In a remarkable turn of events, shares of AppLovin surged by an impressive 45% on Thursday, elevating the online gaming and advertising firm to an enviable position in the tech world. Following the release of its third-quarter earnings, which exceeded expectations, the stock price soared past $245 during early afternoon trading. This remarkable performance has positioned AppLovin as a standout in the tech sector, boasting an astonishing 515% increase year-to-date. Currently, the company enjoys a market capitalization exceeding $80 billion, solidly placing it ahead of its competitors valued at $5 billion or more, as per the data from FactSet.

In its quarterly report, AppLovin revealed a 39% increase in revenue, amounting to $1.2 billion, surpassing the average estimate of $1.13 billion. Earnings per share also impressed the market, landing at $1.25 while analysts had predicted only 92 cents. Looking to the future, the company’s guidance for the fourth quarter indicates anticipated revenue between $1.24 billion and $1.26 billion, marking a 31% growth at mid-range compared to analysts’ expectations of $1.18 billion. Such promising forecasts underscore a strong commitment to sustained growth within the competitive landscape.

Founded just over a decade ago, AppLovin’s initial fame stemmed from its gaming segment, which has seen slower growth in recent times. However, the company’s online advertising division has flourished due in part to advancements in artificial intelligence. The introduction of their AI-driven advertising engine, known as AXON, has been credited with fostering much of the company’s recent growth. Following an updated version release last year, the platform’s effectiveness in delivering targeted advertisements has drastically improved. Impressively, revenue from AppLovin’s software platform ballooned by 66% this quarter to $835 million, predominantly driven by enhancements in AXON’s operational capabilities.

While revenue growth is undoubtedly impressive, Wall Street is particularly fascinated by the company’s profitability metrics. In the reported quarter, AppLovin’s net income skyrocketed by 300%, reaching $434.4 million or $1.25 per share, a significant leap from $108.6 million or 30 cents per share a year prior. Moreover, the software platform achieved an adjusted profit margin of an eye-popping 78%. Analysts at Wedbush are clearly optimistic, recommending an increased price target for the company’s shares from $170 to $270, citing strong revenue and exceptional EBITDA conversion as key motivators.

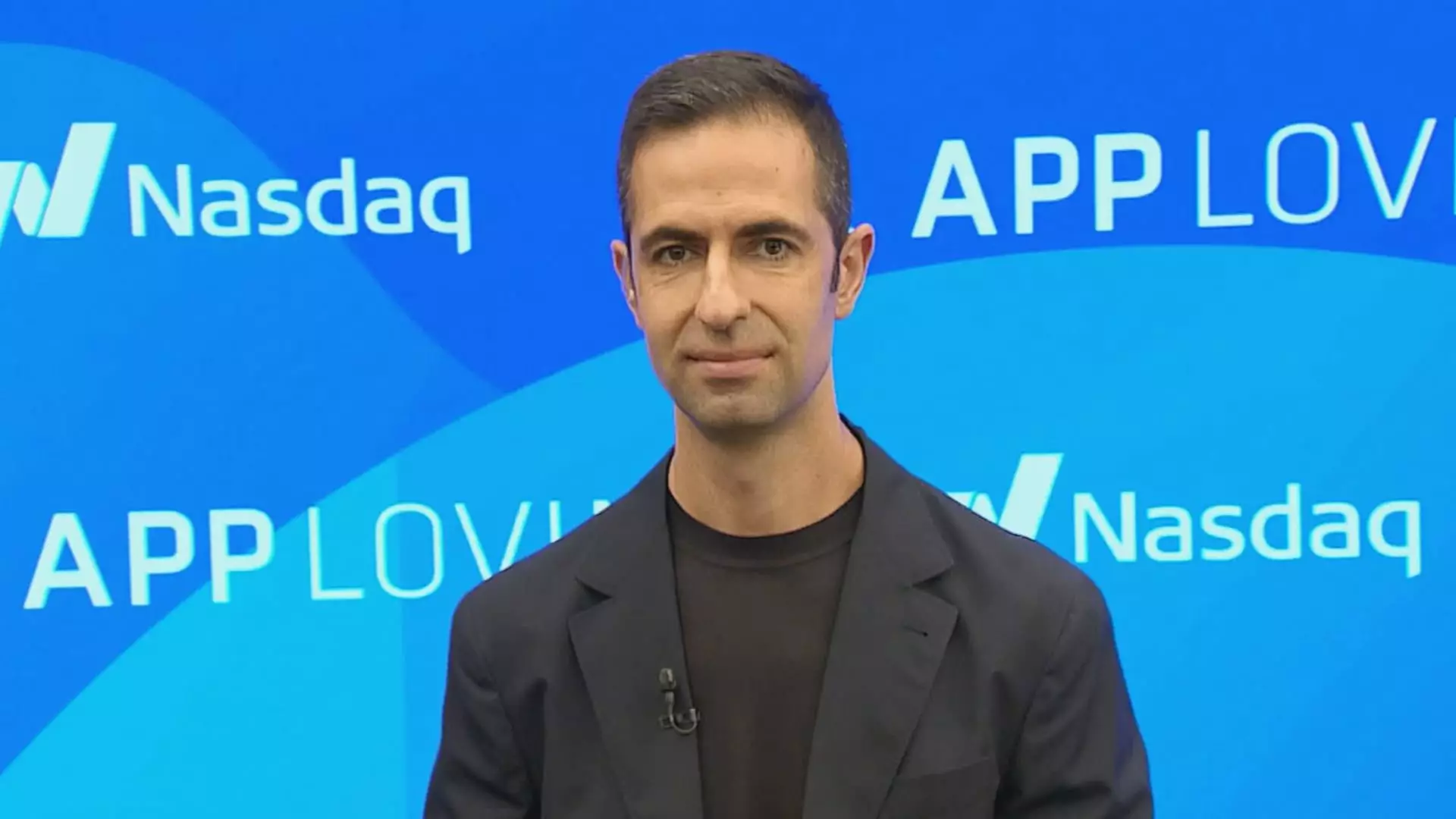

Looking forward, CEO Adam Foroughi revealed progress on a pilot e-commerce project during the earnings call, designed to integrate targeted advertising within gaming experiences. Foroughi described the newly developed product as potentially revolutionary, declaring it may be one of the finest innovations in his career at AppLovin. Despite its current pilot status, excitement is palpable as the firm seeks to expand its technological prowess and prepare for what may come next.

AppLovin’s current trajectory signals a thrilling chapter not just for the company itself but also for the wider tech industry. As innovation and market demand continue to align, this company appears poised to retain its lead while influencing the future of online advertising and gaming.