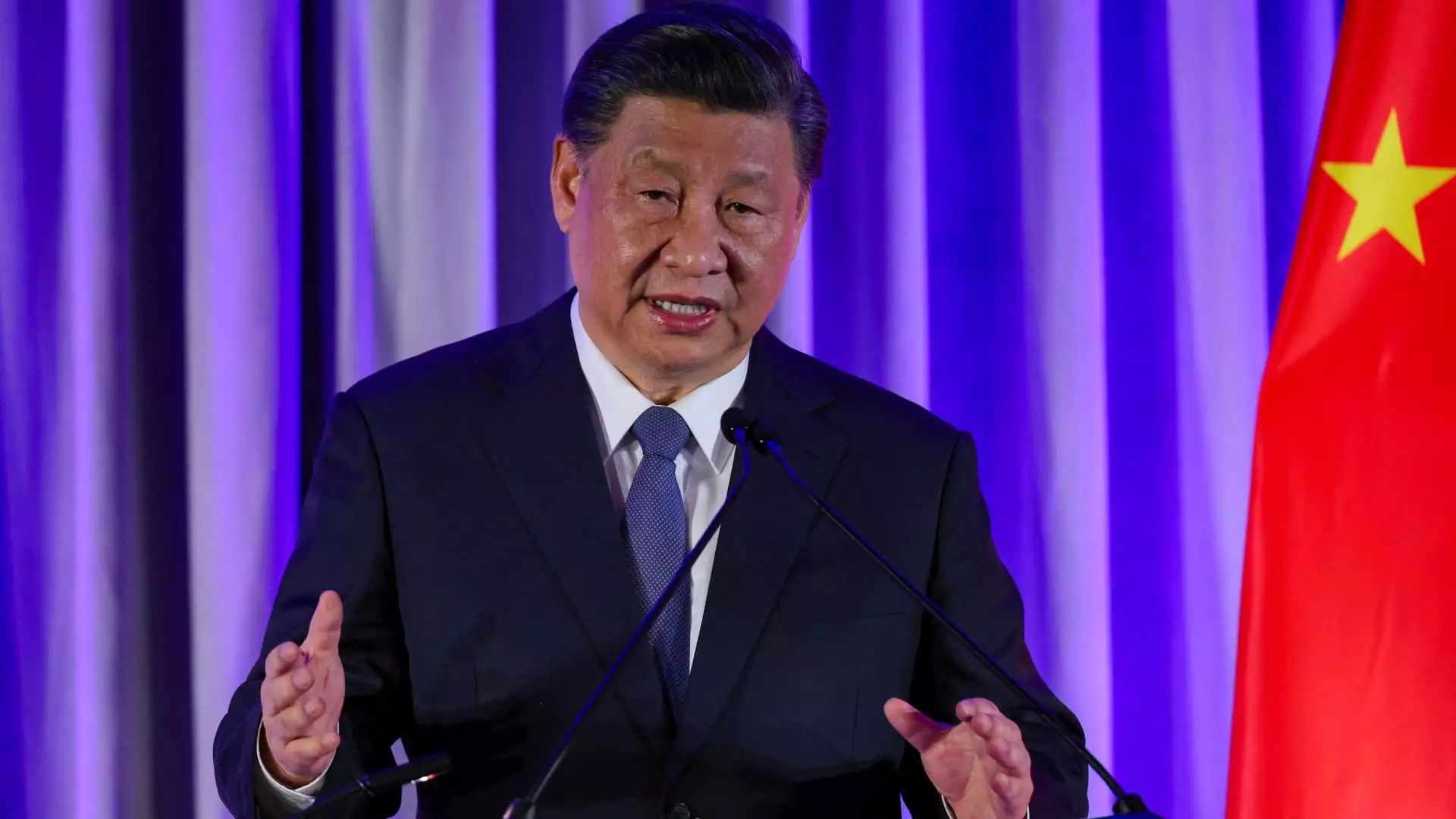

In an urgent response to a prolonged downturn in the property sector, China’s leadership has convened a high-level meeting aimed at interrupting the decline in the real estate market. At the forefront of this initiative, President Xi Jinping emphasized the necessity of stabilizing the economy and responding to public concerns, signaling a shift in focus from merely managing the consequences of the downturn to actively implementing policies designed to rejuvenate the sector. The readout from the Politburo meeting reflects a critical juncture for the Chinese economy, particularly given the real estate sector’s historical importance, which accounted for over a quarter of the nation’s economic output.

China’s real estate market has experienced significant turmoil since the government enacted stringent measures on corporate debt in 2020, causing a ripple effect that has not only weakened developers but has also adversely influenced local government revenues and household wealth. Recent statistics indicate that the property sector’s contraction is decelerating, with new home sales showing a slight improvement from earlier pessimistic forecasts. Analysts suggest that this stabilization is crucial for encouraging consumer confidence and breaking the cycle of indecision that has plagued potential homebuyers.

Economists posit that a balanced approach is essential for reviving the housing market—one that prioritizes not just restoring home values but also reigniting purchasing activity among consumers. Analysts recognize that simply pushing home prices upward would not effectively address the broader economic malaise; instead, encouraging investments in housing is seen as more beneficial for economic recovery.

The meeting underscored the importance of collaborative fiscal and monetary policy support to reignite the economy, marking a notable shift in leadership tone. Officials have signaled the possibility of cutting interest rates and increasing funding for prioritized real estate projects. Specifically, strategies include limiting new housing supply and easing the financial burden on existing mortgage holders, with projections indicating that these measures could relieve up to 150 billion yuan ($21.37 billion) annually from mortgage payments.

While the immediate effect of the meeting has been positive on stock markets—evidenced by surging property stocks—the enduring question remains: will these efforts translate into substantial, long-term recovery for the sector? Analysts caution that, while the measures create a sense of optimism, tangible results will take time to manifest and will require sustained commitment to structural reforms.

The Politburo’s readout hinted at a strategic pivot from the earlier aggressive pursuit of economic targets “at all costs” to a more tempered approach that acknowledges the challenges ahead. This nuance reflects a broader recognition among policymakers of the complexities facing China’s economy, particularly the need to balance immediate recovery efforts against the backdrop of long-term structural economic changes.

Predictive models from various financial institutions, including Goldman Sachs and Capital Economics, suggest a potential growth rate below the previously targeted 5% for the upcoming years—a clear indication that caveats must be placed on expectations for rapid recovery. This moderating of predictions highlights an emerging consensus that China’s economic trajectory may include bouts of slower growth as it transitions to a more sustainable framework, supported by technological advancements and high-quality industries.

China’s recent high-level meeting reflects a proactive stance on addressing the challenges posed by the real estate sector and broader economic uncertainties. While the leadership’s narrative has shifted towards stabilization and gradual recovery, the road ahead remains fraught with obstacles that will require unwavering policy attention and innovative strategies.

As the government navigates between encouraging consumer confidence and managing structural changes, the emphasis on providing support to both the property market and the households it affects will be pivotal. Optimism remains tempered by caution, as analysts acknowledge that while the recent measures are a step in the right direction, only concerted and decisive actions over time will yield a robust revival of the property sector and restore faith in the broader economic landscape.