Chinese real estate has long been a cornerstone of its economy, representing a substantial portion of the nation’s GDP. However, since 2021, the sector has faced unprecedented challenges, including high debt levels and a resulting wave of defaults among developers, which has led to a significant number of unfinished housing projects. Homebuyers, disillusioned and anxious, have witnessed their confidence erode as they grapple with the uncertainty surrounding their investments. To stabilize a sector that has been in distress, the Chinese government has embarked on a series of policies aimed at revitalizing the market.

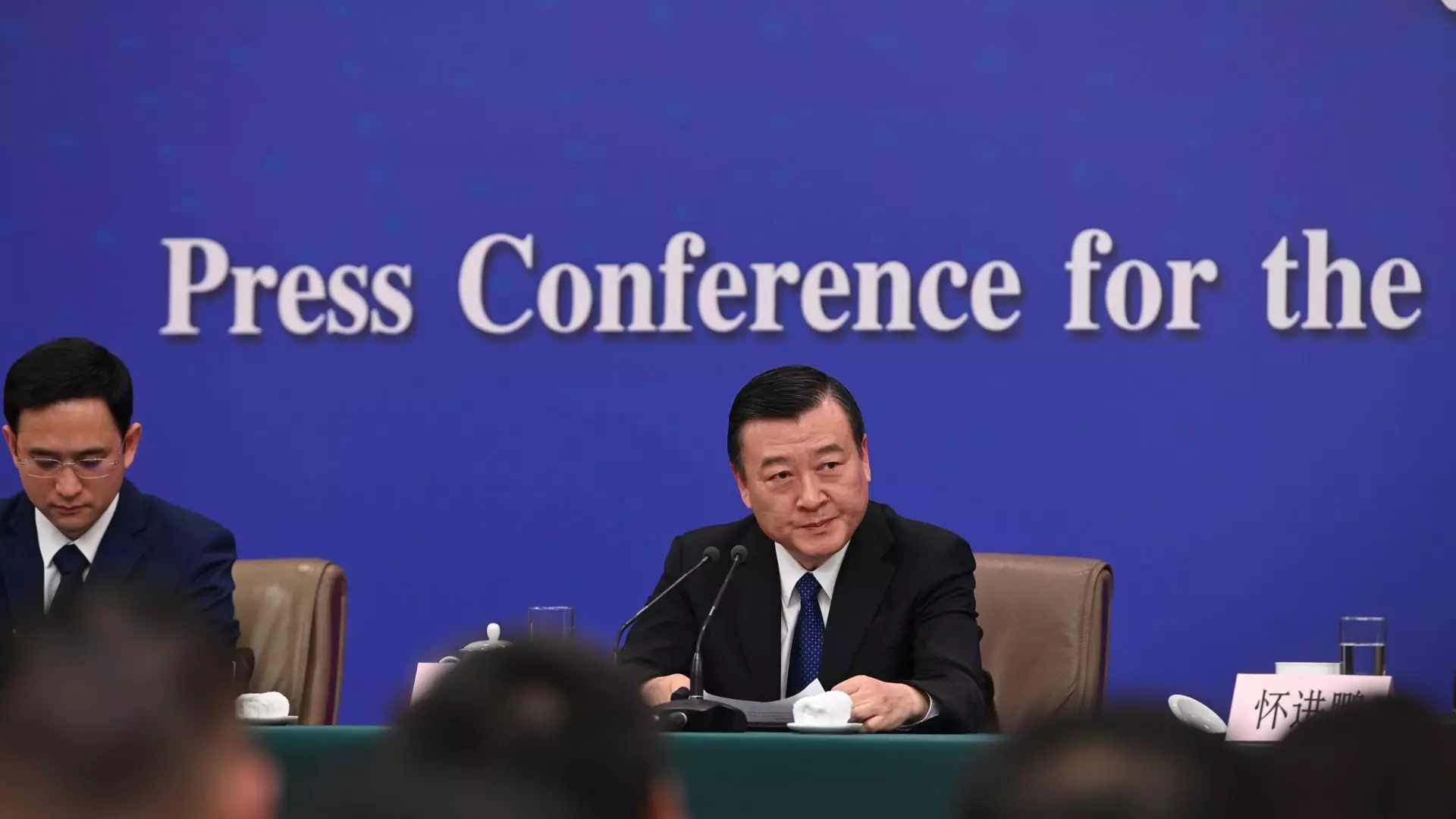

In an effort to navigate this turbulent landscape, the Chinese Ministry of Housing has introduced an initiative colloquially referred to as the “whitelist.” This program allows local governments to nominate real estate projects that merit expedited attention from banks, thereby facilitating quicker access to financing. As of now, the initiative has already approved loans amounting to 2.23 trillion yuan, with a government projection to increase this total to 4 trillion yuan by the end of the year. Ni Hong, the Minister of Housing, emphasized a shift that now includes all commercial housing projects as eligible, indicating a broader strategy to ensure the completion of unfinished units.

Although well-intentioned, the initiative raises questions about sustainability and the implications for developers who may still be operating under high levels of debt. The call for banks to disburse funds quickly and in full rather than in tranches can provide short-term relief but risks further inflating the financial bubble that has already led to significant challenges.

Alongside the whitelist initiative, various governmental bodies have floated additional measures aimed at stimulating real estate activity. For instance, the recent reduction in required cash reserves for banks to 50 basis points and a significant cut in minimum down payments for second-home buyers were celebrated as positive strides. However, analysts suggest that the government appears to be more focused on fine-tuning existing measures rather than proposing completely new solutions capable of effectively addressing the root causes of the ongoing crisis.

Bruce Pang, an economist at JLL, pointed out that the improvements in sale volumes and prices, while welcomed, may not immediately translate into a revitalized property investment climate. This raises concerns as investors are left uncertain about the robustness of the government’s response to these challenges. Many had hoped for more aggressive stimulus measures, yet markets reacted unpredictably, as evidenced by the noticeable drop in the Chinese CSI 300 real estate index shortly after the announcements.

Despite the optimism that may have been present in the initial reactions to government announcements, prevailing sentiment within the investor community has been one of caution. The CSI 300, which rose on previous trading days, plunged over 5% following the latest governmental briefing, illustrating a stark disconnect between government communication efforts and market response. Investors worry that recent policy measures are insufficient to offset a downturn that has caused housing prices to plummet by nearly 6.8% between July and August alone.

The volatility in the market not only reflects apprehension about the effectiveness of these initiatives but also signals a fundamental lack of confidence among investors regarding the future trajectory of China’s real estate sector.

In a bid to further stimulate activity, different cities across China have initiated their plans. From lifting restrictions on home purchases in cities like Guangzhou to easing down payment requirements in metropolitan hubs such as Beijing and Shanghai, localities are recognizing the need for tailored interventions. However, the effectiveness of these measures may differ widely based on regional economic conditions.

Despite these local initiatives, the overarching trend remains discouraging. Recent data shows new home sales staggering and prices dropping, reinforcing the notion that the sector is far from a robust recovery. In light of these developments, the need for cohesive policy formation at both local and national levels to ensure a collaborative resurgence in real estate cannot be overstated.

As China grapples with the challenges posed by its faltering real estate sector, it finds itself at a crossroads. The government’s recent fiscal interventions and the whitelist initiative aim to offer a constructive path forward. However, policymakers must be acutely aware of the potential long-term ramifications of such rapid manipulation of market dynamics.

Investment in restoration — not just construction — is crucial to instilling confidence back into the market, ultimately leading to sustainable growth within the housing sector. While government action is fundamental, successful recovery will likely require a multifaceted approach that balances immediate financial relief with structural reform. Addressing the historical issue of high debt levels among developers and promoting responsible financial practices will be pivotal in rebuilding what has been lost.