China recently reported data that indicated slower growth on the consumer side while industrial activity remained robust. Retail sales only rose by 2.3% in April from a year ago, a figure significantly lower than the 3.8% increase that was originally forecasted. This slower growth in retail sales reflects potential challenges in the consumer market, which could have broader implications for the overall economy.

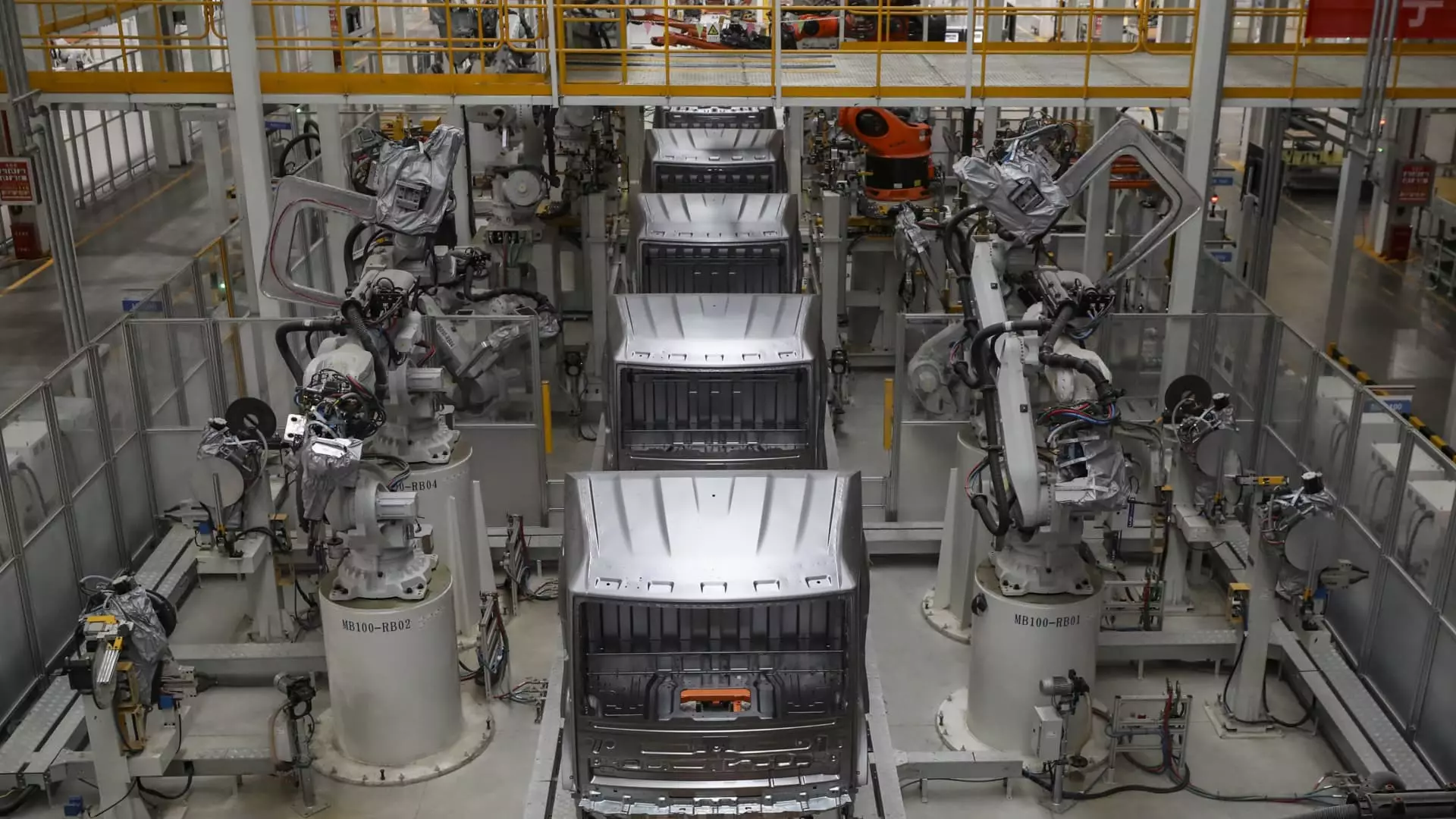

Despite the sluggish growth in retail sales, industrial production in China saw a significant increase of 6.7% in April from a year ago. This figure exceeded expectations for 5.5% growth and marked a notable improvement from the 4.5% growth reported in March. The strong performance of industrial activity indicates resilience in this sector of the economy.

Fixed asset investment in China rose by 4.2% for the first four months of the year, falling short of the expected 4.6% increase. This mixed performance in fixed asset investment highlights potential challenges in driving growth through investment. The lower-than-expected increase could pose risks to long-term economic development.

One of the key areas of concern in China’s economy is the real estate sector, which saw a steep decline in investment. Real estate investment was down by 9.8% year-on-year for the first four months of 2024, indicating significant challenges in this sector. The sluggish performance of the real estate market could have broader implications for economic growth.

The urban unemployment rate in April was reported at 5%, highlighting potential challenges in the labor market. Some consumers are uncertain about their future income, leading them to remain cautious about spending. This trend could impact overall retail sales and consumer confidence in the economy.

To address economic challenges, China recently launched a six-month program for issuing long-term bonds to fund strategic projects. While the economic impact of these initiatives may not be felt immediately, they could play a crucial role in supporting long-term growth. Additionally, the government has implemented policies to support the delivery of homes and stabilize the property market.

Despite challenges in the retail sales and real estate sectors, China’s economy has shown resilience in industrial activity and investment. The country has set a target of around 5% GDP growth for 2024, indicating a cautious yet optimistic outlook. It remains to be seen how government initiatives and policy measures will impact the overall economic performance in the coming months.