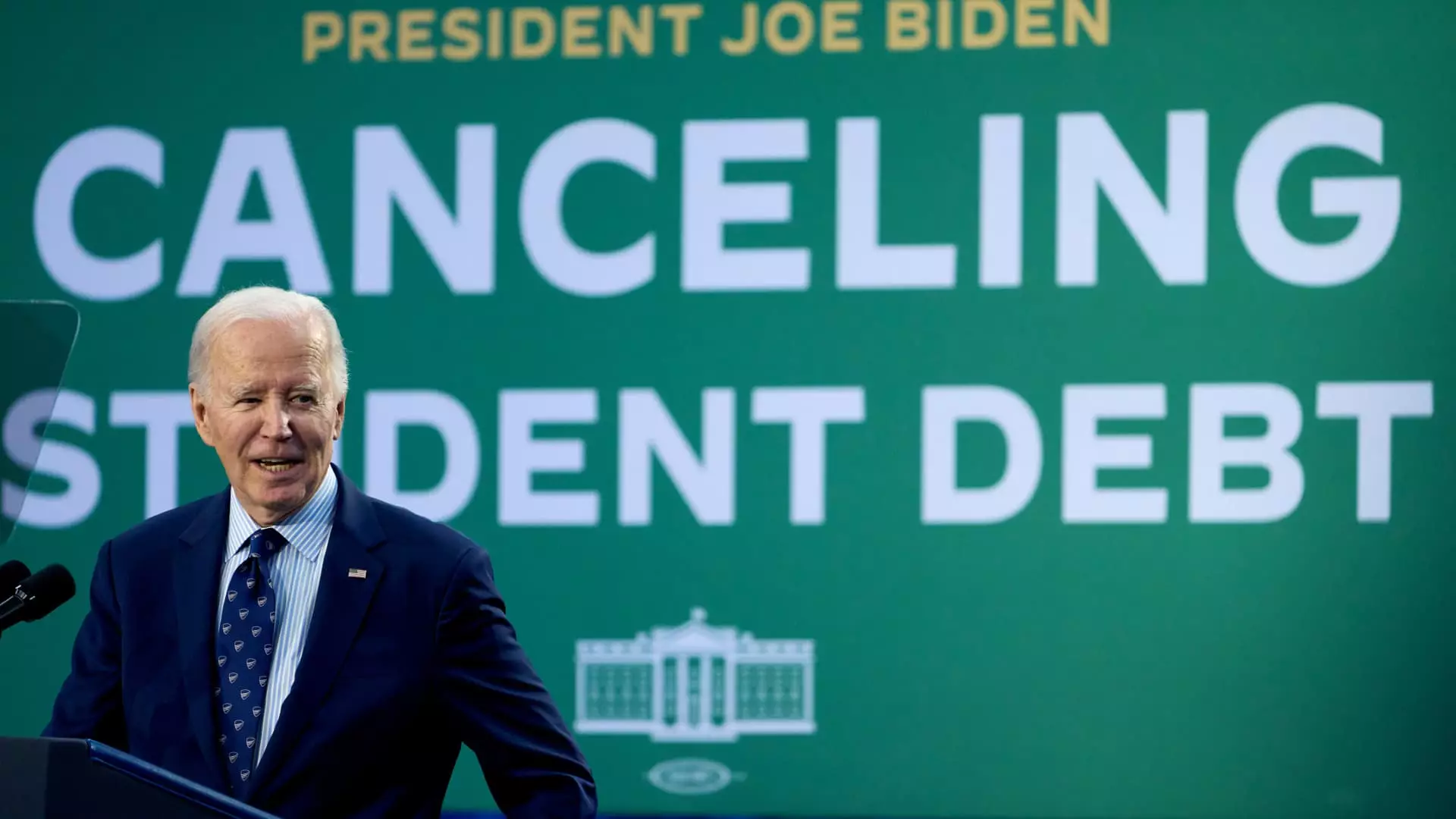

On a significant Thursday in the final months of President Biden’s administration, a pivotal announcement was made concerning student loan forgiveness. The U.S. Department of Education revealed it would forgive over $600 million in student debt for approximately 4,550 borrowers associated with the Income-Based Repayment (IBR) plan and 4,100 former DeVry University students. This decision marks a crucial step in addressing the challenges faced by borrowers, particularly those misled by former educational institutions like DeVry, known for substantial misrepresentations concerning their job placement rates.

As President Biden approaches the end of his term, the striking figures related to student debt forgiveness come into focus. Over the course of his presidency, he is expected to forgive a remarkable total of $188.8 billion in student loans, benefiting approximately 5.3 million borrowers. This context adds weight to the recent announcement, signaling not only an end to a specific initiative but also framing it as part of a broader legacy of addressing educational financial burdens. Higher education expert Mark Kantrowitz described this phase as “the end of an era,” highlighting the unprecedented scale of relief efforts under Biden’s administration.

Despite significant strides in student debt cancellation, the Biden administration faced significant challenges, particularly with the Supreme Court’s ruling that blocked a wide-ranging forgiveness plan intended for tens of millions of Americans. This ruling underscored the complexities involved in reforming the student loan landscape, reflecting a tension between legislative intent and judicial interpretation. Nonetheless, the administration managed to implement targeted relief measures through the enhancement of existing debt relief programs, showcasing a steadfast commitment to supporting borrowers who were often left behind.

In tandem with the recent debt cancellation announcements, the Education Department also finalized a crucial adjustment regarding income-driven repayment (IDR) plans. These plans are designed to provide loan forgiveness after a set period of manageable payments, usually spanning 20 to 25 years. However, borrowers have frequently voiced concerns regarding the inadequacies of tracking systems. With the completion of the payment count adjustment, borrowers can now access accurate information about their repayment status, fostering transparency and trust in the system. This change signifies an important shift in the administration’s approach, acknowledging prior failures and pushing towards a more reliable system for tracking payments.

As the Biden administration prepares for the transition of power, the impact of its student loan forgiveness initiatives remains profound. The recent debt cancellations not only alleviate immediate financial burdens for thousands but serve as a reflection of broader efforts to reform a historically flawed student loan system. The enhanced IDR plans and targeted relief measures demonstrate a commitment to ensuring that borrowers are treated fairly and transparently in their pursuit of educational opportunities. As discussions surrounding student debt continue to evolve in the political landscape, the progress made thus far will likely serve as a pivotal point for future reforms and promise a shifting paradigm in higher education financing.