In a recent move that underscores its commitment to improving patient access, Eli Lilly has made significant adjustments to how it offers its weight loss drug, Zepbound. This initiative, aimed particularly at uninsured patients and those whose Medicare plans do not cover obesity treatments, reflects both market demand and the ongoing conversation about the management of obesity as a chronic disease.

Eli Lilly’s decision to release higher doses of Zepbound in single-dose vials at competitive price points is strategic. By offering these vials at nearly half of their usual monthly retail price, the company aligns its goals with the needs of patients who may have previously been priced out of effective weight management solutions. Specifically, the 7.5 milligram and 10 milligram doses are available for $499 per month upon the first prescription fill, and these prices remain accessible for refills within 45 days. If patients wait longer, the price increases significantly.

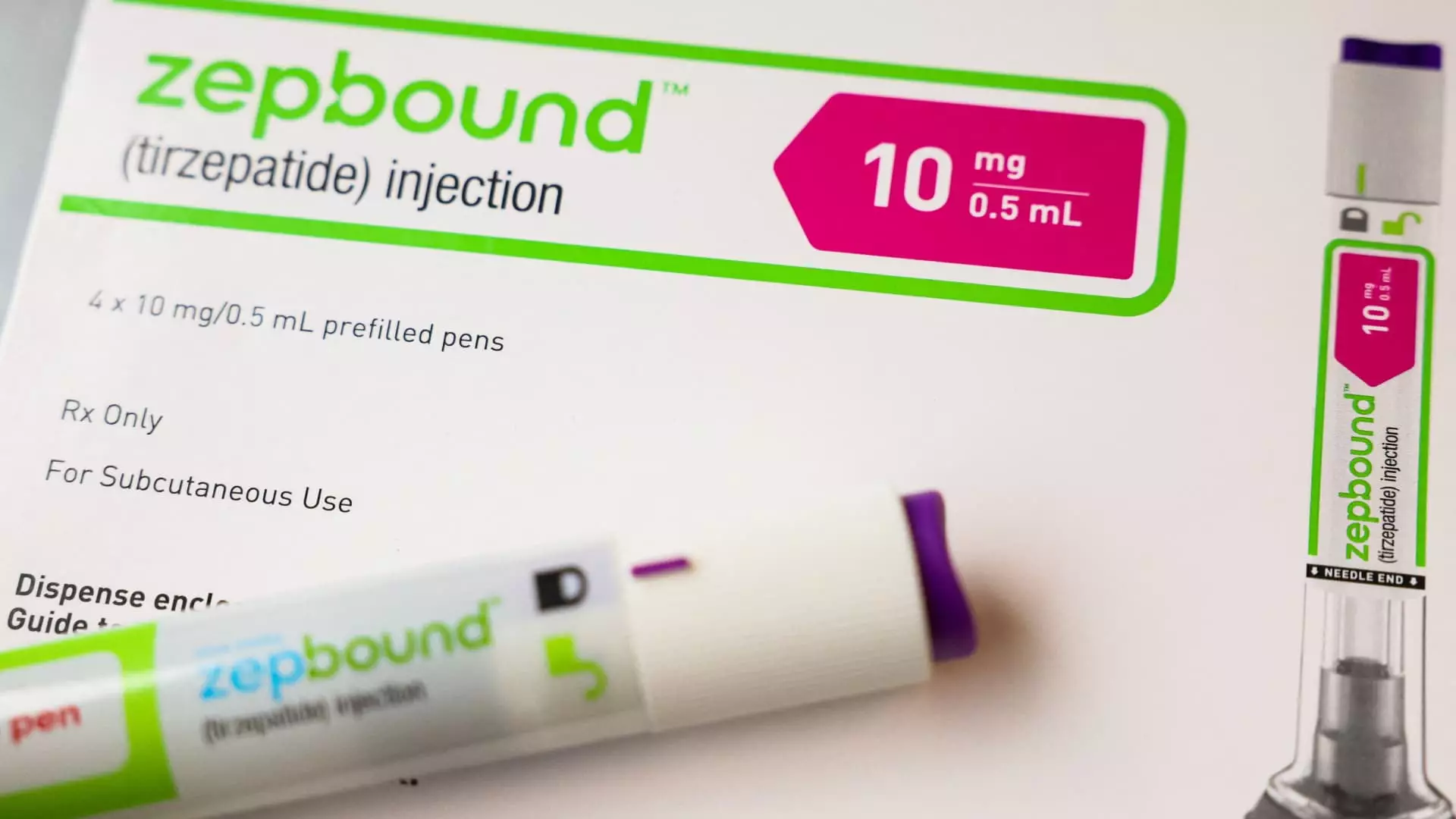

This reduction marks a pivotal change for patients who are not adequately covered by insurance. With obesity increasingly recognized as a chronic disease, the need for effective treatments that can be accessed without the burden of exorbitant costs is more critical than ever. However, this affordability aspect comes with conditions—patients must use a syringe and needle to administer their doses manually. In contrast, Zepbound’s previous formulation included autoinjector pens, allowing for easier self-administration with a button click.

As Eli Lilly increases the availability of Zepbound, it coincides with a recent lifting of the FDA’s shortage status for the drug. Previously, patients often turned to compounded versions of Zepbound from pharmacies as alternatives due to supply issues and high costs associated with the branded product. In this context, the launch of single-dose vials positions Eli Lilly not only as a supplier of legitimate medications but also as a vehicle for safety standards, ensuring that patients are not misled by unregulated substances.

Patrik Jonsson, president of Eli Lilly’s diabetes and obesity division, has emphasized that providing a reliable product is central to the company’s mission. With the potential for compounded alternatives to disrupt market integrity, Eli Lilly’s push to meet demand directly is a clever way to ensure they control both supply and quality. Jonsson’s statements also hint at a deeper understanding of market dynamics, where grocery-level competition with compounders is not a focus, as their goal remains clear: ensuring safety over cost-cutting.

One glaring issue in the rollout of Zepbound is its accessibility to Medicare beneficiaries. Not only do these individuals typically face disparities in coverage for obesity medications, but they are also excluded from many of Eli Lilly’s existing savings programs intended to subsidize the costs. Jonsson noted this gap, articulating the company’s intent to fill it with more affordable solutions. He also expressed hope for future policy changes that would bring Medicare into alignment with the comprehensive treatment of chronic diseases like obesity.

The implications of not providing adequate options for Medicare participants cannot be overstated. As discussions around health care and obesity continue to evolve, it becomes essential for pharmaceutical companies to advocate for policy changes that address inequities in treatment access. Eli Lilly’s strategic adjustments might serve as a valuable case study in understanding how businesses can navigate, and even influence, the legislative landscape concerning health care affordability.

Eli Lilly’s engagement with the direct-to-consumer market through LillyDirect provides another layer to its outreach strategy. This platform connects eligible patients with telehealth providers who can prescribe the medication, circumventing traditional barriers to access. The convenience of home delivery is appealing, especially for patients who may find it difficult to visit healthcare facilities regularly.

The potential for Zepbound to capture a more significant share of the obesity treatment market through LillyDirect remains promising. As of now, Jonsson has indicated that the uptake of the vials is progressing well but constitutes a small percentage of the broader obesity treatment landscape. Initial engagement suggests that about 10% of new obesity patients are opting for Zepbound via LillyDirect, indicating that as more options become available, this figure may increase substantially.

In essence, Eli Lilly’s recent moves to adjust its Zepbound offering reflect a broader shift needed in the healthcare narrative. As the landscape evolves, the integration of affordability, accessibility, and patient-centric approaches becomes imperative—representing not only good business but also a moral obligation in health care provision.