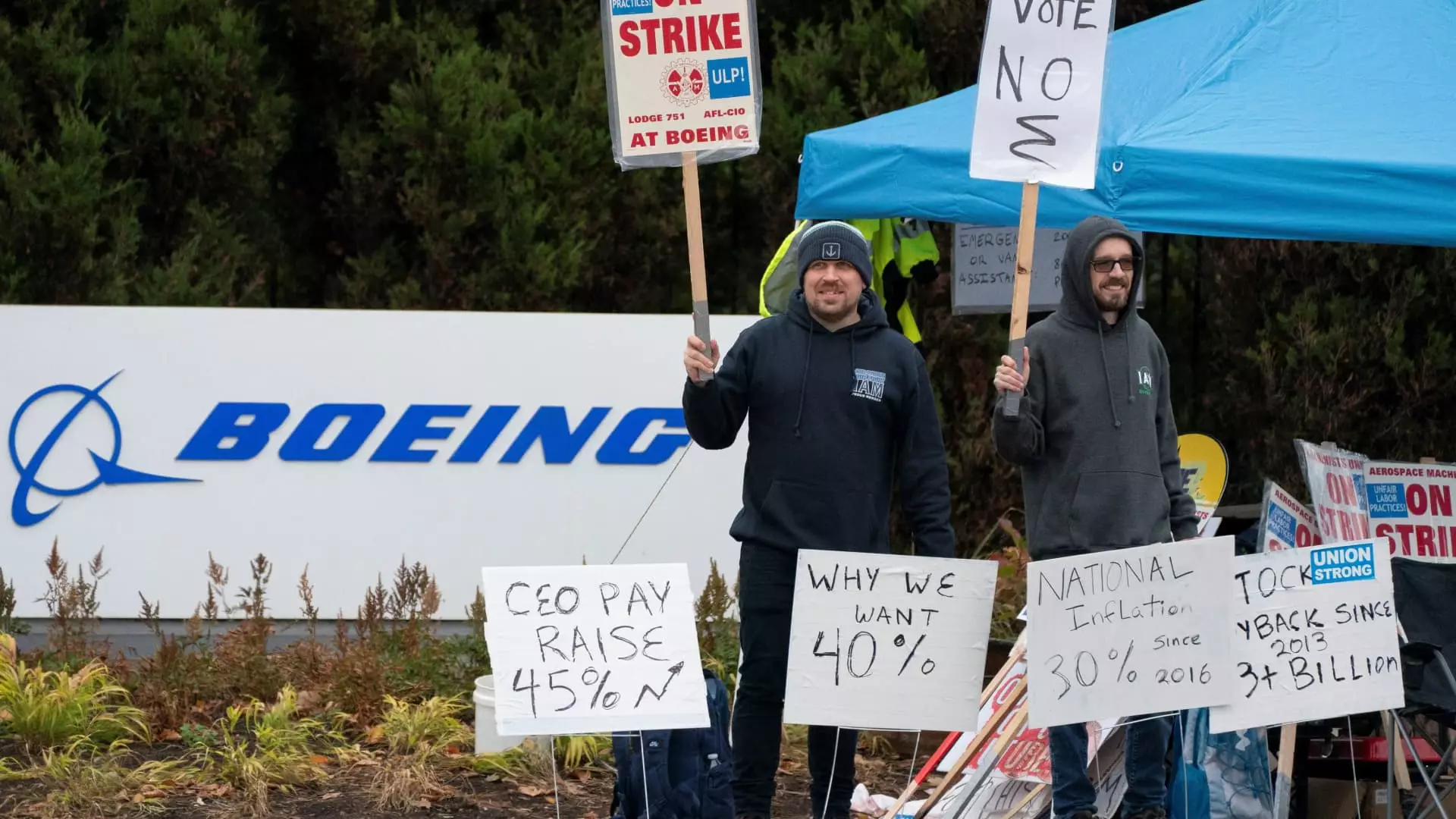

The recent strike by Boeing’s machinists, prompted by grievances over job security and compensation, has cast a shadow over the aerospace giant’s production capabilities and financial health. Since the strike’s initiation in mid-September, Boeing has grappled with mounting operational losses and a significant slowdown in aircraft production—critical to their status as a leading exporter in the United States. The machinists, represented by the International Association of Machinists and Aerospace Workers District 751, are advocating not just for better pay but also for a sense of stability in a rapidly changing industry marked by escalating living costs in the Seattle area, where many employees reside.

As the strike persisted, both Boeing and the union found themselves at a crucial juncture. A recently negotiated contract proposal emerged, which stands as a pivotal moment in the ongoing labor dispute. The contract offers a significant wage increase of 38% over a four-year term, slightly more than the previous offer of 35%. This adjustment equates to a cumulative pay rise approaching 44% when factoring in compounding increases. Moreover, to sweeten the deal, the new proposal presents machinists with a choice between a one-time ratification bonus of $12,000 or a combination of a prior $7,000 bonus alongside a $5,000 contribution to their 401(k) plans. The union’s message has been clear: acceptance of the proposal is essential, as pushing for further negotiations could lead to diminished offers in the future.

The repercussions of the strike extend beyond just Boeing’s assembly lines. It has been reported that the strike adversely affected U.S. employment figures, as noted by the Labor Department in their latest jobs report. The involvement of the Biden administration in these negotiations underscores the broader economic implications of the strike, with Acting Labor Secretary Julie Su actively engaging with both Boeing and the union to facilitate a resolution. This federal interest highlights the essential role of Boeing within the U.S. economy, not merely as a company, but as a cornerstone of American manufacturing and employment.

Boeing’s leadership, particularly CEO Kelly Ortberg, has recognized the urgency of resolving the strike to stabilize the business. Ortberg’s remarks urging workers to vote on the new contract reflect a desire to mend gaps and redirect focus back to recovering from recent production challenges. His perspective indicates an understanding that the company’s future relies not only on operational efficiency but also on a satisfied and motivated workforce.

Despite the hopeful tone of the new proposal, underlying tensions persist, particularly regarding Boeing’s decisions to move certain production lines, such as the 787 Dreamliner, to non-unionized facilities in South Carolina. These moves have fueled dissatisfaction among machinists who feel their security and job prospects are under threat. The strike’s continuation has thwarted Boeing’s efforts to rebound from prior production errors and safety incidents, including the alarming case of a door plug malfunctioning midair in a Boeing 737 Max 9.

The overarching flexibility that machinists have sought amidst a backdrop of soaring living costs underscores a need for corporations like Boeing to carefully consider employee needs in their growth strategies. As Boeing progresses toward the conclusion of this strike, the upcoming vote on the new contract will mark a critical moment, potentially illuminating the balance between operational demand and workforce satisfaction in an evolving economic landscape.

The current labor dispute at Boeing encapsulates a defining moment for the aerospace industry, drawing attention to the intricate relationship between employability, economic viability, and corporate governance in times of significant change. How Boeing navigates this challenge will not only define its immediate future but will also influence standards and expectations across the broader manufacturing sector.