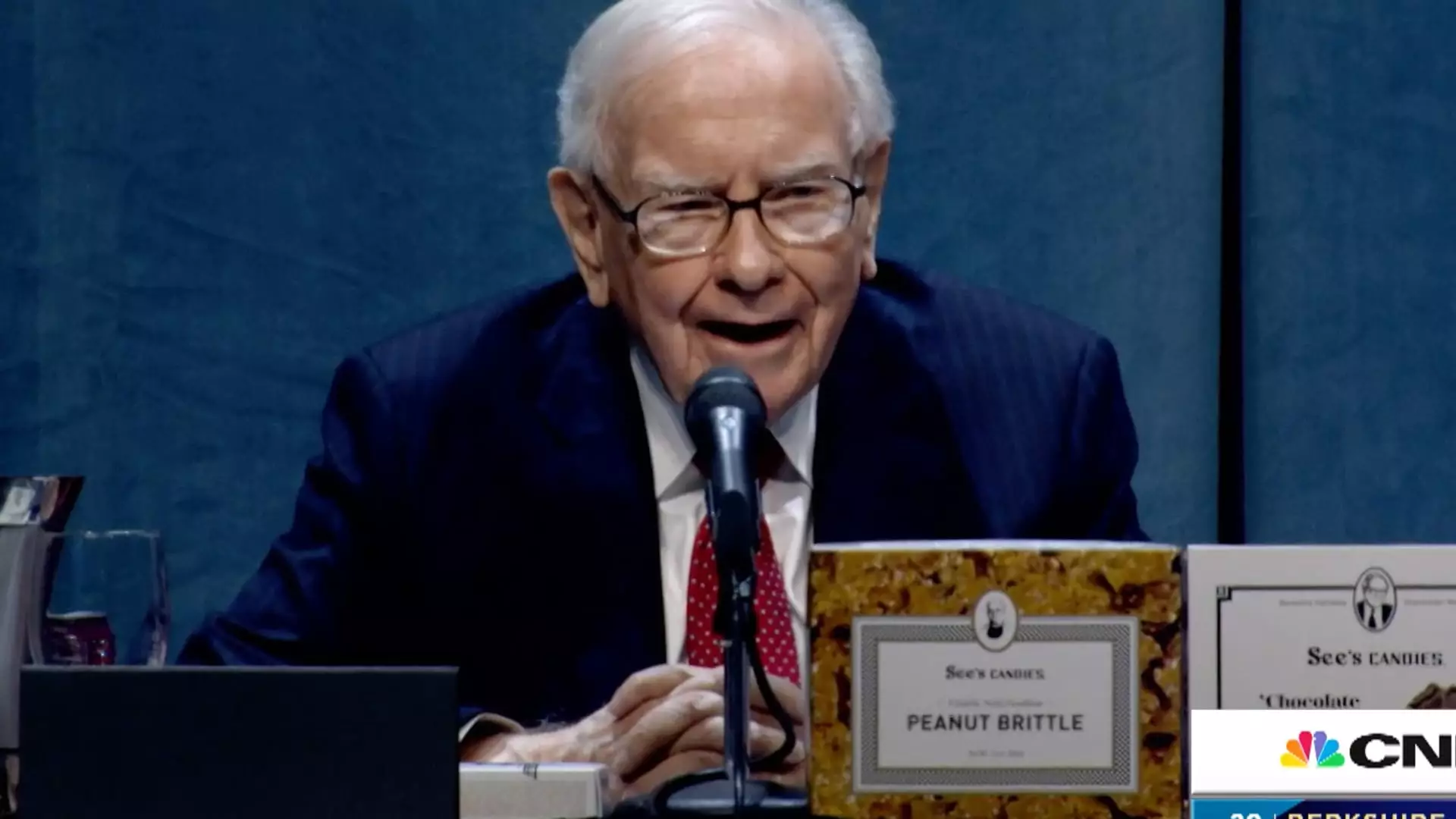

Warren Buffett, the renowned CEO of Berkshire Hathaway, has shared his thoughts on President Donald Trump’s tariff policies, which are generating significant debate in economic circles. Buffett, known as the “Oracle of Omaha,” suggests that imposing tariffs, particularly punitive ones, can have detrimental effects on consumers and the economy as a whole. He equates tariffs to a form of warfare, highlighting their potential to escalate tensions and disrupt global trade. His perspective is crucial, given his extensive experience in various sectors such as insurance, railroads, and manufacturing.

Buffett’s assertion that tariffs essentially act as a tax on goods is an essential aspect of his commentary. When imposed, these tariffs do not vanish into thin air; rather, the economic burden transfers to consumers. This can lead to inflation, as business owners often pass on increased costs to their customers. Such dynamics provoke the question he emphasizes: “And then what?” It urges us to consider the cascading effects of these policy decisions. Tariffs not only impact prices but can also lead companies to make less optimum production decisions, potentially stifling innovation and overall economic growth.

Buffett’s comments come at a time of increased volatility in the market, with the S&P 500 showing minimal gains. His cautious approach—marked by a significant divestment in stocks and hoarding a substantial cash reserve—raises eyebrows among analysts and investors. While some interpret this as a bearish sentiment regarding the economy, others argue that Buffett is strategically positioning his conglomerate for future leadership and success.

The reaction to Trump’s trade policies from the broader market underscores the controversy surrounding tariffs. Many investors remain concerned about the unpredictable nature of policy changes, which can lead to sharp fluctuations in stock prices. With tensions rising not just in North America but also with China, a comprehensive strategy concerning trade is critical for economic stability.

As Buffett refrains from providing direct commentary on the current economic state, it signals a cautious stance amid uncertain times. His approach serves as a reminder that while tariffs can be instruments of policy, their execution requires careful deliberation regarding their long-term impacts. The eventual need for clarity in trade policy cannot be overstated, particularly as global market dynamics continue to evolve with both opportunities and challenges.

Ultimately, Buffett’s insights offer a thought-provoking lens through which to parse trade policies and tariffs. As investors and policymakers navigate these complexities, the balance between protecting domestic interests and fostering global relations will remain a critical focal point for economic discourse. Understanding the ramifications of tariffs is more than just an academic exercise; it has real-world implications for consumer prices, business health, and overall economic growth.