Nvidia is under the spotlight as it prepares to release its fiscal third-quarter earnings this Wednesday. Analysts and investors alike are looking for insights not only from the results themselves but also from the company’s forward-looking statements regarding its performance in the ongoing landscape of artificial intelligence (AI). Wall Street’s consensus estimates predict revenues of $33.16 billion and adjusted earnings of 75 cents per share. However, the real intrigue lies in Nvidia’s ability to maintain its rapid growth trajectory amid the maturity of the AI sector.

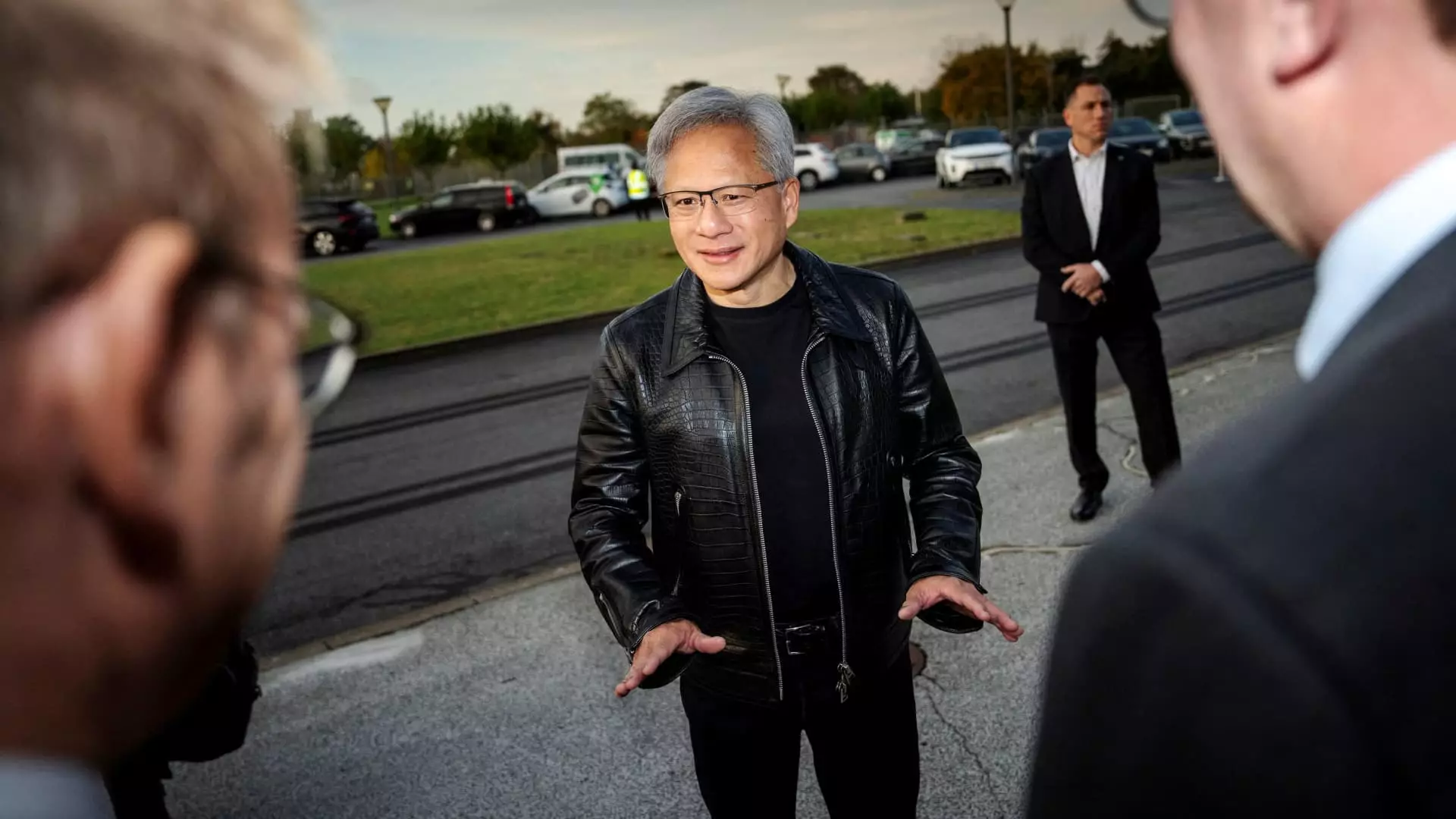

Beyond the numbers, Nvidia’s forecast for the subsequent quarter, including expectations for earnings of 82 cents per share and sales of $37.08 billion, is crucial. Wall Street’s focus will be on how the company plans to leverage its latest innovation, the Blackwell AI chip, to sustain momentum. This next-generation chip is aimed at data centers and is already being shipped to major players such as Microsoft, Google, and Oracle. Investors will be scrutinizing comments from CEO Jensen Huang, hoping to discern the level of demand for Blackwell and the chip’s potential impact on Nvidia’s trajectory.

However, Nvidia is not without its hurdles. Current reports indicate that some systems utilizing the Blackwell chips are experiencing overheating problems, a concern that could hinder its adoption rate. This issue could be a focal point during the earnings call, with analysts eager to hear how Nvidia plans to address these operational challenges. In August, the company projected “several billion” dollars in sales tied to the Blackwell chip for the upcoming January quarter, but these aspirations could be tempered by technical setbacks.

Although Nvidia’s stock has seen an almost threefold increase since the beginning of 2024, the company reported a formidable 122% growth in sales during its most recent quarter. While impressive, this growth reflects a notable deceleration from the 262% and 265% year-over-year growth rates reported in the earlier quarters of April and January, respectively. This raises questions about the sustainability of Nvidia’s growth as the AI market matures and competition intensifies.

As Nvidia approaches this critical earnings announcement, the stakes are high for both the company and its investors. The outcomes could signal whether Nvidia will continue its trend of extraordinary growth or grapple with the challenges that a more developed market presents. Investors must not just rely on past performance but consider future uncertainties and potential market fluctuations resulting from both technical challenges and evolving competition in the tech landscape. As Nvidia braces for the upcoming results, all eyes will be on how well it can navigate this pivotal moment while continuing to push the boundaries of AI innovation.