On Wednesday, U.S. stocks saw a significant rebound after a three-day losing streak. This positive momentum was reflected in the S & P 500, the Dow Jones Industrial Average, and the Nasdaq Composite, which all posted gains. Jim Cramer described the day as a “good day” and attributed the previous day’s decline to a temporary glitch rather than a long-term trend. The sell-off was triggered by concerns about a U.S. recession following a disappointing jobs report and the unwinding of the “yen carry trade.” However, the market showed resilience and bounced back on Wednesday.

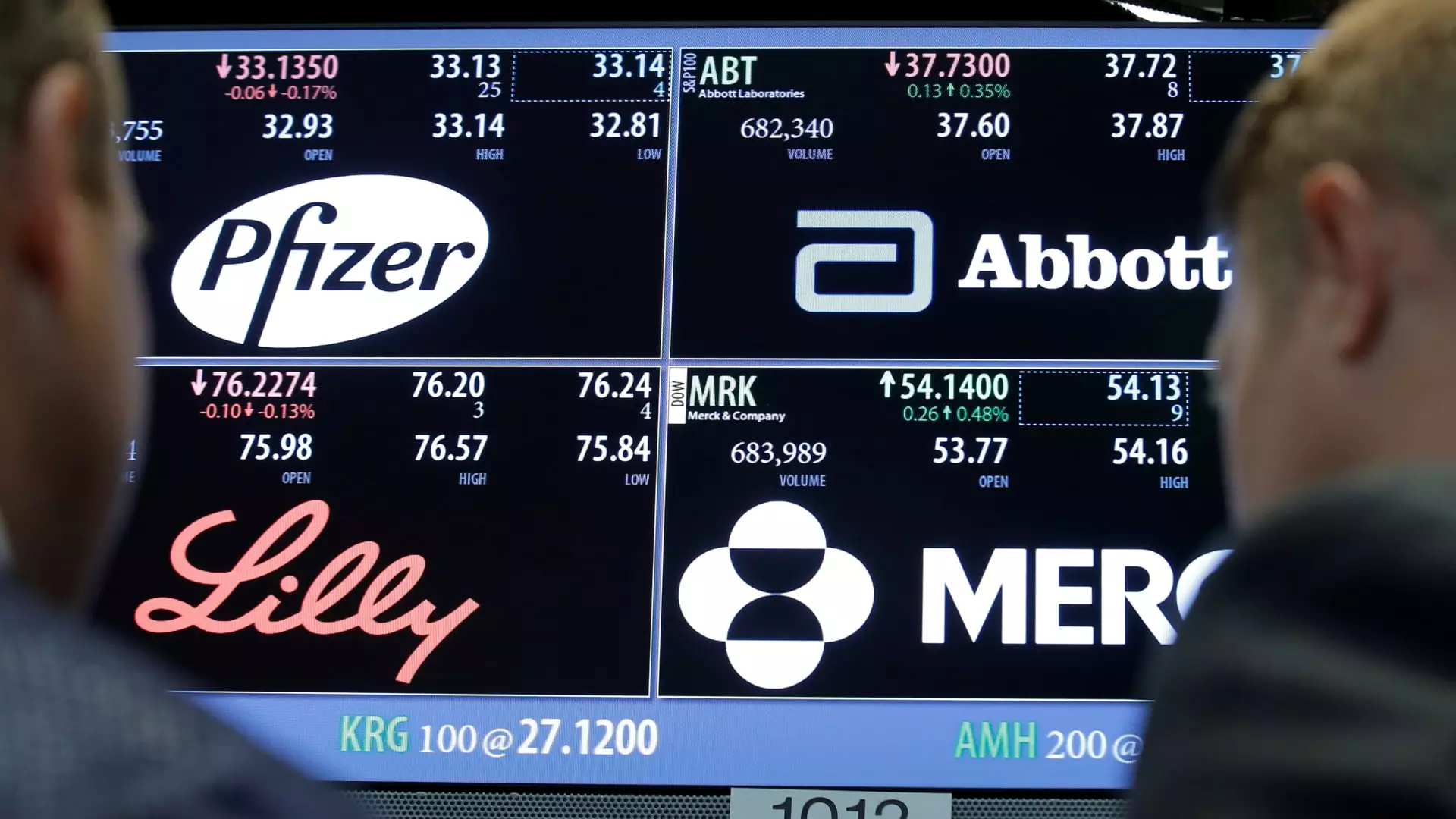

Eli Lilly’s shares experienced a decline of 1.7% on Wednesday after Novo Nordisk reported lower-than-expected earnings. The Danish company’s weak performance raised questions about the potential impact on Eli Lilly, particularly regarding its GLP-1 drugs Zepbound and Mounjaro. Despite the concerns, it was clarified that Novo Nordisk’s sales miss was due to concessions made to U.S. pharmacy benefit managers, not a decrease in demand for its products. Jim Cramer warned that Eli Lilly’s shares could face further pressure when the company releases its quarterly results. However, he expressed optimism about the long-term prospects of Eli Lilly, suggesting a possible buying opportunity if the stock price drops significantly.

Amazon’s Positive Outlook and Market Response

Amazon received positive news about its e-commerce business following CVS Health’s quarterly earnings report. The pharmacy chain announced plans to close 900 retail locations by the end of the year as part of a restructuring effort. This development was viewed as a boon for Amazon’s e-commerce platform, as consumers increasingly rely on online shopping for everyday essentials. Consequently, Amazon’s stock saw a 3% increase in value on Wednesday. The potential reduction in retail competition could further strengthen Amazon’s position in the market and drive future growth.

As a member of the CNBC Investing Club with Jim Cramer, subscribers gain access to valuable insights and trade alerts from the renowned financial analyst. Jim Cramer follows a disciplined approach to trading, waiting 45 minutes after issuing a trade alert before making any transactions in his charitable trust’s portfolio. Additionally, if a stock is discussed on CNBC TV, he waits 72 hours before taking action to avoid any potential conflicts of interest. It is important for subscribers to review the terms and conditions, privacy policy, and disclaimer of the Investing Club to understand the limitations and responsibilities associated with the information provided. It is emphasized that no fiduciary obligation or duty is created by receiving information from the Investing Club, and there are no guarantees of specific outcomes or profits.

Wednesday’s market activities showcased the resilience of U.S. stocks in the face of recent challenges. The positive performance of major indices, the impact of Novo Nordisk’s earnings on Eli Lilly, and the optimistic outlook for Amazon’s e-commerce business provide valuable insights for investors. By staying informed and following the guidance of experienced analysts like Jim Cramer, investors can make well-informed decisions and navigate the dynamic landscape of the stock market.