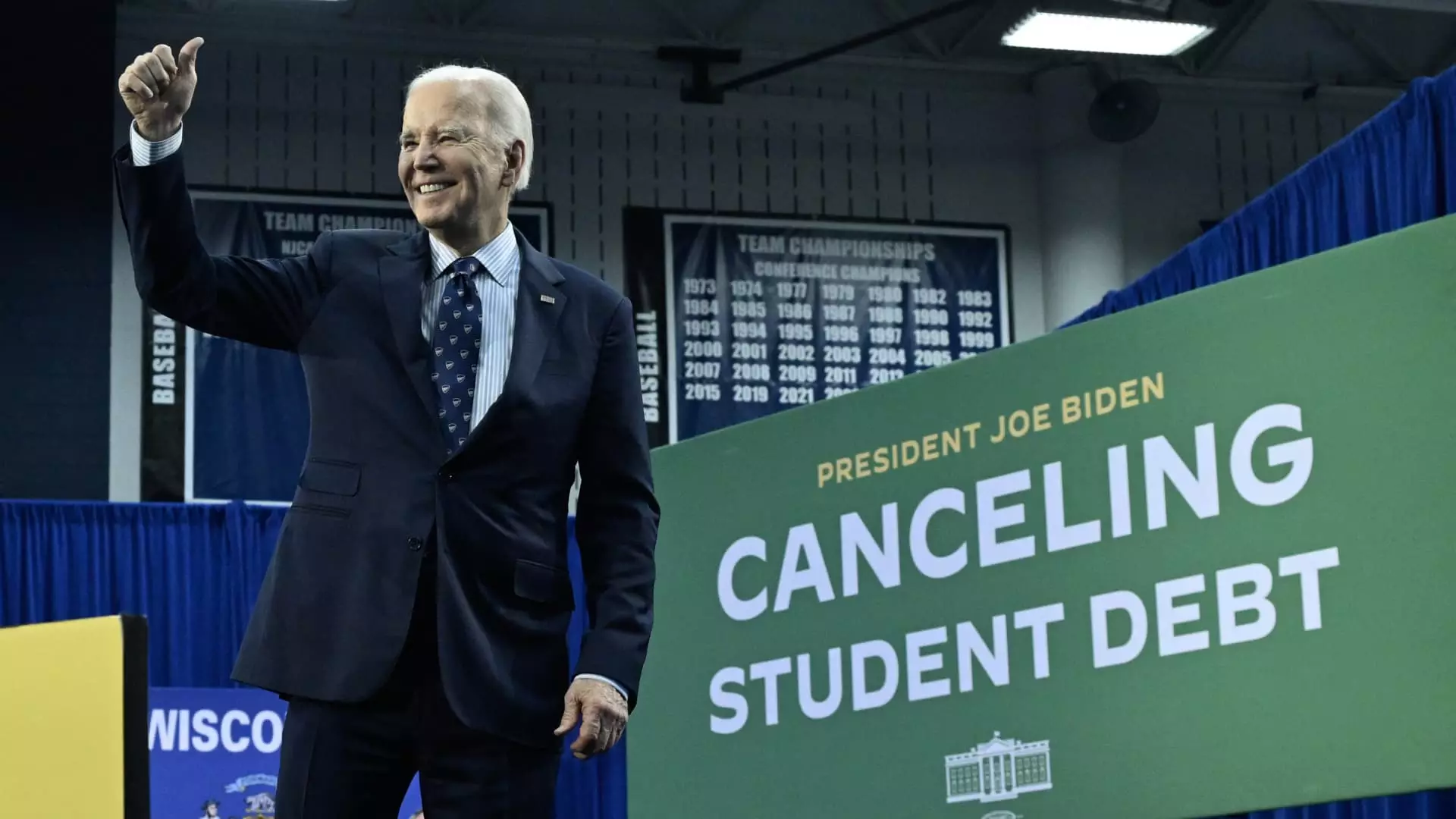

The Biden administration’s student loan relief plan, known as the Saving on a Valuable Education (SAVE) plan, faced a legal challenge that resulted in a temporary block last week. However, in a recent ruling, the 10th Circuit U.S. Court of Appeals granted the administration’s request to resume a key provision of the plan as the legal challenges unfold. This decision is considered a significant win for President Biden and his efforts to provide relief to student loan borrowers.

Impacts of the SAVE Plan

The SAVE plan has been hailed as President Biden’s biggest accomplishment in delivering assistance to student loan borrowers. Approximately 8 million borrowers have already signed up for the new income-driven repayment plan, according to the White House. Under the SAVE plan, borrowers are only required to pay 5% of their discretionary income towards their debt each month, with those earning $32,800 or less having a $0 monthly payment. This is a significant reduction compared to other income-driven repayment plans, where borrowers typically pay 10% or more of their discretionary income.

Legal Challenges Faced

Despite the recent favorable ruling, challenges to the SAVE plan persist. A federal judge in Missouri issued a second injunction against the plan, preventing the Biden administration from forgiving student debt under the program. The injunctions stem from lawsuits filed by Republican-led states earlier this year, alleging that the administration was overstepping its authority with the plan. The states raised concerns that the administration was attempting to circumvent the Supreme Court’s ruling against its previous sweeping debt forgiveness plan.

While the Biden administration’s SAVE plan has seen success in providing relief to student loan borrowers, it continues to face legal challenges that threaten its implementation. The recent federal appeals court ruling granting temporary relief is a positive development for the administration. However, the road ahead remains uncertain as legal battles unfold. President Biden’s efforts to address the student loan debt crisis are critical, and the outcome of these legal challenges will have significant implications for millions of borrowers across the country.