Nvidia, the renowned chipmaker at the forefront of AI technology, recently released its fourth-quarter earnings report for the fiscal year. The outcome not only surpassed expectations but also provided deeper insights into the company’s strategic trajectory as it navigates through a rapidly evolving tech landscape. By examining the key figures and market responses, we can grasp the implications of this performance and what it means for Nvidia’s future growth, particularly in the artificial intelligence sector.

In the latest earnings report, Nvidia posted a remarkable revenue figure of $39.33 billion, outperforming the analysts’ consensus that predicted $38.05 billion. Additionally, the adjusted earnings per share came in at 89 cents, exceeding the expected 84 cents. What stands out here is not just the financial beat but the robust outlook for the upcoming quarter, with Nvidia projecting approximately $43 billion in revenue for Q1, indicating a possible year-over-year growth of 65%. Though this represents a deceleration from the astronomical growth of 262% in the previous year, it still demonstrates the company’s strong market hold and anticipated expansion.

The significant year-on-year comparisons reflect Nvidia’s ability to leverage its core competencies in AI to drive sales. Chief Financial Officer Colette Kress underscored the company’s expected surge in sales of its new AI chip, Blackwell, reinforcing confidence in its growth trajectory. The company’s net income for this quarter reached $22.09 billion, illustrating a dramatic climb from $12.29 billion a year ago. Furthermore, Nvidia’s gross margin reported at 73%, while slightly down year-over-year, aligns with industry expectations given the complexities involved in developing advanced data center products.

Nvidia’s data center division continues to be the powerhouse of its revenue generation, comprising a staggering 91% of total sales. This segment alone amassed $35.6 billion in revenue, representing a phenomenal 93% increase from the previous year. Parallel to Nvidia’s mission to dominate AI processing, the demand in this segment has seen growth potential that seems almost limitless.

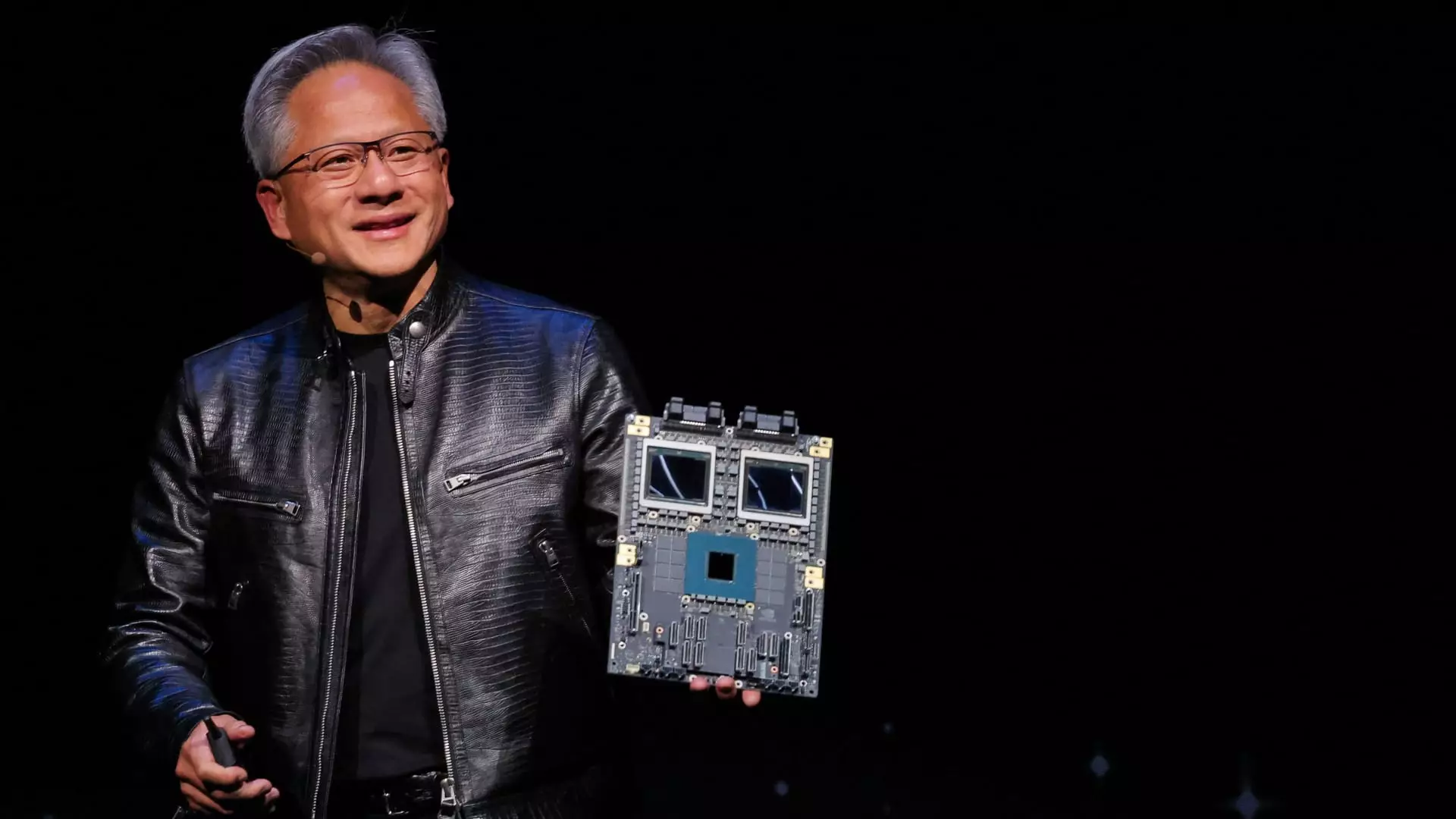

Revenue from the latest generation of AI chips, Blackwell, has been touted as the fastest ramp-up in the company’s history, with a substantial portion coming from major cloud service providers. Kress articulated that these providers contributed nearly half of the data center revenue. This dominance not only reflects market confidence in Nvidia’s chips but also sets a precedent for the company’s ability to innovate and cater to rising computational needs in AI.

Nvidia’s strategic transition from training AI to delivering AI through inference capabilities is a critical factor in its growth narrative. Previous models focused primarily on development and training, while Blackwell is designed to facilitate real-time processing of AI applications. Kress emphasized that innovative AI algorithms could significantly escalate the demand for computing power, with potential increases of up to 100 times for certain tasks. This characterization represents not merely a commentary on Nvidia’s market approach but an acknowledgment of the broader shift in AI methodology.

Moreover, Nvidia addressed investor concerns regarding custom chip designs from competitors like Amazon and Microsoft. In an industry where chip development often results in extensive capital expenditure without guaranteed deployment, Nvidia seems to be well-positioned. This perspective alleviates concerns regarding potential market threats and highlights the company’s ongoing competitive edge.

Despite the impressive figures, not all sectors of Nvidia’s business displayed forward momentum. The gaming segment, which has been a staple of Nvidia’s revenue stream, reported $2.5 billion, falling short of expectations set at $3.04 billion and showcasing an annual decline of 11%. Similarly, networking sales faced a downturn of 9% year-over-year, illustrating challenges amidst the flourishing data center revenue.

Nonetheless, Nvidia’s commitment to innovation remains evident, as recent introductions aimed at the consumer market incorporate the same architectural advantages seen in their AI chips. Additionally, the automotive sector has shown signs of expansion, with automotive sales soaring 103% year-on-year to $570 million. Although this figure occupies a minor portion of the company’s overall sales, it reveals the potential for new growth avenues.

In an assertive move to enhance shareholder value, Nvidia disclosed plans for a significant $33.7 billion in share repurchases throughout fiscal 2025. This strategy not only reflects confidence in the company’s future prospects but also signals an intent to return value to shareholders amidst rapid growth.

Overall, Nvidia’s fourth-quarter financial results paint a compelling picture of a company at the pinnacle of the AI revolution, notwithstanding certain struggles in traditional divisions like gaming. With the ongoing ramp-up in data center revenues and proactive engagement in chip development, Nvidia seems set to maintain its leadership position in the fast-evolving landscape of artificial intelligence. As the company moves forward, all eyes will be on how effectively it navigates emerging challenges and captures new opportunities in myriad sectors.