As we step into 2025, the financial markets have opened with a palpable excitement, reminiscent of eras marked by speculative trading and the whims of retail investors. The recent fluctuations illustrate a unique blend of exuberance and unpredictability, as a variety of asset classes—most notably cryptocurrencies and meme stocks—exhibit significant price movements. Analysts and investors alike are attempting to unravel the various factors at play, particularly in the absence of overt catalysts that might explain the sudden spikes in stock valuations.

The Crypto Resurgence

At the forefront of this renewed market enthusiasm is a dramatic resurgence in the cryptocurrency sector. Bitcoin, having crossed the remarkable threshold of $96,000, has propelled associated stocks into a frenzied buying spree. Companies such as Microstrategy have seen their stock prices soar, highlighting a remarkable gain of over 360% throughout 2024. The sustained interest in cryptocurrencies is not merely a flash in the pan; it showcases a broader acceptance of digital currencies as serious financial instruments. Additionally, one particularly obscure token, humorously dubbed “fartcoin,” establishing itself with a staggering market valuation of $1.38 billion after a 45% price jump, exemplifies the speculative nature that now dominates this space. This peculiar trajectory raises questions about the long-term viability of such investments, particularly for casual traders engaging based on social media trends rather than fundamentals.

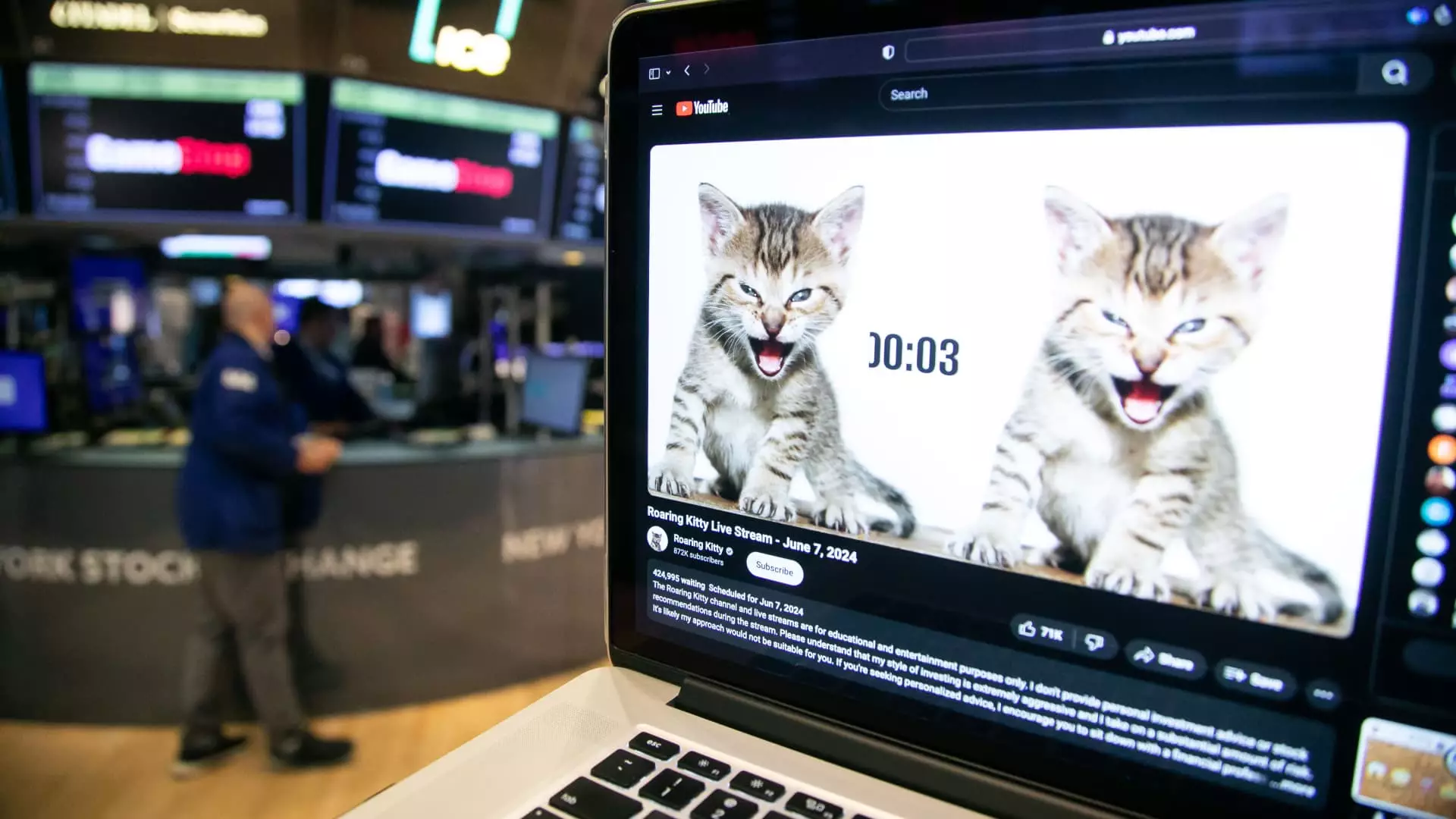

The intermingling of social media with stock trading is becoming increasingly apparent. The activities of online figures such as “Roaring Kitty,” also known as Keith Gill, have become a bellwether for retail trading movements. His latest cryptic posts are stirring debates among investors regarding potential connections to stocks like Unity Software and GameStop. The fervor surrounding meme stocks demonstrates how dynamics have shifted; no longer are investments solely dictated by financial fundamentals, but rather a blend of cultural references and online banter. This behavior reflects an evolution in market participation, where social media sentiment can drive massive stock fluctuations, creating opportunities for quick gains but also significant risks.

As observers delve deeper into market patterns, certain sectors continue to play a pivotal role in overall market performance. The semiconductor industry has emerged as a key player following a robust 2024, with stocks such as Broadcom and Nvidia charting gains as they adapt to varying economic conditions. The excitement around artificial intelligence may have plateaued, but the fundamental demand for semiconductors remains high, spurring optimism among investors. Such developments suggest that certain sectors can sustain growth independent of broader market sentiments, fostering a nuanced investment climate where value and speculation coexist.

Various economic forecasts indicate that the sentiment of retail investors may be shifting as a response to broader macroeconomic signals. Banking institutions, such as Morgan Stanley, emphasize the potential for “animal spirits” to emerge under the new administration, suggesting that deregulation could spur increased market activity. Yet, the uncertainty surrounding potential protectionist measures and their implications for inflation throws a wrench into optimism. Historical parallels to past market behaviors—such as the aftermath of election results—make clear the volatility encapsulating the current landscape. Market participants appear cautiously optimistic, yet acutely aware that rapid gains can quickly reverse in the face of geopolitical or economic turmoil.

The early days of 2025 highlight a remarkable chapter in trading history, encapsulating the duality of excitement and anxiety that define speculative trading environments. As cryptocurrencies reclaim notoriety and meme stocks captivate the attention of retail traders, one must approach these market dynamics with both enthusiasm and caution. The contemporary investor landscape is a testament to the changing tides of market participation, where social media sentiment and speculative fervor intertwine to influence stock prices in unprecedented ways. Navigating this evolving terrain will require vigilance, adaptability, and an understanding that the wild fluctuations seen today may foreshadow either extraordinary opportunities or significant risks in the near future.