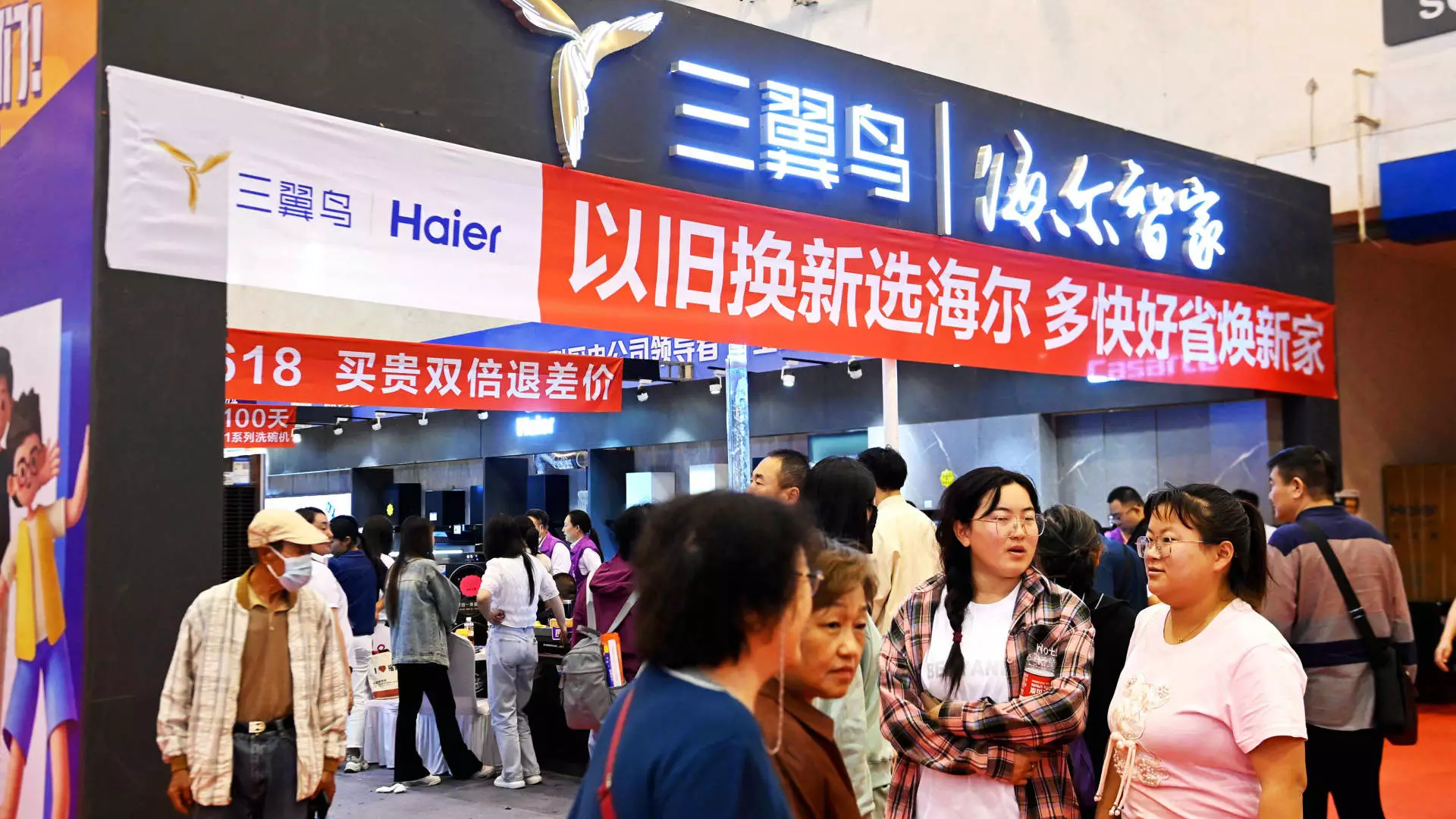

In a bid to stimulate domestic consumption and rejuvenate economic growth, China has launched an ambitious trade-in policy supported by substantial government funding. In July, the Chinese government announced a plan to allocate 300 billion yuan (approximately $41.5 billion) in ultra-long special government bonds aimed at enhancing various trade-in and equipment upgrade initiatives. This strategy seeks to encourage consumers to exchange old appliances and vehicles for new ones while simultaneously upgrading infrastructure. However, months into its implementation, the program’s effectiveness and immediate impact remain questionable, raising concerns among businesses and analysts alike.

China’s new trade-in policy is structured around significant financial incentives designed to boost consumer spending. Half of the allocated funds are aimed at subsidizing trade-ins of larger consumer goods such as cars and home electronics, which are often necessary purchases for households. The other half focuses on upgrading large equipment, including elevators, thereby addressing infrastructure needs in urban environments. Although local governments can leverage these ultra-long government bonds to stimulate purchases, the requirement for consumers to have a used product to trade in poses a notable barrier to participation.

This structure suggests that while the initiative is well-intentioned, the reliance on consumers to invest financially upfront along with the need for pre-owned items complicates its execution in practice. As Jens Eskelund, president of the EU Chamber of Commerce in China, noted, the actual rollout of the program remains muddled, and businesses have not seen tangible benefits since its inception. The expectation that immediate, measurable results would be generated seems overly optimistic in the face of current consumer behavior and infrastructural challenges.

Emerging from a period of cautious economic growth, consumers in China have exhibited an overall reluctance to spend. While government incentives can provide a financial safety net for trade-ins and upgrades, many consumers remain apprehensive, which has led to only modest increases in retail sales. For instance, retail growth saw a meager rise of just 2.7% in July, after stagnation in June. The key question is: will the trade-in policy significantly alter this trend?

The recent surge in new energy vehicle (NEV) sales presents a silver lining, showing a 37% jump in July despite a general decline in passenger car sales. This phenomenon suggests that specific segments of the market may be responding to the incentives being provided. However, the overall retail landscape remains challenging, highlighting that localized success does not necessarily translate into broader economic recovery.

Despite the hurdles faced, some businesses express hope for future benefits. Companies like Otis, which manufacture elevators, recognize the potential in the trade-in policy even if immediate results are lacking. The emphasis on renewing outdated equipment ties into broader trends of energy efficiency and modernization, which could benefit the industry in the long run. Otis’ president acknowledged the prevalent interest from local governments to ensure effective funding deployment, though results have yet to materialize in substantial orders.

Kone, another major player in the elevator market, echoed a similar sentiment. With over 15% revenue decline in Greater China during the first half of 2024, the CFO stressed that the changes propelled by government initiatives could facilitate critical decisions by clients regarding modern upgrades. This could ultimately prove beneficial, though the uncertain timeline for realization remains a point of concern.

Conversely, for companies like ATRenew, the new policy presents a paradigm shift regarding the secondhand marketplace. While immediate impacts have not crystallized, the long-term growth scenario appears promising. The significant uptick in trade-in orders through platforms like JD.com suggests that early adopters are beginning to engage with the government’s program, paving the way for broader acceptance and effectiveness as the policy matures.

One glaring issue is the disparity in implementing the central government’s policies across various regions in China. Some local governments have only recently disclosed specific details on how the trade-in program will function, leading to confusion and a lack of coordination in execution. This disconnect between policy creation and local application hinders businesses’ ability to strategize and prepare for participation in the program, further complicating the overall success of the initiative.

The Chinese government’s trade-in policy represents a calculated effort to boost domestic consumption following economic stagnation, yet its effectiveness has been muted by consumer hesitance and local implementation challenges. While there remain reasons for optimism, as evidenced by specific market segments exhibiting growth amidst a broader slowdown, the reality remains that such initiatives require effective execution to yield substantial results. As various stakeholders await clearer outcomes, it becomes apparent that while financial incentives may pave the way, they must be coupled with a robust strategy to address consumer concerns and engage effectively with local governments. The success of this initiative hinges not only on the funds available but also on the faith placed in the program by consumers and businesses alike.