The Biden administration has set forth a plan to move forward swiftly with its student loan forgiveness program. With the aim of starting to alleviate people’s debts as early as this fall, the administration is taking decisive action. The program holds significant importance, particularly in the context of the upcoming presidential election, according to experts. Mark Kantrowitz, a noted higher education expert, highlights that issues that create a stark contrast between Democrats and Republicans can have a considerable impact on the election outcome. Student loan forgiveness falls into this category, posing a critical factor in influencing voter turnout for one party over the other.

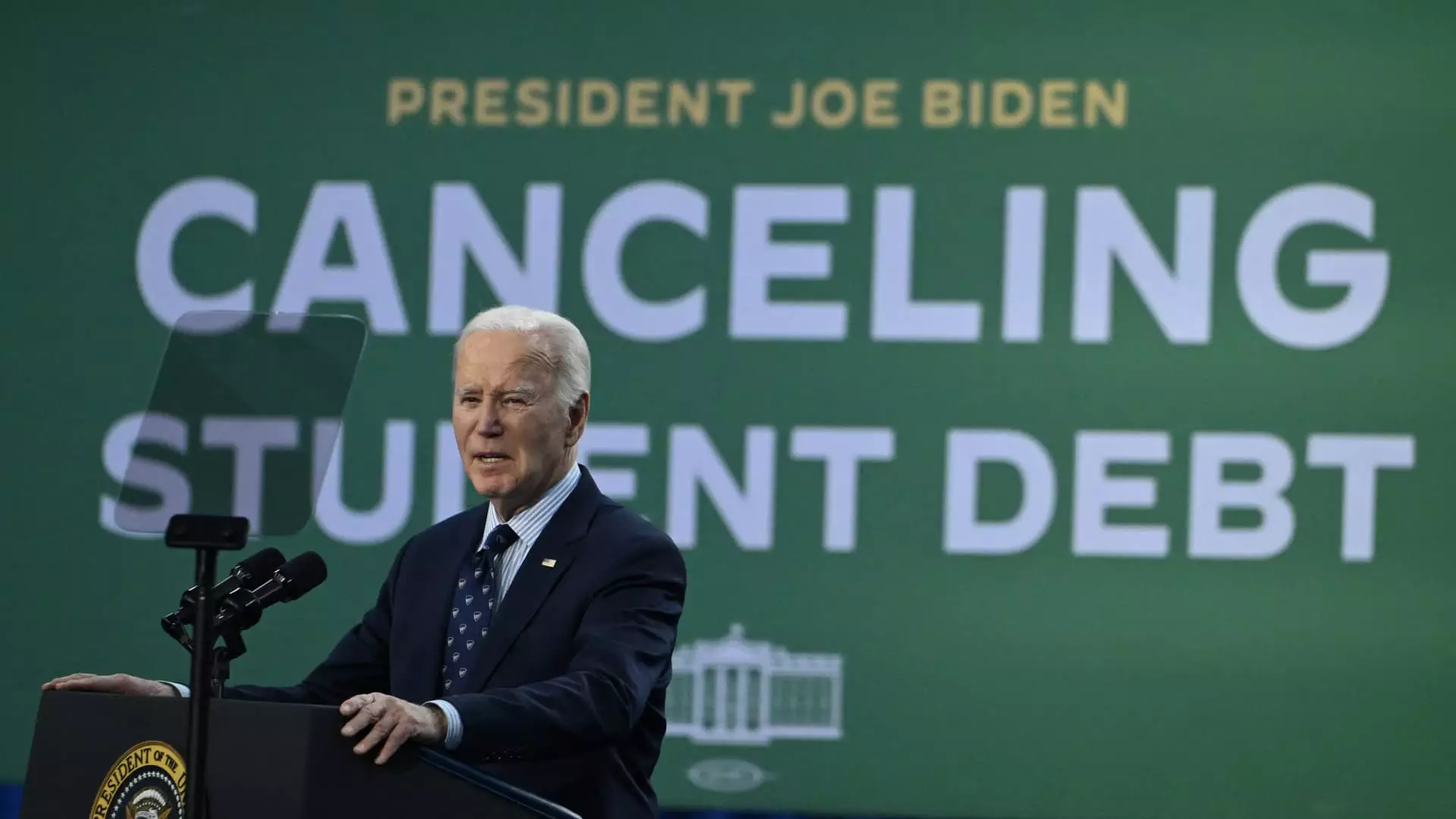

President Joe Biden’s initial campaign pledge to eliminate student debt faced a setback in June when the Supreme Court deemed his $400 billion loan cancellation proposal unconstitutional. Undeterred by this ruling, Biden directed the U.S. Department of Education to explore its existing authority to forgive student debt. Through enhancements in the current loan relief programs, the department has managed to clear the education debts of 4 million individuals, amounting to $146 billion in aid, during Biden’s tenure. Nevertheless, the pressure on Biden to expand these efforts persists. Astra Taylor, co-founder of the Debt Collective, points out that over 40 million people were promised debt cancellation, underscoring the magnitude of the unmet expectations compared to the actual relief provided.

Biden’s Revised Plan for Student Loan Forgiveness

In response to the Supreme Court ruling, President Biden unveiled a more tailored approach to student loan forgiveness. While his first plan aimed at canceling loans for nearly all federal student loan borrowers, the revised program now focuses on specific groups, including those facing financial hardship and graduates of substandard schools. The plan also includes provisions to clear interest on the debt for around 25 million individuals. Kantrowitz predicts that the Biden administration will push to implement this updated relief package before the November election to influence voter sentiment.

Political Implications of Student Loan Forgiveness

Recent surveys indicate that canceling student debt resonates with a significant portion of voters, with 48% deeming it an important issue for the 2024 presidential and congressional elections. Notably, this policy stance could be particularly advantageous for Biden with younger voters, a demographic where he has faced challenges in securing support. Gen Z respondents, in particular, have highlighted the importance of student debt relief as a key factor in the election. Biden’s pivot towards student loan forgiveness also underscores a divergence in policy approaches between him and his potential Republican opponent, Donald Trump, who has previously opposed debt relief measures and supported the Supreme Court’s decisions against Biden’s proposals.

After facing legal hurdles in his earlier attempts at student loan forgiveness, Biden has shifted to the negotiated rulemaking process for a more robust strategy. This process involves a series of steps, including the formulation of a rule by a committee of negotiators, publicizing the proposed rule, and allowing for a public comment period. Although this process may be time-consuming, with the final rule legally coming into effect in July 2025, there is potential for certain provisions to be implemented sooner with the Education Department’s discretion. The administration aims to expedite the release of the final rule to potentially implement the plan before the election, although legal challenges remain a looming threat.

This revised article delves into the proactive approach undertaken by the Biden administration regarding student loan forgiveness, highlighting the political ramifications, policy adjustments, and legislative mechanisms shaping the future of this critical issue.