The recent earnings reports from semiconductor companies have shed light on the varied effects of the boom in artificial intelligence on the industry. While some companies have exceeded expectations, others have fallen short, reflecting the intricate dynamics of the semiconductor supply chain and the unequal dominance of certain players in different sectors of the market.

The Role of Large Language Models and Generative AI

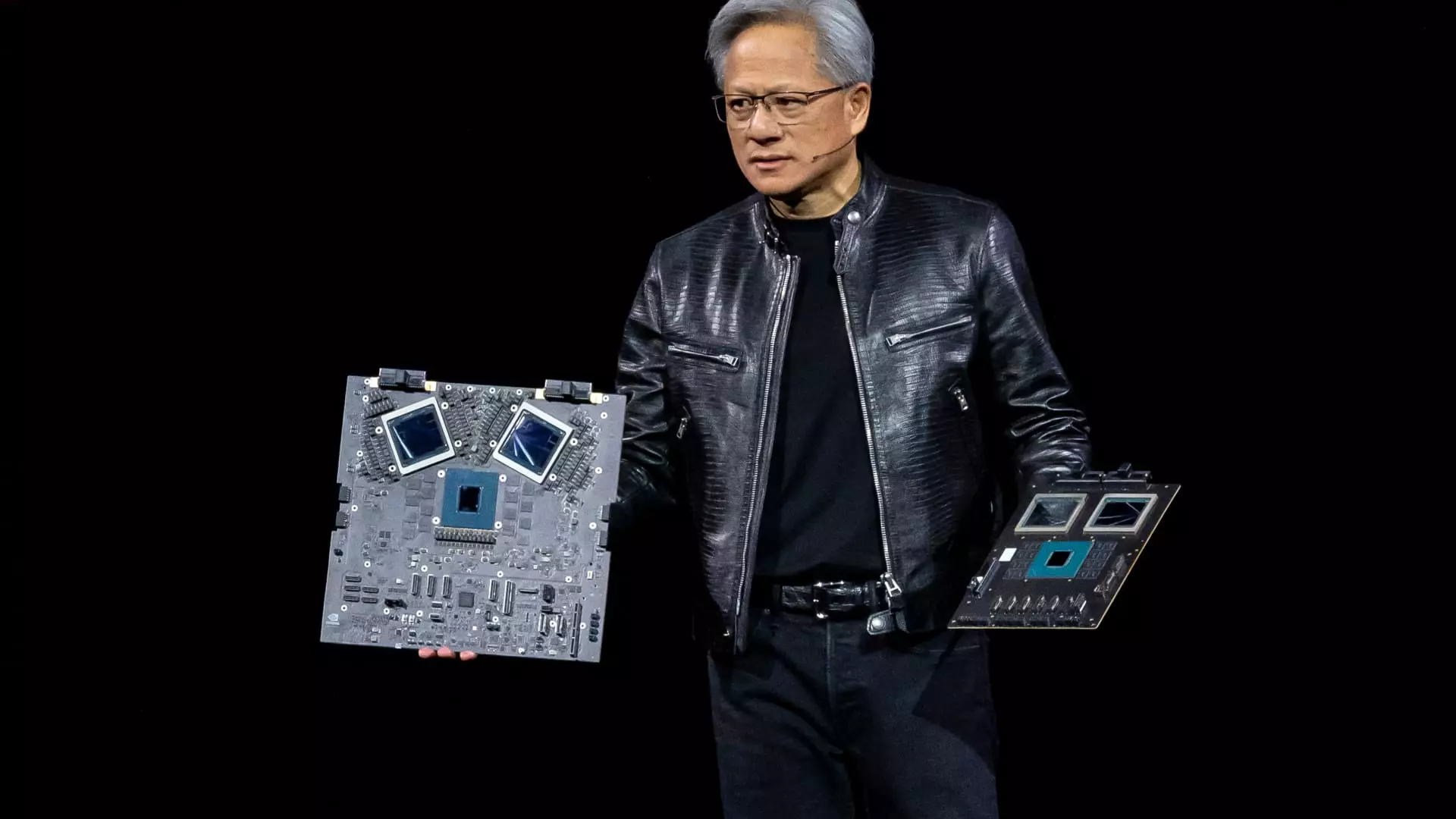

The current fascination with artificial intelligence is centered around large language models (LLMs) and generative AI. LLMs necessitate massive computing resources and data for training, forming the foundation for generative AI applications like chatbots developed by tech giants such as Google and OpenAI. As these companies continue to pour resources into training LLMs, the demand for computing power has surged, benefiting companies like Nvidia, whose graphics processing units (GPUs) are crucial for training these models.

While Nvidia has long been a frontrunner in providing GPUs for AI purposes, rival chipmaker AMD has made significant strides with the introduction of its own AI chip, the MI300X. AMD’s strategic entry into the AI chip market has started to pay off, with the company expecting substantial revenue growth in data center GPU sales by 2024. The positive earnings report from AMD for the second quarter is indicative of their success in leveraging the AI boom.

Not only chip companies but also chip manufacturing and tool companies are reaping the benefits of the AI revolution. TSMC, the world’s largest semiconductor manufacturer, reported a substantial increase in net profit in the second quarter, surpassing market expectations. Similarly, ASML, a key player in producing advanced chip manufacturing tools, experienced a significant rise in net bookings as demand from companies like TSMC surged. Samsung, known for its semiconductor division, saw a staggering year-on-year increase in operating profit, further emphasizing the positive impact of the AI market on chip manufacturers.

Challenges Faced by Some Semiconductor Firms

Despite the overall growth in AI investment, not all semiconductor companies have experienced a boost in their financial performance. Companies like Qualcomm and Arm have seen their share prices decline due to light guidance for the current quarter. Although both firms have emphasized their importance in AI applications, their exposure to the technology remains limited. Qualcomm’s revenue is still heavily reliant on smartphones, while Arm’s revenue comes predominantly from consumer electronics rather than data centers where AI training is prevalent.

As the AI landscape continues to evolve, semiconductor companies must navigate the complexities of the industry to capitalize on the opportunities presented by artificial intelligence. While some companies have successfully adapted to the AI boom and are reaping the rewards, others are facing challenges due to their limited exposure to the technology. Moving forward, strategic investments and collaborations will be crucial for semiconductor firms to thrive in the age of artificial intelligence.