As 2024 unfolds, China’s economy faces an array of challenges, coupled with emerging opportunities that could reshape its trajectory. Despite government assertions of impending fiscal support, concrete changes remain elusive, leaving investors and consumers alike to question the effectiveness of current measures. This analysis delves into the intricacies of China’s economic situation, the shortcomings of fiscal stimulus, and the implications of long-term structural issues.

As anticipation builds around government fiscal support, the reality is that meaningful assistance has yet to materialize in a manner that truly bolsters the economy. Policymakers have cut interest rates and laid out broad stimulus plans since late September, yet the robust measures expected to rejuvenate economic activity aren’t scheduled for announcement until March’s annual parliamentary review. Observers, such as those at BlackRock, express caution, underlining that current fiscal efforts are inadequate for addressing the sustainable drags on growth. While there’s a slight optimism among investors regarding the potential for purchasing more Chinese stocks, the looming structural challenges warrant a careful approach, given the potential for sustained economic stagnation.

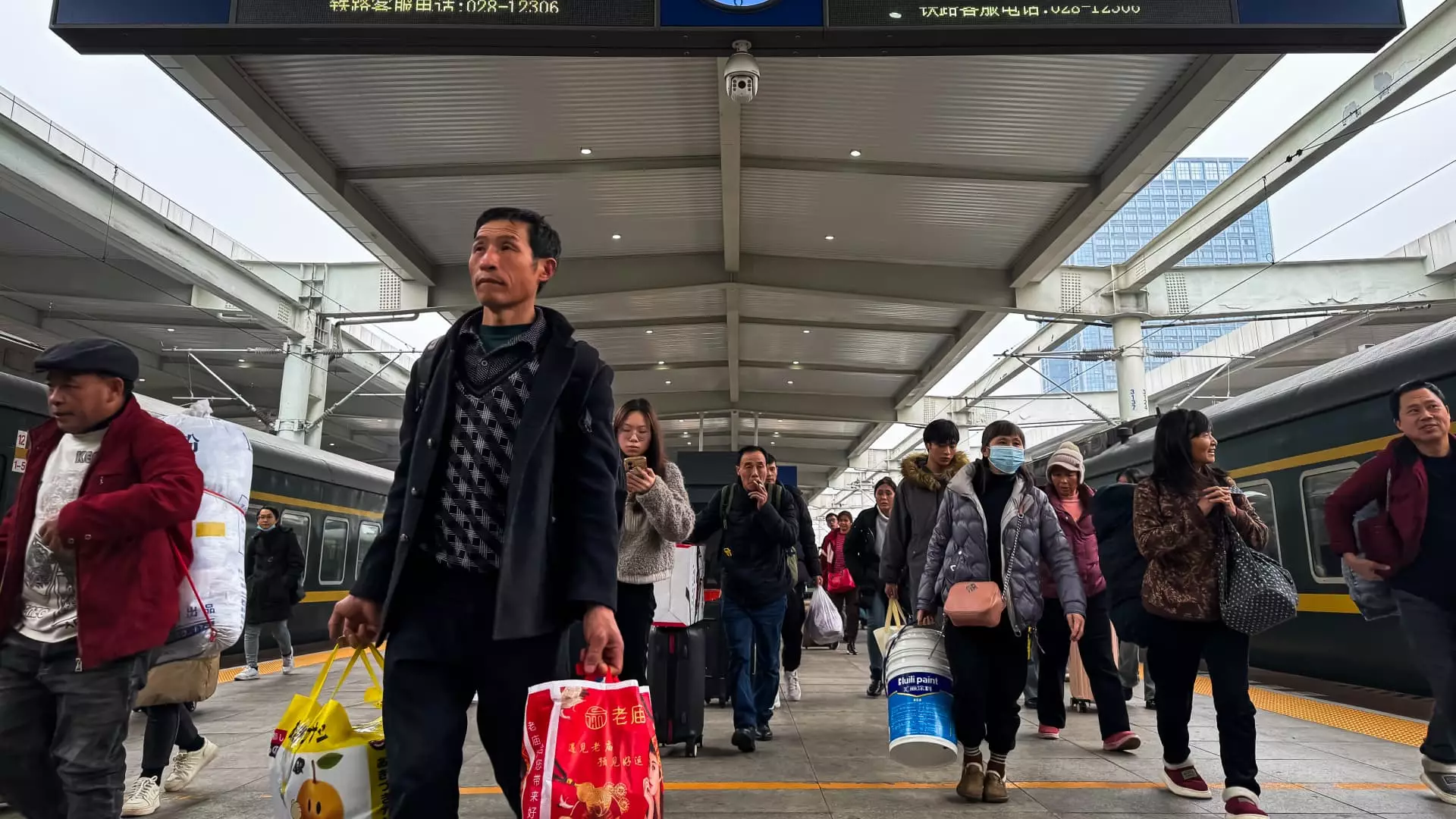

Perhaps the most pressing issue facing the Chinese economy is waning domestic demand. Recent figures reveal a mere 0.5% rise in consumer prices, excluding food and energy — the slowest pace observed in a decade. This stagnation raises alarms about deflationary pressures and questions about consumer confidence. Officials from Beijing have echoed these sentiments, noting that weak consumer spending, alongside diminishing foreign investment, poses a significant barrier to economic vitality. With a target of 2% consumer price inflation set for 2025, there is a clear urgency for governmental action to stimulate demand across various sectors.

China’s real estate market, historically a cornerstone of its economic structure, continues to grapple with vulnerabilities stemming from regulatory crackdowns on developer debt and the repercussions of the Covid-19 pandemic. Developers have faced significant challenges, and while recent government shifts signal a pivot towards stabilizing this sector, the recovery remains uncertain. Authorities are implementing measures to complete unfinished residential projects, but analysts suggest the real estate sector has not yet hit rock bottom. As high inventory levels persist in smaller markets, pressure mounts on property prices, further complicating the economic landscape.

The disparity in real estate dynamics is starkly highlighted in cities like Foshan, where significant inventory levels indicate that recovery may be a protracted journey. Construction activity has not only slowed due to financial constraints but has also been hindered by broader consumer hesitance, particularly regarding new home purchases and the associated demand for appliances and services.

In response to these tumultuous economic conditions, the Chinese government has increasingly tied security considerations with economic policies. Emphasizing a push for domestic production and consumption, the government aims to enhance self-sufficiency, particularly in technology and strategic industries. This pivot has significant implications for the country’s investment landscape, compelling foreign businesses to adapt to localized operations that are stymied by heightened operational costs and reduced productivity.

Officials have been vocal about prioritizing consumption expansion over investment efficiency, suggesting that 2024 will witness an aggressive focus on consumer policies. Initiatives such as the recently introduced trade-in subsidies could bolster consumer engagement, yet skepticism remains regarding their potential for sustained impact. Analysts caution that the temporary boost from these programs may diminish substantially by the year’s second half if other structural issues persist.

The road ahead for China’s economy is fraught with uncertainty, as it grapples with conflicting signals from both internal policies and external pressures. While optimism exists surrounding government intervention and potential recovery in consumer sentiment, underlying structural challenges and geopolitical tensions loom large. The upcoming parliamentary session in March may provide critical insights into the government’s comprehensive strategy and long-term vision for economic revitalization.

Ultimately, as 2024 progresses, the confluence of domestic and international factors will shape the economic realities faced by Chinese consumers and businesses alike. Investors should remain vigilant and adaptive, recognizing that while opportunities may arise, hurdles like weak demand and real estate volatility will continue to define China’s economic landscape in the near future. The nation’s journey towards recovery is likely to be gradual, demanding resilient policy responses and innovative solutions to address deep-seated economic concerns.