Cleveland Federal Reserve President Loretta Mester recently expressed her anticipation for interest rate cuts within this year. However, she made it clear that the upcoming policy meeting in May would not be the venue for such decisions. Mester highlighted the progress made in terms of inflation and acknowledged the continuous growth of the economy. This growth may pave the way for rate cuts in the future, though she refrained from providing specific details regarding the timing or extent of these cuts. In her speech in Cleveland, Mester emphasized the need for more data to strengthen her confidence in the trajectory of inflation towards the 2 percent target.

Mester stated that she is closely monitoring inflation data to determine whether certain anomalies observed earlier this year are temporary disruptions or indications of a stagnation in the progress towards the inflation target. She acknowledged the lack of adequate information for a decisive action at the next FOMC meeting, leading to speculation that a cut during the April 30-May 1 meeting is unlikely. Market pricing also aligns with Mester’s sentiments, indicating minimal expectations for a cut during this period.

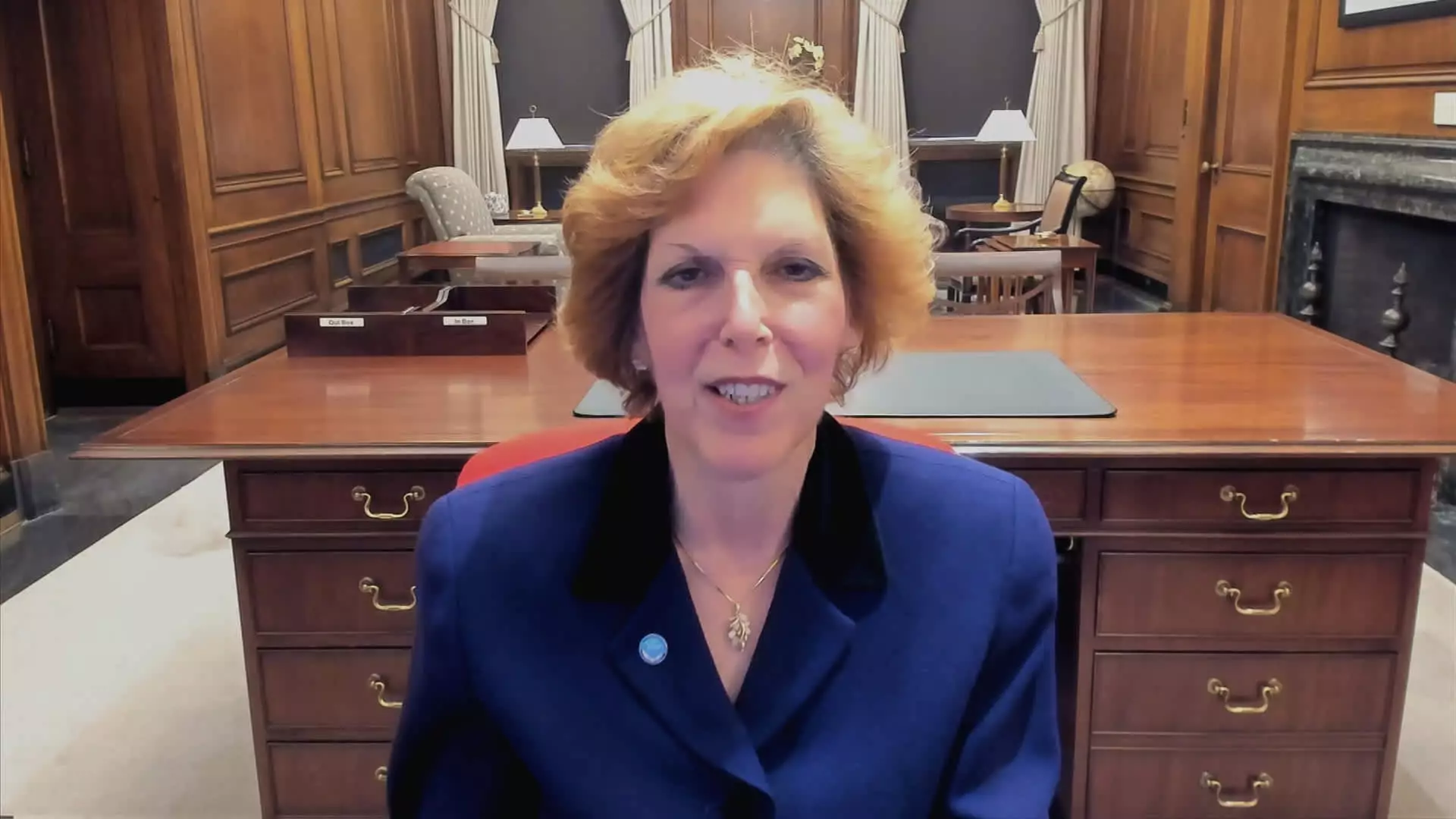

As a voting member of the FOMC who is set to depart in June due to term limits, Mester’s insights hold weight within the committee. The upcoming transition period raises questions about the direction of future interest rate cuts, with futures traders anticipating a commencement of easing in June and a projected cut of three-quarters of a percentage point by the year’s end. San Francisco Fed President Mary Daly echoed this sentiment by suggesting that three reductions in the interest rates serve as a reasonable baseline for this year, although she cautioned that projections are not guarantees.

In addition to discussing short-term rate cut expectations, Mester also shared her views on the long-run federal funds rate. Contrary to the conventional belief of a 2.5% long-run rate, Mester believes that the neutral rate, also known as the “r*” rate, should be positioned at 3%. This rate signifies a level where monetary policy neither restricts nor stimulates the economy. Following the March meeting, projections suggest a potential shift towards a higher long-rate rate of 2.6%, indicating divergence among members regarding the future trajectory of interest rates.

Mester emphasized the importance of calibrating policy responses to economic developments to avoid abrupt and aggressive interventions. The historically low interest rates during the Covid pandemic constrained the Fed’s ability to maneuver policy effectively, highlighting the significance of aligning actions with evolving economic scenarios. As Mester navigates the final stages of her tenure within the FOMC, her insights provide valuable perspectives on the future direction of interest rates and the broader economic landscape.