Super Micro shares took a hit, dropping by as much as 15% in extended trading after the server maker reported revenue slightly below expectations for its fiscal third quarter. The company’s earnings per share of $6.65 adjusted versus an expected $5.78, while revenue stood at $3.85 billion compared to an anticipated $3.95 billion. Despite this, the company saw a significant 200% year-over-year jump in revenue in the quarter ending on March 31. This marked a considerable improvement from the 103% year-over-year increase reported in the previous quarter.

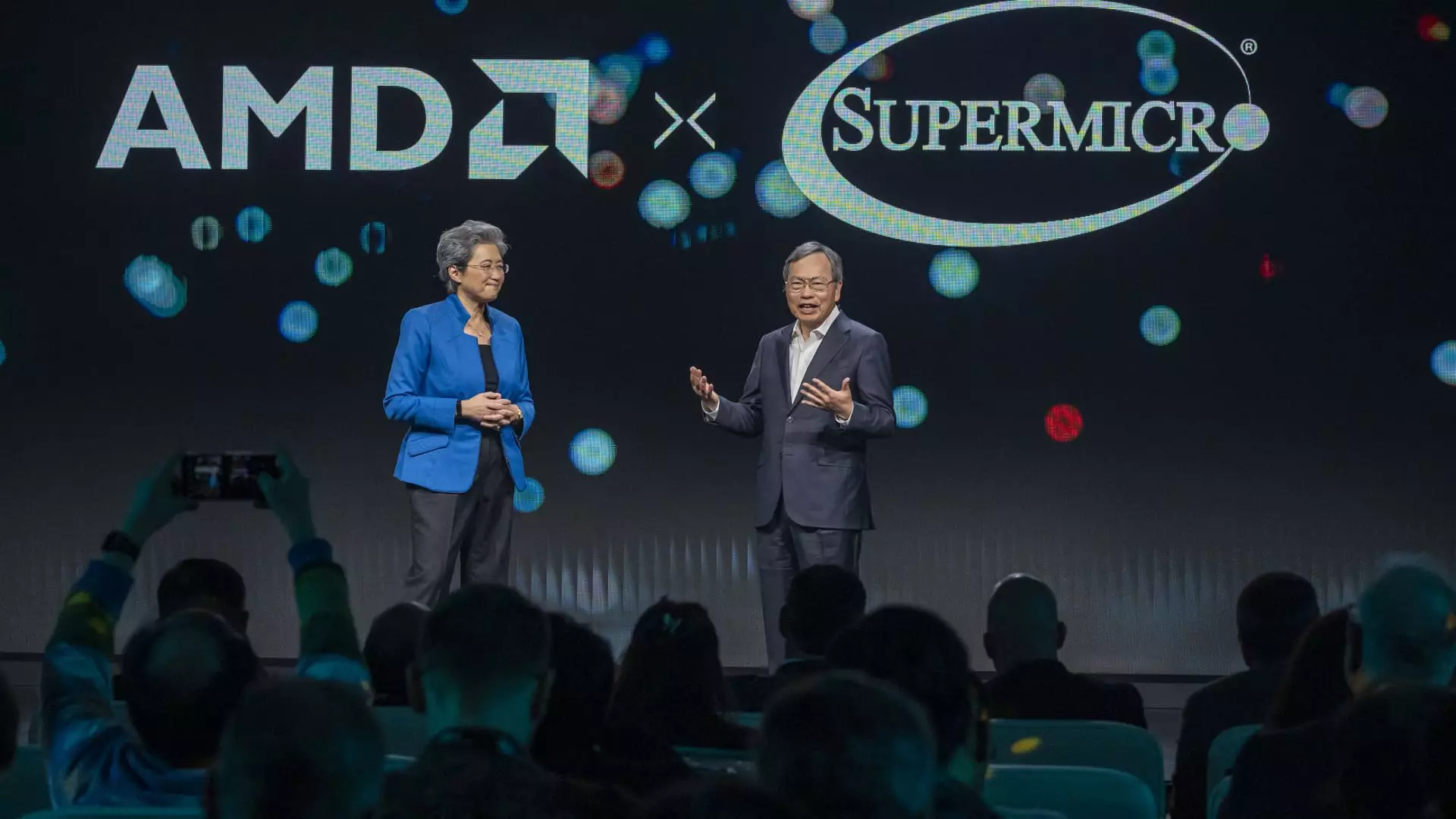

Super Micro raised its fiscal 2024 revenue guidance to a range of $14.7 billion to $15.1 billion, up from the previous range of $14.3 billion to $14.7 billion. Analysts had been expecting $14.6 billion, with the mid-point of the new guidance range indicating a potential 582% year-over-year revenue growth. The company’s CEO, Charles Liang, highlighted the strong growth in the customer base during a conference call with analysts, signaling positive momentum for the business.

Despite the after-hours stock decline, Super Micro’s shares have surged by 205% year-to-date, outperforming the S&P 500 stock index, which has gained 6%. The company faces competition from established IT equipment providers like Hewlett Packard Enterprise, but investors have shown enthusiasm for its potential as a key server provider for Nvidia graphics processing units used in AI applications. In fact, Super Micro’s stock skyrocketed by 246% last year, prompting its inclusion in the S&P 500 in March.

Liang acknowledged that component shortages had impacted the company’s performance during the quarter, but expressed confidence in the continued strength of AI growth in the coming quarters. To support its rapid expansion, Super Micro conducted a secondary offering to raise capital. The company’s efforts to enhance its supply chain, along with plans to introduce energy-efficient liquid-cooled servers, are aimed at improving operational efficiency and reducing costs for customers.

Super Micro’s fiscal third quarter results reflect a mixed performance, with strong revenue growth overshadowed by slightly lower-than-expected figures. The company’s outlook for future growth, particularly in the AI space, presents opportunities for further expansion and market leadership. However, challenges such as component shortages and intense competition in the IT sector will require strategic planning and execution to sustain momentum and drive continued success.