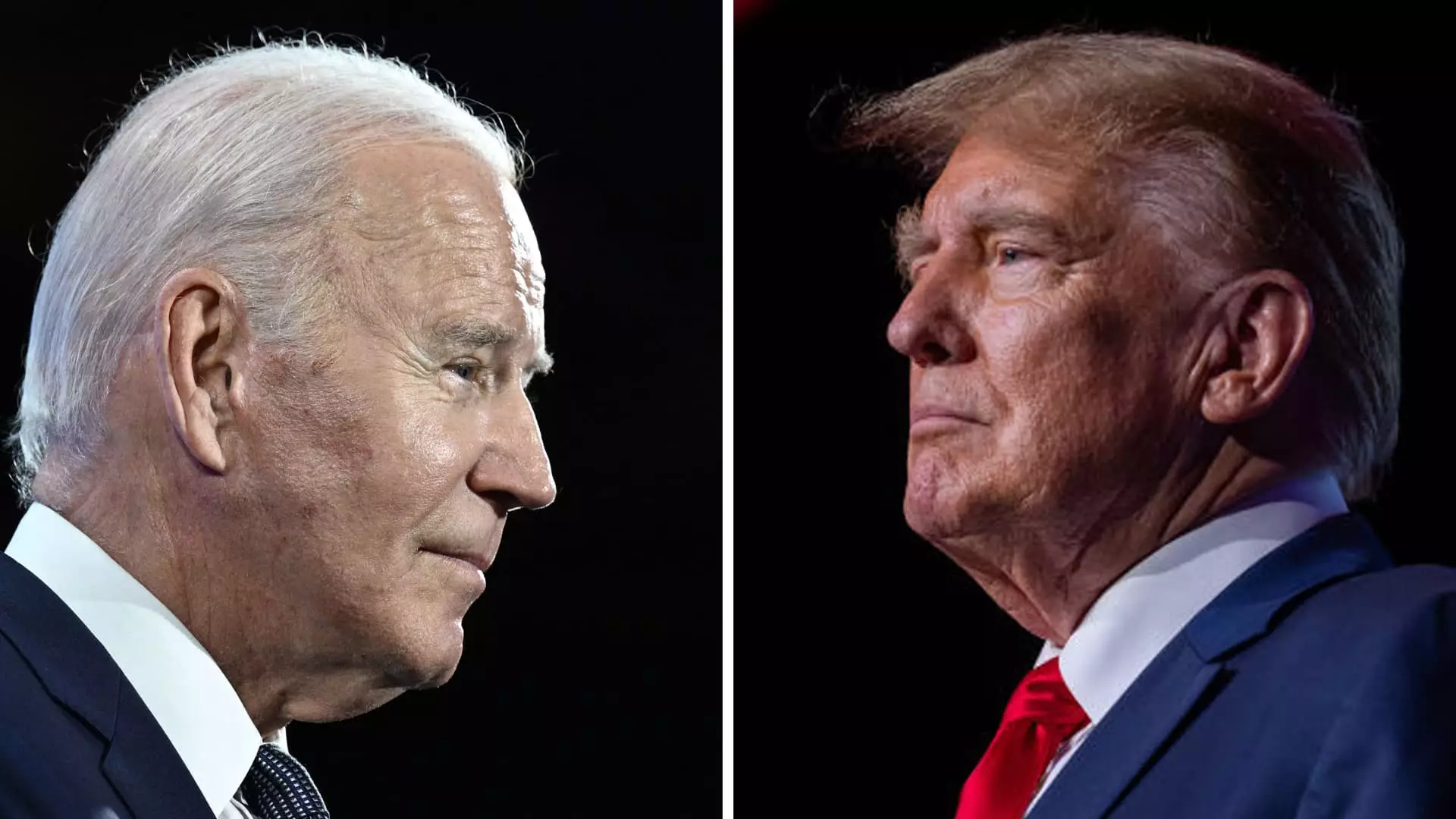

In the realm of American politics, President Joe Biden and former President Donald Trump have made promises to extend expiring tax breaks for the majority of Americans. However, the real challenge lies in finding ways to finance these extensions as the expiration date for the tax breaks approaches. The Tax Cuts and Jobs Act of 2017, enacted by Trump, will see its trillions of dollars in tax breaks coming to an end after 2025 if no action is taken by the Congress. This would result in a tax hike for over 60% of filers, according to the Tax Foundation.

The looming 2025 tax cliff poses a significant threat as the federal budget deficit becomes a major concern. Erica York, a senior economist and research manager at the Tax Foundation’s Center for Federal Tax Policy, highlighted that fully extending the TCJA provisions could lead to an estimated $4.6 trillion increase in the deficit over the next decade, as reported by the Congressional Budget Office in May. Despite initial estimates in 2018 suggesting that economic growth from the TCJA would cover a portion of the tax cuts’ costs, subsequent studies have shown otherwise.

Economists like Howard Gleckman, a senior fellow at the Urban-Brookings Tax Policy Center, have strongly criticized the notion that the TCJA or its extensions would pay for themselves. Studies and analyses from organizations like the Yale Budget Lab, Tax Foundation, Penn Wharton Budget Model, and American Enterprise Institute have shown only a marginal 1% to 14% offset in economic growth, debunking the claims of tax cut proponents.

On one hand, Trump advocates for the extension of all TCJA provisions, while Biden focuses on extending tax breaks for individuals earning less than $400,000, which is representative of a vast majority of Americans. Biden’s economic advisor, Lael Brainard, has proposed higher taxes on the ultra-wealthy and corporations as a means to fund the tax cut extensions for the middle class. Conversely, Trump has favored tariffs on imported goods as a revenue-generating strategy.

Amidst these policy proposals and debates, the uncertainties surrounding the political landscape, particularly regarding the control of the White House and Congress, adds another layer of complexity to the situation. Without a clear understanding of which party will have the reins of power, the future of tax breaks and fiscal policies remains ambiguous.