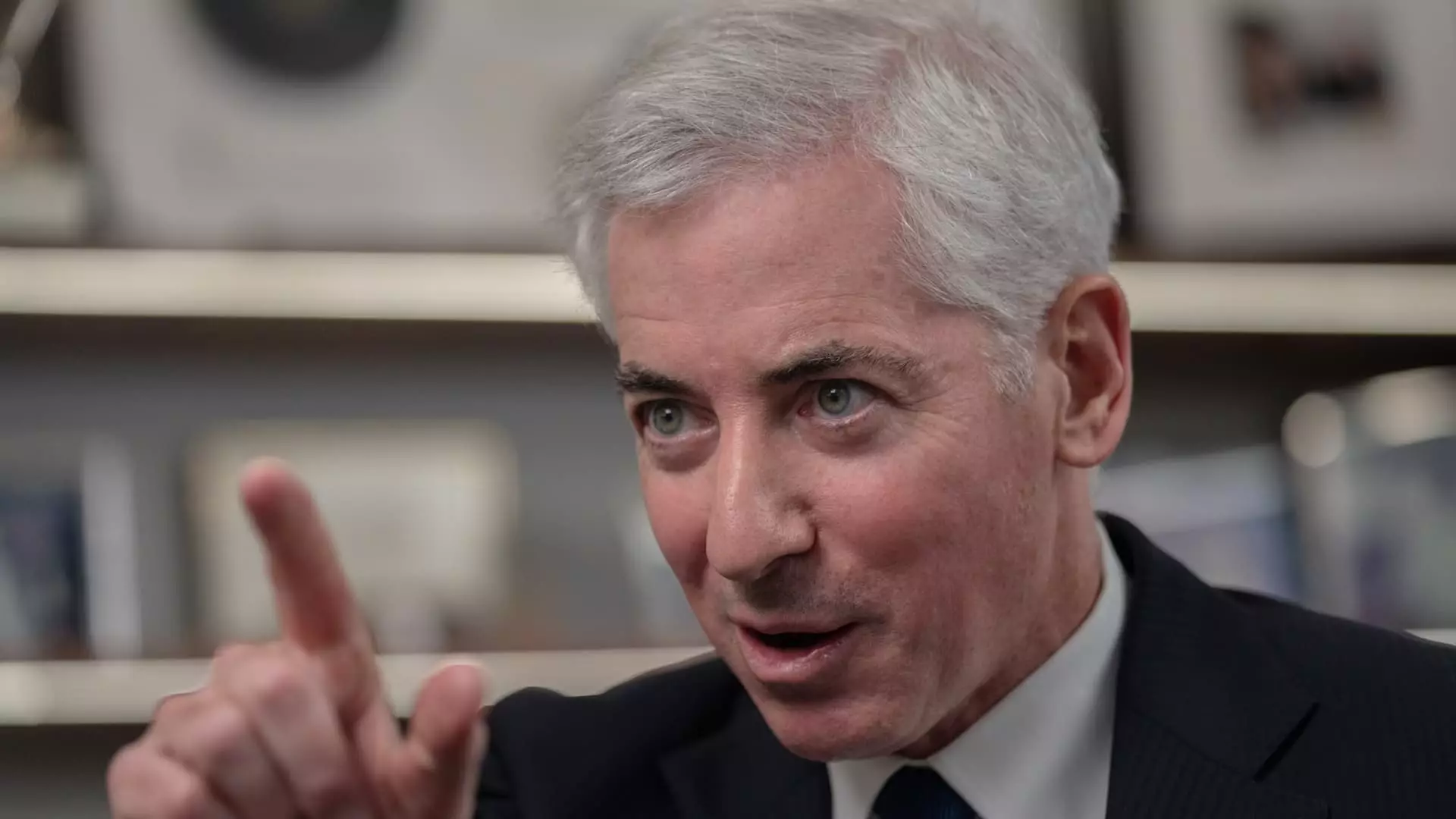

Bill Ackman’s decision to withdraw plans for an initial public offering for Pershing Square USA reflects a shift in investor demand from the fund. Despite attempting to model the offering after Berkshire Hathaway, the initial excitement surrounding the IPO significantly waned, leading to the fund’s eventual withdrawal.

Initially aiming to raise $25 billion, Pershing Square USA later revised its target to $2 billion due to the lackluster response from potential investors. This drastic reduction in fundraising goals suggests that the fund failed to generate sufficient interest to meet its original expectations.

The postponement of the IPO was further confirmed by a notice on the New York Stock Exchange’s website, signaling a setback in Ackman’s plans to take Pershing Square public. This delay highlights the challenges faced by the billionaire investor in navigating the complexities of the public markets.

Baupost Group’s decision not to invest in the offering dealt a significant blow to Ackman’s efforts to attract high-profile investors to Pershing Square. The absence of Seth Klarman’s Boston-based hedge fund, despite earlier indications of participation, underscores the difficulty in securing key backers for the fund.

Ackman’s move to publicly list Pershing Square was perceived as a strategic move to engage with retail investors and capitalize on his growing presence in the market. However, the lack of investor interest in the IPO suggests that retail investors may not have been as receptive to the offering as anticipated.

With over one million followers on social media platform X, Ackman has used his online presence to voice his opinions on various topics, including the U.S. presidential election and antisemitism. While his online following may have contributed to his visibility, it did not translate into strong investor demand for Pershing Square’s IPO.

Bill Ackman’s decision to withdraw Pershing Square USA’s IPO reflects the challenges faced by the fund in attracting investor interest and meeting its fundraising targets. The failed offering highlights the importance of gauging market demand accurately and securing key investors to support public listings successfully.