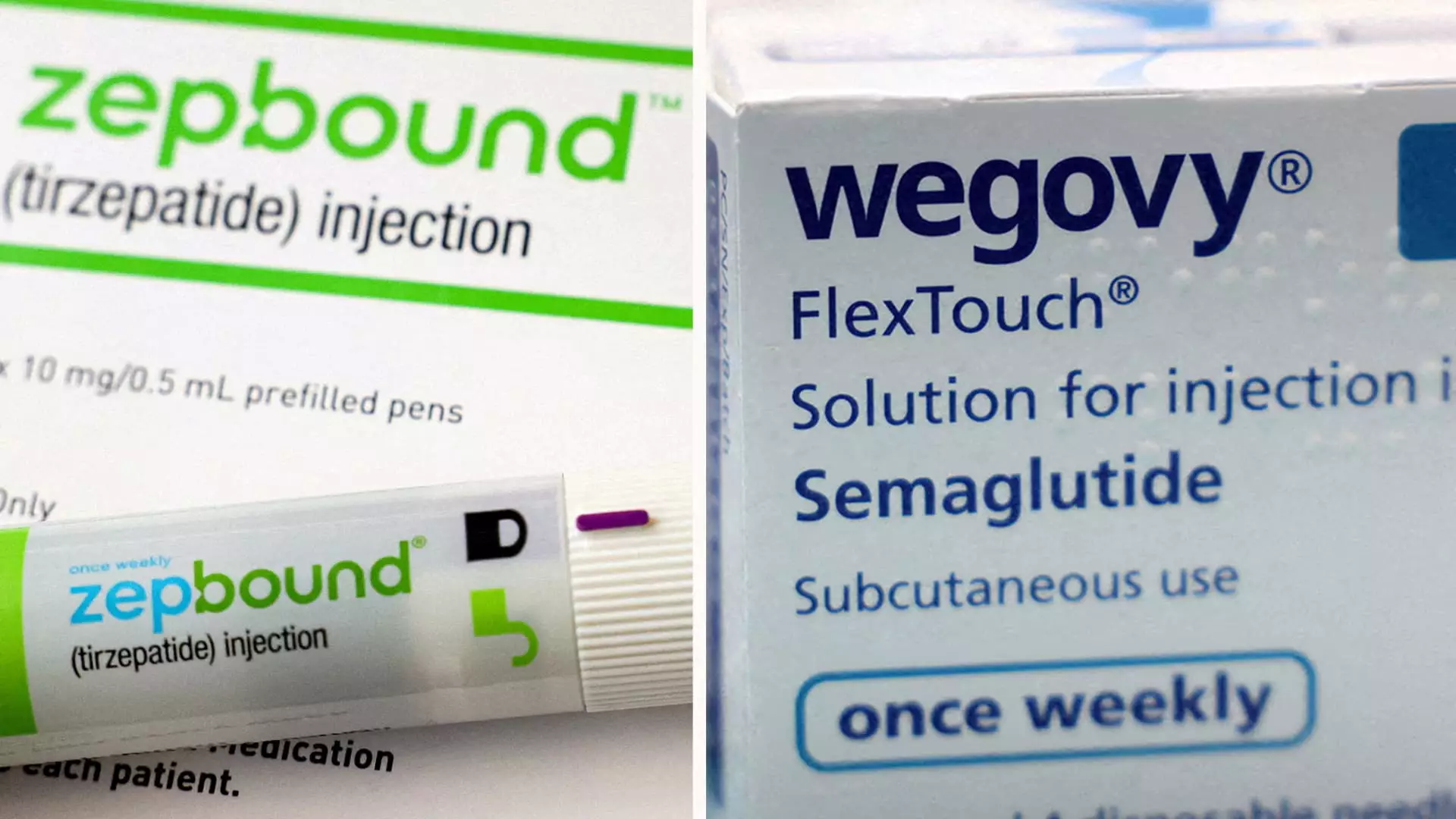

The field of obesity treatment is witnessing a significant evolution, notably characterized by competitive advancements in medication efficacy. Recently, Eli Lilly released compelling data showcasing its obesity medication, Zepbound, as outperforming Novo Nordisk’s widely utilized Wegovy in their first direct clinical comparison. This new revelation opens discussions about the potential of Zepbound to reshape treatment paradigms for patients with weight management challenges.

Zepbound’s Clinical Performance: A Significant Breakthrough

The phase three trial results for Zepbound indicate that participants lost an impressive average of 20.2% of their body weight over a period of 72 weeks. This translates to roughly 50 pounds for individuals struggling with obesity. In stark contrast, Wegovy, which has been a well-regarded option in the obesity treatment landscape, resulted in a significantly lower average weight loss of 13.7%, equating to about 33 pounds during the same time frame. The implications of these findings highlight not just a marginal gain; Eli Lilly reports a staggering 47% higher relative weight reduction among those taking Zepbound compared to the Wegovy group.

Moreover, the data reveals another dimension of Zepbound’s efficacy: over 31% of participants managed to shed at least a quarter of their total body weight, while only about 16% of Wegovy users achieved similar results. This newfound evidence strengthens the argument for Zepbound as a potentially superior choice for patients seeking effective weight loss solutions.

While the latest results from the head-to-head trial represent a turning point, they are further corroborated by a range of other studies. One of the late-stage studies reported that Zepbound users could lose more than 22% of their initial weight, overshadowing Wegovy’s 15% average loss over a comparable duration. Such results underscore a consistent trend favoring Zepbound across various research efforts, prompting experts to reassess the landscape of obesity pharmacotherapy.

Interestingly, the trial was deliberately focused on patients who battled obesity or were overweight while also dealing with at least one weight-related medical condition. This strategic patient selection enhances the applicability of the findings, offering clearer insights into how Zepbound may be uniquely beneficial to certain demographics within the larger patient population.

The stakes in the obesity treatment market are soaring, with analysts projecting a potential worth of $150 billion annually by the early 2030s. Eli Lilly’s Zepbound, although just recently approved in the United States, is positioned strategically to capitalize on this expanding market. Data analytics firm GlobalData forecasts that Zepbound could achieve annual sales of approximately $27.2 billion by 2030, while Wegovy is projected to generate around $18.7 billion. As these two giants vie for market dominance, Zepbound’s burgeoning presence could set new benchmarks in sales and consumer trust.

Despite the positive trends, there are operational challenges in the healthcare landscape related to the accessibility of these medications. The surge in demand for both Zepbound and Wegovy has resulted in noteworthy supply chain strains, as Eli Lilly and Novo Nordisk invest substantially in enhancing their production capacities. While the FDA now lists all doses of these drugs as available, the journey to accessibility remains complicated due to the patchy insurance coverage for weight loss treatments in the United States.

Understanding the underlying mechanisms of action for both drugs is crucial in assessing their effectiveness and suitability for different patients. Zepbound functions by modulating appetite and regulating blood sugar levels through the synergistic activation of two gut hormones: GIP and GLP-1. In contrast, Wegovy primarily activates only GLP-1. Some researchers argue that the dual-target approach of Zepbound may provide an additional edge, influencing metabolic processes related to sugar and fat breakdown more effectively than its competitor.

This detailed understanding marks an essential consideration for healthcare providers and patients alike as they navigate the treatment choices available within the obesity management landscape. As more clinicians look to make informed decisions based on robust data, the comparative efficacy of these medications can play a defining role in shaping treatment protocols.

As Eli Lilly and Novo Nordisk continue their rivalry in the burgeoning market for obesity medications, Zepbound’s promising results offer hopeful implications for those facing weight management challenges. With ongoing studies and evolving data likely to further illuminate the potential of these drugs, the future landscape of obesity treatment seems poised for transformation.