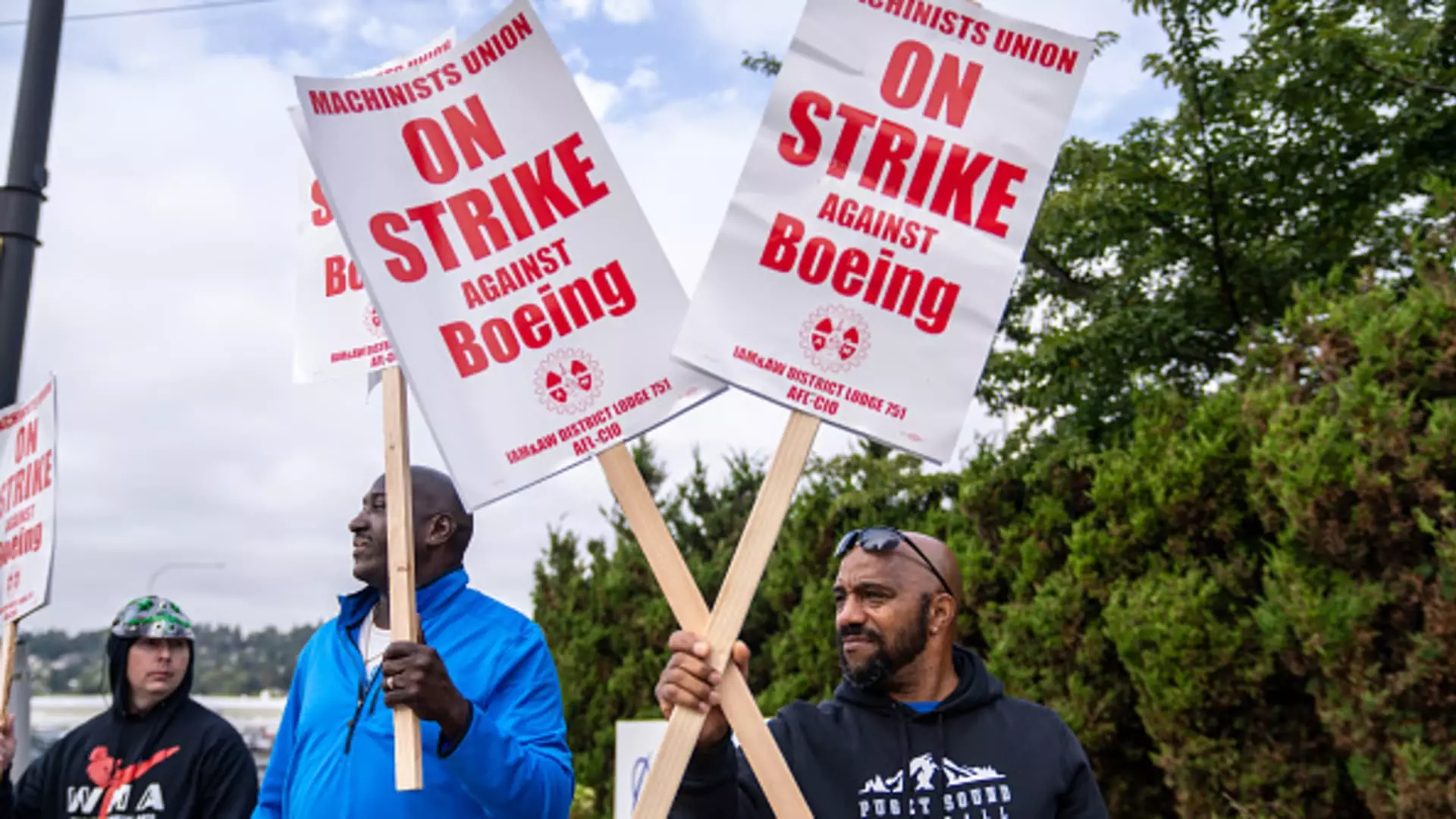

The ongoing strike by Boeing machinists, which has entered its second month, marks one of the most significant challenges the aircraft manufacturer’s leadership has faced in years. With over 30,000 machinists walking off the job due to a rejected contract offer, Boeing is confronted with mounting financial pressures that compound an already troubling operational landscape. The looming questions are: what led to this breakdown in labor relations, and how will it impact Boeing’s future?

Boeing’s decline has been exacerbated by a series of unfortunate events leading up to the strike. The company’s struggles have been well documented, from the infamous crashes of the 737 Max to ongoing production issues that have plagued its various aircraft models. S&P Global Ratings posits that the strike is costing Boeing over $1 billion each month, a staggering amount that is reflective of the wider financial crisis enveloping the company. This unprecedented situation leaves Boeing scrambling to find solutions while maintaining investor confidence.

With a new CEO at the helm, Kelly Ortberg, there is a critical urgency to resolve the labor conflict, as the company has yet to turn a profit since 2018. The strike has idled production in key facilities in the Seattle area, bringing cash flow to a standstill at a time when the company is keenly aware of its precarious position within the market. Ortberg’s upcoming earnings call on October 23 only adds to the pressure, as investors anticipate clear strategies for reining in losses and returning to profitability.

At the core of the strike is a deep-seated tension between the International Association of Machinists and Aerospace Workers and Boeing’s management. The recent rejection of a tentative labor agreement revealed significant discord, with a striking 95% of union members voting against it. Analysts suggest that sentiments among workers reflect disillusionment with Boeing’s labor practices, now compounded by the loss of health benefits and paychecks for the striking workers. Profound issues related to job security and benefits will require sensitive negotiation to bridge the gap between labor and management.

The union’s demands, specifically regarding the reinstatement of a pension plan, highlight a philosophical disconnect between the workforce and Boeing’s finance-focused strategies. Historically, workers have fought against what they perceive as corporate attempts to erode worker rights and benefits; the current strike is simply the latest iteration of this ongoing struggle. However, without a willingness from both parties to come to the negotiation table, resolution appears distant.

Boeing’s challenges are not just confined to its labor relations. The future of the company rests on its ability to stabilize production and regain trust with stakeholders, both internal and external. The planned cuts that Ortberg announced—including a 10% reduction in the global workforce—could further destabilize the company. While layoffs might provide short-term financial relief, they erode the very talent that Boeing needs to recover and innovate in a highly competitive aerospace market. Experts predict that without a clear strategic direction, Boeing could find itself repeating the mistakes that led to its current predicament.

Boeing’s situation serves as a microcosm of broader issues facing American manufacturing. The company’s reliance on labor, which accounts for about 5% of the total production cost of an aircraft, juxtaposes sharply against the necessity of cutting costs to stay afloat. That contradiction suggests systemic problems within the industry, as companies grapple with balancing operational efficiency with fair labor practices.

In the midst of this turmoil, Kelly Ortberg must navigate a treacherous path: finding a resolution to the strike while also addressing Boeing’s chronic issues. Stakeholders are urging for a collaborative approach that not only prioritizes immediate financial recovery but also invests in the company’s long-term future. As labor tensions escalate and financial losses continue to accumulate, the call for transparent and respectful negotiations has never been more urgent.

As we wait to see if the union and Boeing can reconcile their differences, both sides must recognize that the stakes extend beyond a mere labor dispute. The future of one of America’s most iconic manufacturers hangs in the balance, requiring innovative thinking and a commitment to rebuilding trust between labor and management. Whether or not they rise to this challenge will shape the aerospace landscape for years to come.