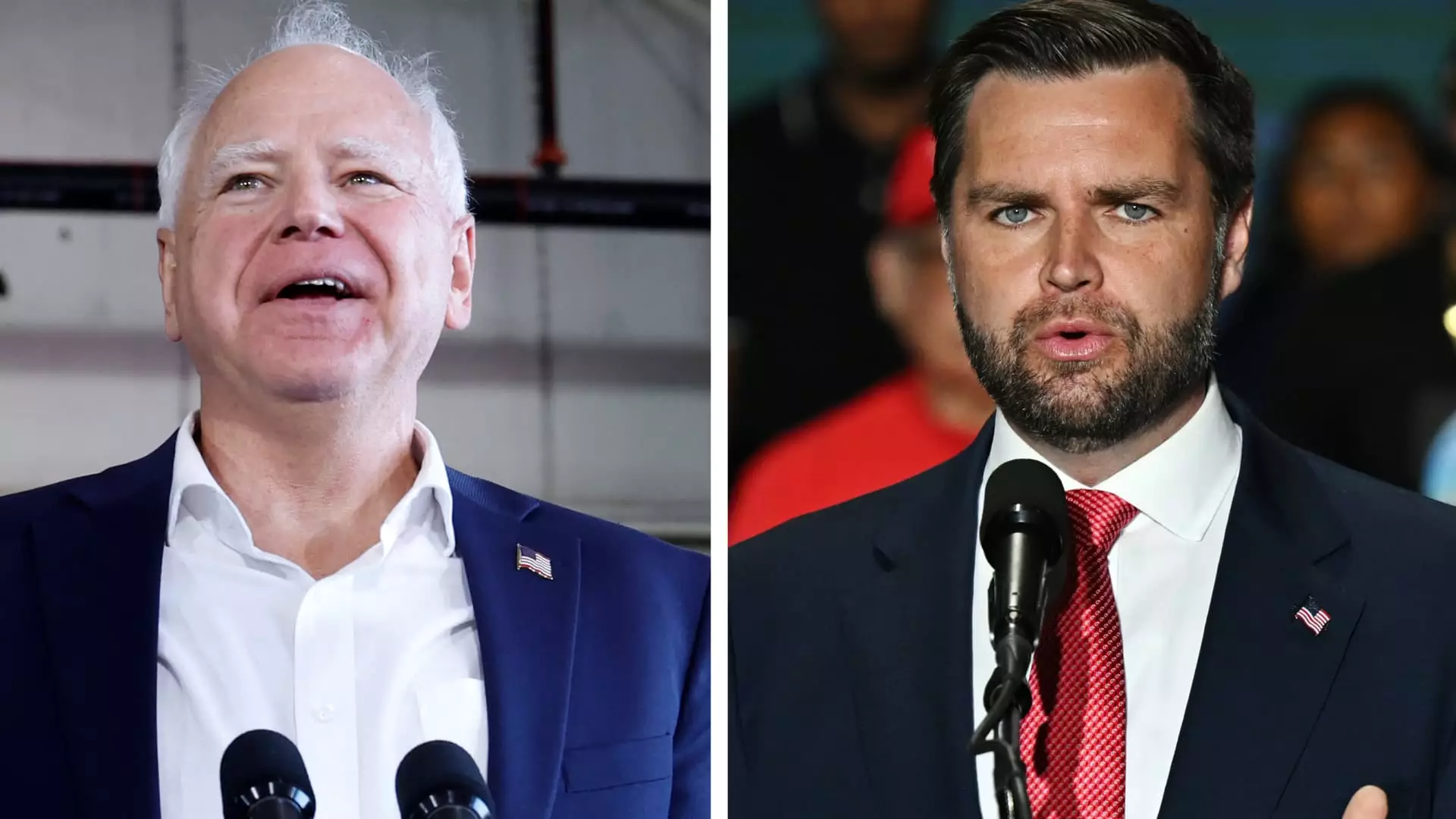

With the 2024 election season in full swing, all eyes are on the candidates as they unveil their personal finance policies that could have a direct impact on the wallets of American voters. Vice President Kamala Harris recently announced her running mate, Minnesota Gov. Tim Walz, while former President Donald Trump selected Sen. JD Vance of Ohio. Both sets of candidates are engaging in class warfare tactics, attempting to depict each other as disconnected from the middle-class Americans they seek to represent.

Affordable housing is a pressing issue for many Americans, and both Walz and Vance have addressed this concern in their policy platforms. Walz, for instance, signed housing legislation in May 2023 that allocated $200 million for down payment assistance, $200 million for housing infrastructure, and $40 million for workforce housing. Experts predict that Walz will champion demand-side housing approaches, aimed at improving housing quality and reducing monthly housing costs under a potential Harris administration. On the other hand, Vance has also emphasized the importance of affordable housing, advocating for policies that tackle poverty by addressing this critical need.

The fate of the child tax credit hangs in the balance, with trillions of dollars in tax breaks set to expire after 2025, including a reduction in the child tax credit from $2,000 to $1,000 per child. In response to this impending change, Congress expanded the child tax credit in 2021, resulting in upfront monthly payments that significantly reduced the child poverty rate. Minnesota followed suit by enacting a state-level refundable child tax credit in 2023, which Walz hailed as a major accomplishment. However, the prospects of a permanent federal child tax credit expansion remain uncertain due to a divided Congress and concerns over the growing federal budget deficit.

A standout issue in the 2024 election is education debt, with Vance vocally opposing student loan forgiveness policies. He argues that forgiving student debt primarily benefits the wealthy and higher education institutions, rather than truly aiding those in need. Conversely, Walz, a former school teacher, has taken a more supportive stance on addressing student loan debt, implementing programs like student loan forgiveness for nurses and free tuition initiatives for low-income students in Minnesota. The differing approaches of the candidates highlight their contrasting priorities when it comes to tackling the student debt crisis.

As the 2024 election approaches, the personal finance policies proposed by candidates like Walz and Vance are under scrutiny. Their positions on critical issues such as affordable housing, the child tax credit, and education debt offer valuable insights into their visions for the nation’s economic future. Ultimately, voters will have to weigh these competing policy proposals and decide which candidate aligns best with their financial interests and values.