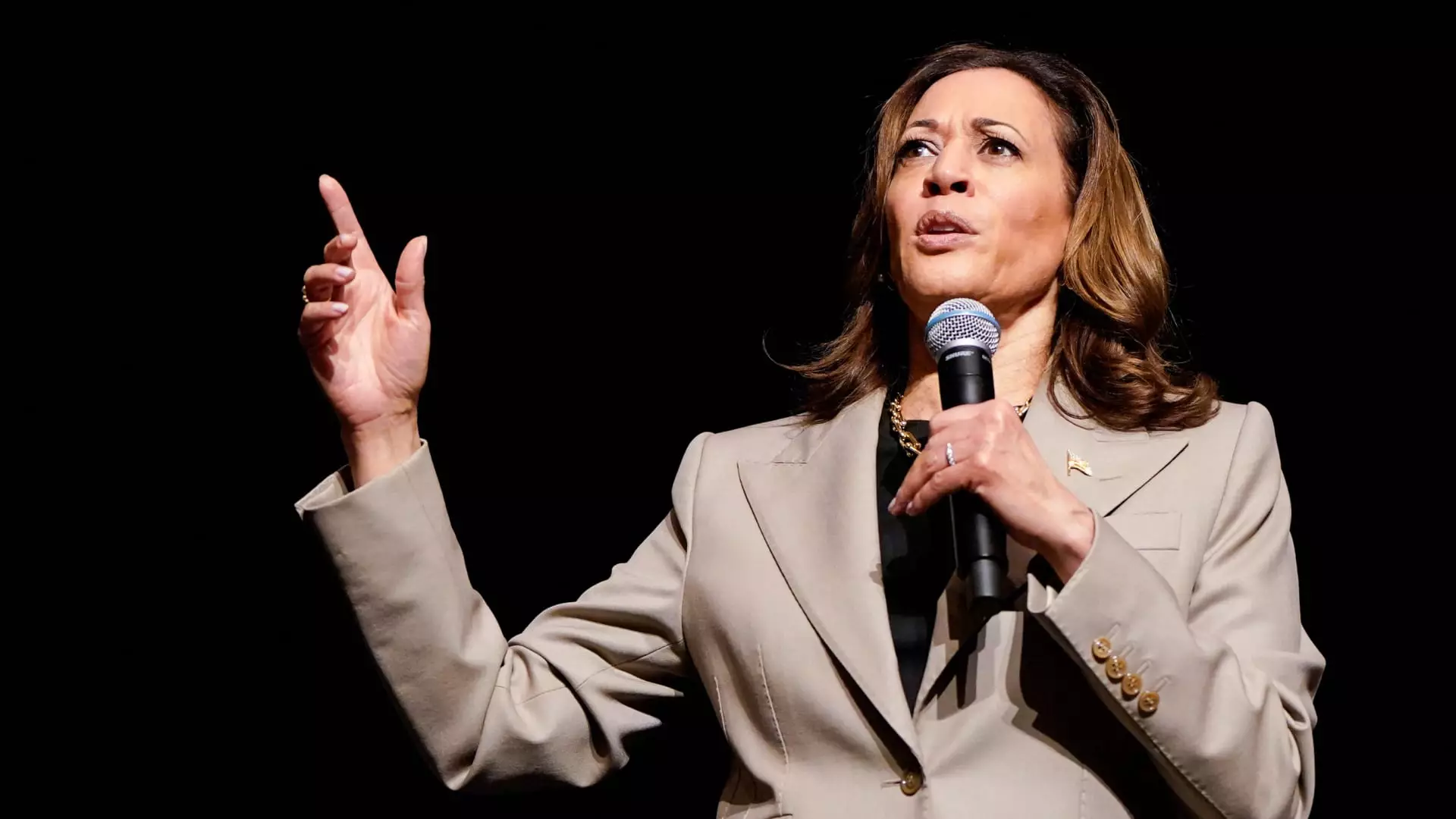

Vice President Kamala Harris recently announced an economic plan that includes an expanded child tax credit of up to $6,000 for families with newborn children. This proposal aims to build on the previous child tax credit enacted through the American Rescue Plan in 2021.

Harris’ plan would provide up to $6,000 in total tax relief to families during the first year of a child’s life. This is a significant increase from the previous child tax credit, which was up to $3,000 or $3,600 depending on the child’s age and family’s income. The proposal targets middle- to lower-income families and is intended to help alleviate the financial burden of raising a child.

Sen. JD Vance of Ohio recently suggested a $5,000 child tax credit, aligning with former President Donald Trump’s stance on expanding the credit for families. This shows a bipartisan interest in increasing the child tax credit, although the specifics of the proposals differ. Harris’ plan includes a $2,400 bonus for newborns, which is seen as a response to Vance’s proposal.

The potential expansion of the child tax credit faces challenges, particularly in terms of its cost. Lawmakers are grappling with the federal budget deficit and the implications of implementing such large tax breaks. Estimates suggest that expanding the credit to $3,000 or $3,600 could cost $1.1 trillion over a decade, while the $6,000 credit for newborns could amount to $100 billion. This raises concerns about the feasibility of these proposals in light of the current economic climate.

The fate of the child tax credit expansion will depend on which party controls the White House and Congress. While there is bipartisan support for the idea of increasing the credit, the specifics of the design and size of the expansion remain uncertain. However, the House-passed bill and Senate negotiations could serve as a starting point for future discussions on the matter.

Vice President Kamala Harris’ economic plan, particularly the proposed expansion of the child tax credit, has sparked discussions about how to best support families with young children. While there are challenges and uncertainties surrounding the feasibility of these proposals, there is a shared goal of providing financial relief to families in need. It remains to be seen how these discussions will unfold in the coming months and what implications they will have on the overall economic landscape.