Micron Technology Inc. faced a significant downturn this past Thursday, with its shares losing a staggering 16% value. This sharp decline marks one of the most troubling days for the chipmaker since the onset of the COVID-19 pandemic, raising concerns among investors about the company’s strategic direction and market performance. At one point, shares were trading at $86.78, almost half of their all-time high reached in June, signalling a dramatic shift in investor confidence.

The primary catalyst for this market reaction was Micron’s release of its disappointing second-quarter guidance. The company projected revenues of approximately $7.9 billion— a stark contrast to the analyst consensus of $8.98 billion. Moreover, its anticipated adjusted earnings per share (EPS) of $1.43 fell short of expectations, which had been set at $1.91. Disappointment emanating from the financial community is further emphasized by a noticeable gap between actual earnings and forecasts, exemplifying a disconnect that could threaten the company’s market standing.

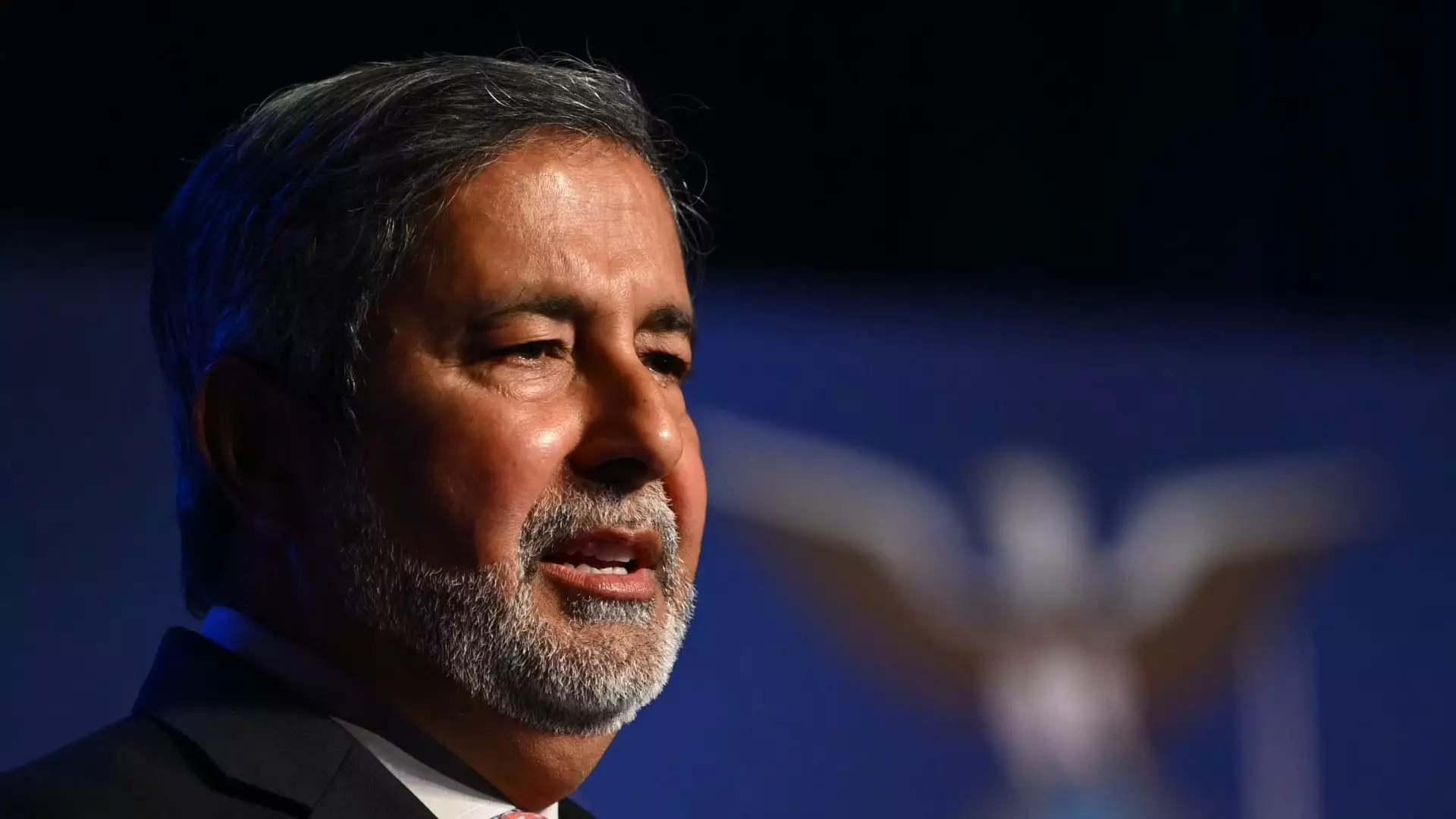

CEO Sanjay Mehrotra’s acknowledgement of slower growth in consumer device segments adds another layer of complexity to the company’s outlook. As highlighted by analysts from Stifel, the ongoing “inventory adjustments” and delays in the PC refresh cycle signal an industry grappling with overstock issues and reluctance among consumers. This raises critical questions about demand sustainability in key markets like smartphones, which are reportedly facing elevated inventory levels. The macroeconomic environment, wrought with uncertainties, is forcing companies to rethink their supply chain and inventory management strategies—an area where Micron must excel to regain lost ground.

Interestingly, while Micron’s earnings report for the first quarter showed robust growth with an EPS of $1.79 and revenue soaring 84% year-over-year to $8.71 billion— largely fueled by a 400% increase in data center revenue due to artificial intelligence demand—the recent projections suggest a troubling inconsistency. While one quarter can signal strong performance due to booming sectors, consistent results are essential for maintaining investor confidence and long-term viability in the technology arena.

These mixed reports highlight a critical juncture for Micron Technology. Maintaining a ‘buy’ rating from analysts like those at Stifel indicates some level of ongoing confidence in the firm’s prospects, albeit with a revised price target reflecting caution in future growth estimates. Investors are left to ponder whether the company can pivot successfully amidst shifting market dynamics and consumer behavior. How Micron navigates this complex landscape will be pivotal in shaping its future trajectory and reinstating its stock’s value.